GBP/NZD Week Ahead Forecast: Weakness Unwinds, Downtrend To Be Tested

- Written by: Gary Howes

- GBPNZD unwinding Q4 weakness

- But too soon to say multi-month downtrend is complete

- U.S. data will be key to NZD movement this week

Image © Adobe Stock

The Pound to New Zealand Dollar exchange rate is in the process of unwinding the weakness that characterised the final quarter of 2024, but it is too soon to suggest a meaningful rally is underway.

The Pound-New Zealand Dollar exchange rate is seen at 2.0440 at the time of writing and looks set to complete a sixth consecutive daily advance.

Based on this, the coming week could see the exchange rate consolidate in the 2.04-2.06 region, which forms the early December consolidation range and, therefore, hints at a degree of gravitational pull.

Yet, from a technical perspective, we must consider recent strength as a countertrend move and prone to being shortlived, with a non-negligible risk of the downtrend restarting.

This is because the exchange rate resides below both the 100- and 200-day moving averages, which confirms the exchange rate remains in a downtrend on a multi-week basis.

Only when the pair breaks above the 200-day MA will we call a turn in trend and advocate for a more meaningful upside in GBPNZD.

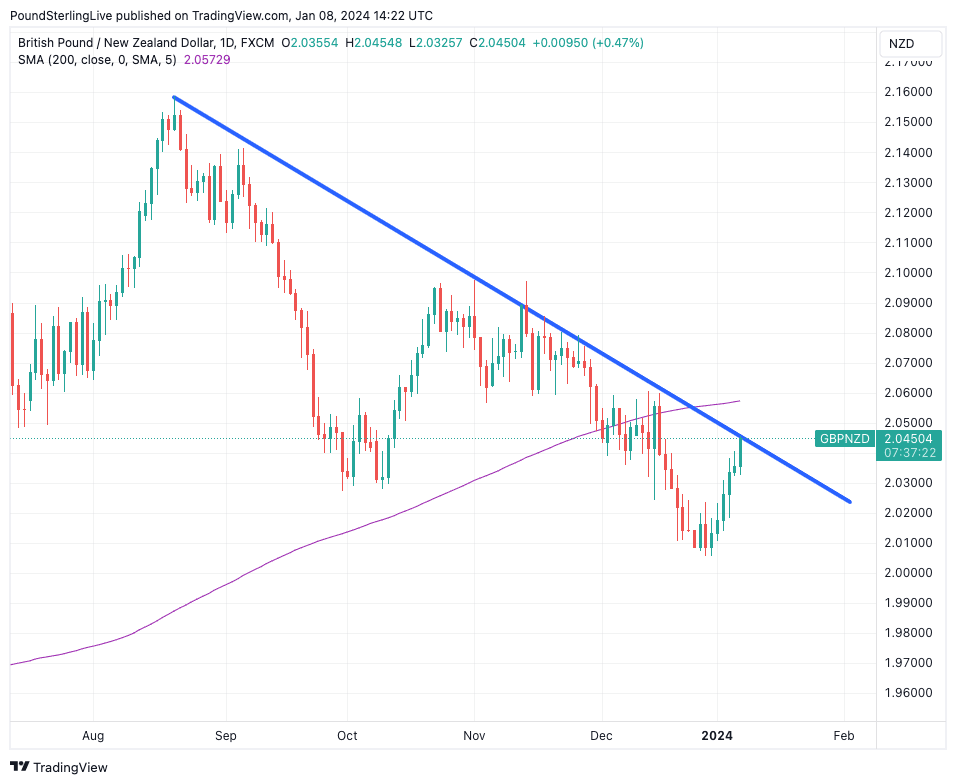

Above: GBPNZD at daily intervals with the 200-day MA and downward trendline annotated.

Also note the downtrend that has been in place since August is yet to be invalidated, as per the above chart which annotates the downward slope of the exchange rate.

The chart shows the recent rebound takes us to the top of the downward-sloping trendline, and we look for signs of resistance around these levels.

Should this trendline be respected, we would have further confidence that early 2024 will see extended weakness in GBPNZD, but should the line be invalidated by a break, a period of sideways consolidation could be the order of the day.

Compare GBP to NZD Exchange Rates

Find out how much you could save on your pound to New Zealand dollar transfer

Potential saving vs high street banks:

NZ$5,350

Free • No obligation • Takes 2 minutes

These technical considerations help us understand where the balance of probabilities lie, allowing those with payment requirements to understand where the probability of risks lie, but ultimately it will be the fundamental developments of the coming days that determine where GBPNZD closes the week.

The New Zealand Dollar has succumbed to a broad-based retreat in 'high beta' currencies and financial assets, i.e. those assets that are positively correlated with stock markets and global investor sentiment.

Risk sentiment has deteriorated over recent days amidst rising U.S. bond yields as markets reappraise the prospect of U.S. interest rate cuts, judging that the first cut might come later than previously expected.

"The rebound in U.S. bond yields rubbed off negatively on the Yen, the high beta and commodity currencies in G10 and EM," says Kenneth Broux, a strategist at Société Générale.

Track GBP with your custom rate alerts. Set Up Here.

"We expect downward pressure on the AUD and NZD to persist in the near term, amid a firmer USD backdrop," says a weekly strategy note from the FX research desk at Barclays. "These currencies have taken the brunt of the pain among G10 FX (aside from the JPY) amid the USD's New Year rally."

Fed rate cut bets retreated after it was revealed last week that the U.S. services sector saw the strongest earnings growth since July 2022, begging the question if the labour market is sufficiently loosening to rein in inflation.

The robust nature of the U.S. economy will be tested on Thursday when December inflation numbers are released.

The market looks for a print of 3.2% year-on-year in December, up from November's 3.1%, driven by a monthly increase of 0.2%. Core inflation is expected at 3.8% y/y, down from 4.0%.

The rule of thumb says should inflation beat these expectations, the New Zealand Dollar will fall, with the market reaction becoming more noticeable the greater the divergence.

Regarding the economic calendar, there is nothing of interest due from New Zealand this week.

In the UK, the release of GDP numbers on Friday forms the data highlight, but it could well be comments from the Bank of England's Andrew Bailey on Wednesday that moves the currency market.

Governor Bailey will appear before the Treasury Select Hearing on the December Financial Stability Report at 2.15 pm GMT.

The financial stability report is not directly linked to monetary policy, but there is a chance Bailey will be asked questions regarding interest rates, which can offer some clues as to whether the Governor maintains his steadfast view that it is too soon to consider cutting interest rates.

Turning to the GDP release, the market is poised for a reading of 0.2% month-on-month in November, while the year-on-year rate is expected at 0.1%.

The rolling three-month figure is expected to read at -0.1%.

Should the data beat expectations, the Pound can move higher, but disappointments could send GBP lower across the board.

Compare GBP to NZD Exchange Rates

Find out how much you could save on your pound to New Zealand dollar transfer

Potential saving vs high street banks:

NZ$5,350

Free • No obligation • Takes 2 minutes