New Zealand Dollar Tops the Table After RBNZ Warns On Further Rate Hikes

- Written by: Gary Howes

Above: File image of RBNZ Governor Adrian Orr at a press conference. Image courtesy of RBNZ.

The New Zealand Dollar leapt higher after the Reserve Bank of New Zealand maintained its base interest rate at 5.5% and warned it would raise interest rates again if necessary.

"In a shock to market analysts and the NZD, the RBNZ’s tone and updated projections were more 'hawkish', says Peter Dragicevich, Currency Strategist for APAC at Corpay.

The Pound to New Zealand Dollar exchange rate dropped to as low as 2.0677 after the RBNZ raised its forecasts for the base rate, known as the OCR. The New Zealand Dollar is 0.44% higher on the day against the U.S. Dollar at 0.6117 and 0.35% higher against the Euro at 1.7755 EUR/NZD.

The decision to keep the OCR at 5.50% was widely expected, but markets were of the view that the central bank might drop any mention of the need to raise interest rates again owing to the slowing economy. This would pave the way to a potential interest rate cut later in the year.

Compare GBP to NZD Exchange Rates

Find out how much you could save on your pound to New Zealand dollar transfer

Potential saving vs high street banks:

NZ$5,350

Free • No obligation • Takes 2 minutes

But the RBNZ made it clear it is still fully committed to the fight against inflation. In fact, it increased its OCR forecast profile by 5-10bp and pushed back the expected timing for the start of rate cuts by a quarter to Q3 2025.

"The central bank surprised the market by not relinquishing any ground on its hawkish stance and by even becoming more hawkish. The market had been looking for a dovish statement and we were looking for something more neutral. The NZD has been given a large boost as a result," says David Forrester, Senior FX Strategist at Crédit Agricole.

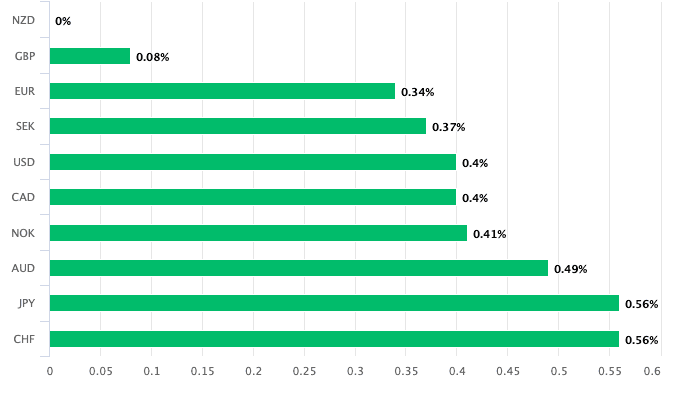

Above: NZD is higher against all its G10 peers on May 22. Track NZd with your own custom rate alerts. Set Up Here

Making the case for a softer tone at the RBNZ is the slowdown in the economy which saw GDP contract in four of the past five quarters, even with robust population growth. New Zealand's unemployment rate has risen by about 1%pt the past year.

"Concerns about inflation are (still) front-of-mind for the RBNZ. The RBNZ nudged up its inflation forecasts with a more gradual pull-back down to target over coming years anticipated," says Dragicevich.

The central bank acknowledged services inflation remains sticky and it continues to see upside risks to non-tradeables inflation, especially from rising insurance, local government rates and residential rents.

Strong net migration continues to drive the latter.

"The RBNZ also points to risks of next week’s budget bringing forward tax cuts and leading to fiscal policy being less of a drag on the economy. It does note, however, that existing declines in government spending are weighing on economic activity and helping bring down inflation," says Forrester.

November Rate Cut

Crédit Agricole still thinks the next move in the OCR is lower rather than higher and that it could come in late 2024.

We believe the outlook does not warrant further tightening. However, the RBNZ’s tone and track does pour cold water over our call for a cut come November. The risks are clearly for a cut later rather than sooner.

Jarrod Kerr, Chief Economist at Kiwibank, also went into today's RBNZ event thinking all signs would point to a cut later in the year. This is now in question.

"We believe the outlook does not warrant further tightening. However, the RBNZ’s tone and track does pour cold water over our call for a cut come November. The risks are clearly for a cut later rather than sooner," says Kerr.

Interestingly, while the RBNZ said domestic financial conditions remain restrictive, they are now modestly less restrictive than at the previous meeting. This reflects the global easing in interest rate expectations and rallying equity prices.

In short, they lessen the need for the RBNZ to cut interest rates.

The New Zealand Dollar can remain supported by New Zealand's ongoing yield superiority (the carry trade), however, should this higher-for-longer stance at the RBNZ hurt the economy in the coming months, the currency could come under pressure.