GBP/NZD Set for Further Gains

- Written by: Gary Howes

Above: File image of Paul Conway, source: RBNZ.

A constructive technical setup and a limited calendar risk in the coming week, save for an appearance by RBNZ Chief Economist Conway, should support the Pound to New Zealand Dollar exchange rate in the coming days.

GBP/NZD rose to its strongest level since September last week at 2.1079, helped by news the New Zealand economy slipped into a double-dip recession in the final half of 2023, underscoring the difficulties the economy faces.

New Zealand has the highest central bank base rate in the G10, meaning there is ample space for the Reserve Bank of New Zealand to cut rates when the cutting cycle commences later this year. An aggressive RBNZ rate cutting cycle would in turn likely weigh on the NZD as is typically the case in a foreign exchange market driven by relative interest rate differentials.

Compare GBP to NZD Exchange Rates

Find out how much you could save on your pound to New Zealand dollar transfer

Potential saving vs high street banks:

NZ$5,350

Free • No obligation • Takes 2 minutes

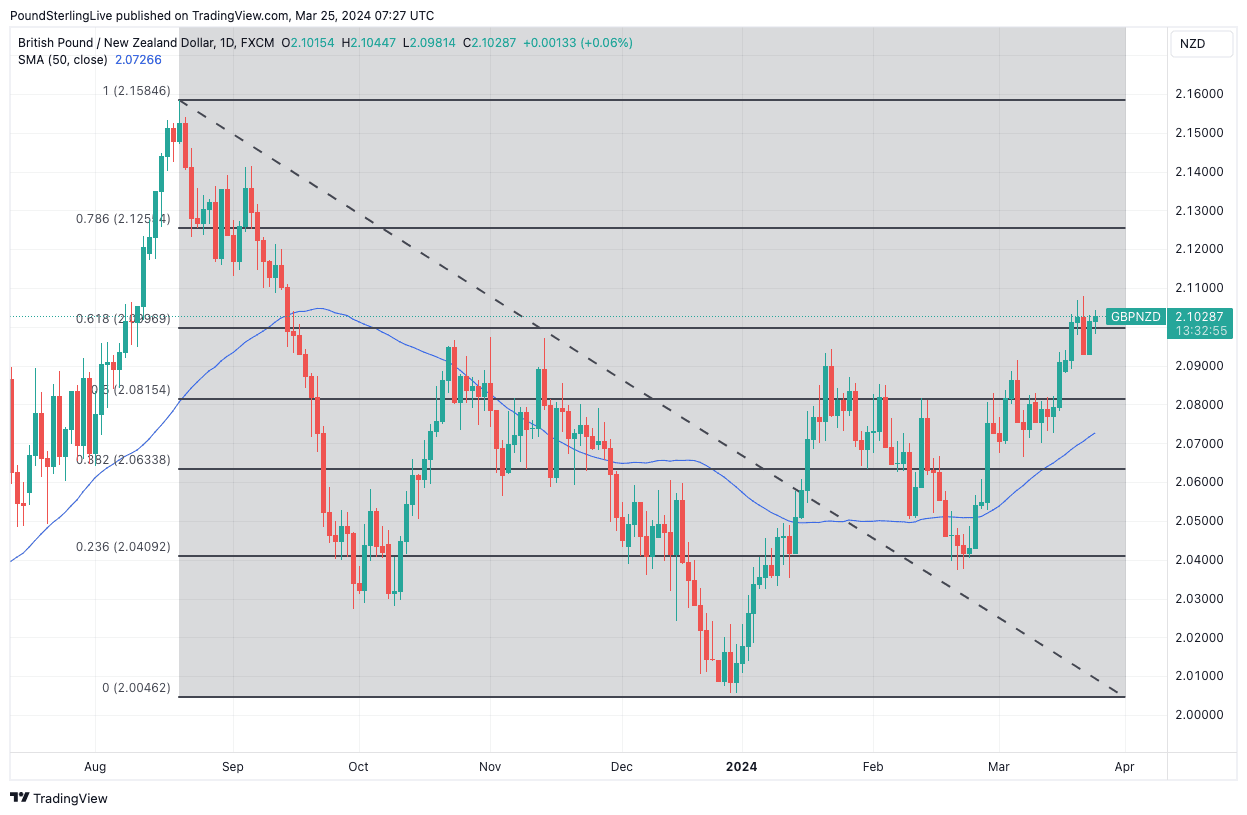

These fundamental developments underpin a constructive GBP/NZD setup that shows the exchange rate to be comfortably above the 50-, 100- and 200-day moving averages. Only when the 50- and 100-DMAs are threatened would we put the market on watch for a turn in trend to the downside. Only a break below the 200-DMA would signal to us a new trend has commenced.

The Retalive Strength Index is at 64.86 and is therefore comfortably consistent with upside momentum.

All this suggests that GBP/NZD is charging higher; however, we would not expect any significant gains just yet.

Above: GBP/NZD at daily intervals, showing the Fibonacci retracement of the Sept-Oct drawdown.

Our preferred stance is to await consolidation around current levels through the coming holiday-shortened week, with an uptrend eventually extending to the 78.6% Fibonacci retracement level of the August-September 2023 drop. This level, located at 2.1250, would form a multi-week target for the uptrend, ahead of the 2023 high at 2.0766.

A potential point of interest on the New Zealand calendar is RBNZ Chief Economist Paul Conway's appearance on Tuesday. He will speak about the February Monetary Policy Statement to a Chartered Accountants (Australia + New Zealand) event.

"NZ’s GDP data surprised the RBNZ to the downside, and the central bank’s chief economist, Paul Conway, will speak next week about the recent MPS. Conway has indicated that RBNZ rate cuts could come earlier than the central bank’s forecast of mid-2025 if the Fed cuts rates earlier and NZ data disappoints. There is some risk Conway further acknowledges the downside risk to the RBNZ’s OCR forecast post both the dovish FOMC and NZ GDP," says David Forrester, an economist at Crédit Agricole.