New Zealand Dollar Tipped to Outperform on RBNZ's Abundance of Caution

- Written by: Gary Howes

Image © Adobe Stock

The New Zealand Dollar firmed against the majority of its peers after the Reserve Bank of New Zealand (RBNZ) left its policy rate unchanged and gave no hint that it was close to making changes.

The Pound to New Zealand Dollar exchange rate fell to its lowest level since mid-March at 2.0887 after the RBNZ said the Official Cash Rate (OCR) needs to remain "at a restrictive level for a sustained period".

It noted that inflation expectations and pricing intentions in New Zealand remain elevated and that the persistence of services inflation remains a risk.

Money market pricing shows investors are priced for the RBNZ to cut interest rates for the first time in the cycle in August, which would be after a host of other G10 central banks.

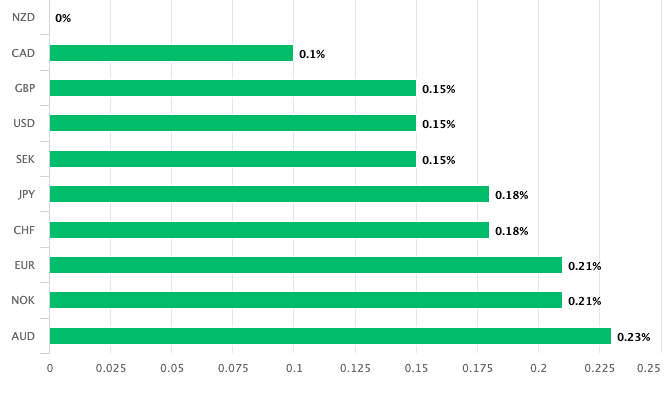

The New Zealand Dollar is the best-performing G10 currency in the wake of the RBNZ policy update, suggesting investors have increased confidence that New Zealand's interest rates will remain higher than at other G10 peers for some months to come.

"They are definitely going to be late to the rate cut party, could potentially be one of the last to arrive. NZD should outperform somewhat, given this set up," says Brad W. Bechtel, Global Head of FX at Jefferies LLC.

Compare GBP to NZD Exchange Rates

Find out how much you could save on your pound to New Zealand dollar transfer

Potential saving vs high street banks:

NZ$5,350

Free • No obligation • Takes 2 minutes

"We continue to expect that the RBNZ will require considerably more certainty before contemplating cuts," says Sharon Zollner, Chief Economist at ANZ.

Heading into the April policy update, economists said the NZD risked coming under pressure if markets brought forward expectations for the start date of the rate cutting cycle. Another downside risk to the currency was if markets raised expectations for the quantum of rate cuts that lie ahead, particularly given the economy's ongoing weakness.

"We continue to expect the RBNZ will cut the OCR in November this year, but that that monetary settings will remain on the restrictive side of neutral for a year or so beyond that," says Mark Smith, Senior Economist at Auckland Savings Bank (ASB).

Above: NZD is the top-performing G10 currency on April 10. Track NZD with your own custom rate alerts. Set Up Here

Going forward, the NZ Dollar can benefit from New Zealand's elevated interest rates, which look set to remain in place owing to RBNZ caution.

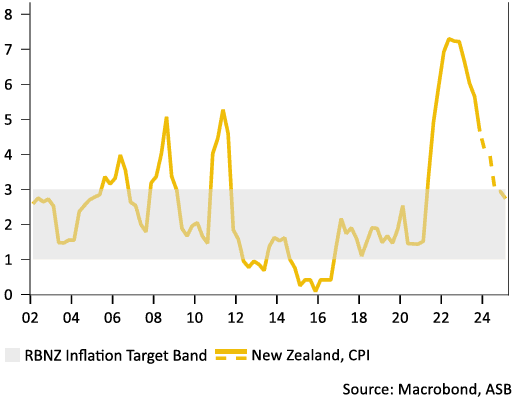

"The RBNZ has been making progress in pushing inflation below 3% on a sustained basis, but the job is not yet done. We envisage that CPI inflation will likely fall below 3% by the end of the year, but only just, with little room for error," says Smith.

Above: NZ inflation is only expected to fall back into the RBNZ's target band at the end of the year.

Economists at Westpac continue to forecast the OCR to remain at 5.5% in 2024 and be reduced from February 2025.

This would put the RBNZ well behind the other major central banks in cutting interest rates and should provide a clear boost for the NZ Dollar via the interest rate channel as a result.

But, concerns for the New Zealand economy would grow as this implies it will labour under restrictive interest rates for a far longer period than other developed economies.

A weak economy is hardly supportive of a currency, particularly if the RBNZ finds itself entering an accelerated rate cutting cycle aimed at boosting activity.