Don't Stand in the Way of the New Zealand Dollar This Week

- Written by: Gary Howes

Image © Adobe Images

The New Zealand Dollar is enjoying something of a purple patch right now, and we don't think it is time to stand in its way.

The Kiwi is the second-best performing currency in the G10, second only to Norway's Krone. The SEK and AUD are the next best performers, which means the G10 is currently being led by 'high beta' currencies that tend to do well when global investor sentiment is buoyant.

One only needs to look at the NASDAQ & S&P 500 stock index - both of which are trading near record highs - for confirmation that the global investor is feeling confident. As long as this is the case, we look for the New Zealand Dollar to outperform.

We also note that domestic developments are supportive of the Kiwi; the Reserve Bank of New Zealand (RBNZ) last week gave little thrift to expectations for imminent interest rate cuts.

Compare GBP to NZD Exchange Rates

Find out how much you could save on your pound to New Zealand dollar transfer

Potential saving vs high street banks:

NZ$5,350

Free • No obligation • Takes 2 minutes

The RBNZ will, alongside the Reserve Bank of Australia, be amongst the last of the G10 central banks to cut interest rates. This can support NZD and AUD against currencies belonging to central banks that are on the cusp of starting a rate cutting cycle.

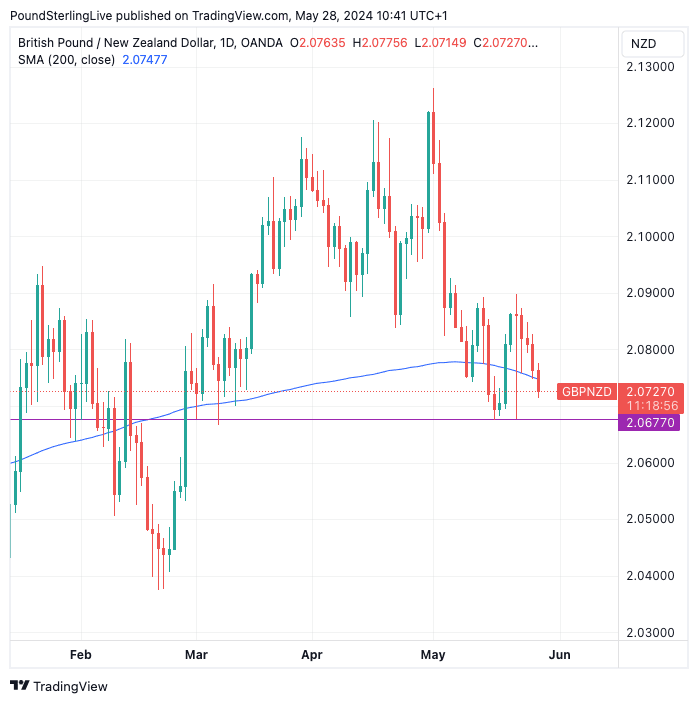

The supportive NZD backdrop is reflected in a downward pointing Pound to New Zealand Dollar exchange rate, where we see the prospect of a potential retest of the May lows in the coming days:

Above: GBP/NZD at daily intervals with the 200-day Moving Average annotated. Track GBP/NZD with your own custom rate alerts. Set Up Here

GBP/NZD rose above the 200-day moving average (DMA) last week, but this looks to have been a false break and this technical indicator looks to be acting as a kind of magnet for price action at present.

The 200 DMA is pointed lower and hints at further downside. The RSI indicator validates this as it is located at 40.57 and is pointed lower.

The first downside target is located at the March-May lows at 2.0677, which can be tested this week. A break below here opens the door to 2024 lows at 2.04 in the course of June.