GBP/NZD Week Ahead: Constructive

- Written by: Gary Howes

- GBPNZD short-term outlook constructive

- NZD could benefit on global sentiment improvement

- GBP PMI survey is main data event

Image © Adobe Stock

The Pound to New Zealand Dollar (GBPNZD) is building up a head of steam that can extend in the coming days given the clean calendar in New Zealand that will be unable to challenge NZD-negative sentiment and risks of a rebound in UK survey activity.

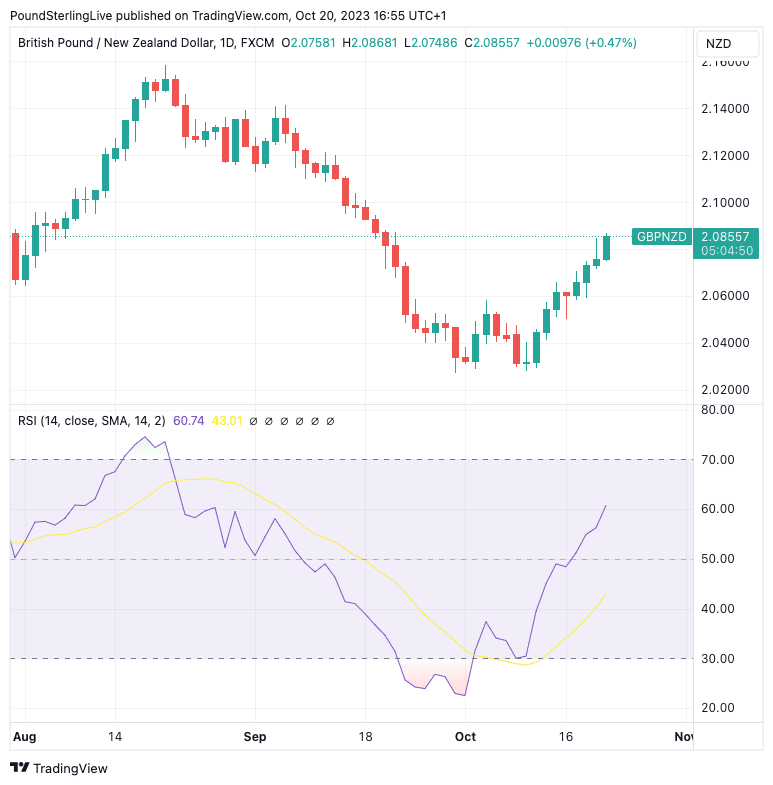

GBPNZD has sprung higher in a rebound from the deeply oversold conditions reached in late September, with the rally now proving more than a mere correction given momentum studies are increasingly positive.

Advocating for further gains is the Relative Strength Index (lower panel in the chart below) which confirms momentum to be comfortably positive.

Above: Daily chart showing the GBPNZD rebound which has built convincing short-term momentum. Set up a daily rate alert email to track your exchange rate OR set an alert for when your ideal exchange rate is triggered ➡ find out more.

The New Zealand Dollar has come under pressure as markets once again lower bets the Reserve Bank of New Zealand (RBNZ) will raise interest rates again in the near future, thanks mainly to last week's undershoot in inflation numbers.

The RBNZ, households and businesses will welcome the inflation undershoot, but from a currency market perspective, it is unsupportive of the NZD.

Compare GBP to NZD Exchange Rates

Find out how much you could save on your pound to New Zealand dollar transfer

Potential saving vs high street banks:

NZ$5,350

Free • No obligation • Takes 2 minutes

"The Australian and NZ rates stories also remain tilted towards their central banks staying on hold. This stance was reinforced for NZ by a soft inflation reading this week and will be tested by the Australian inflation reading in the coming week," says a note from analysts at Crédit Agricole.

Analysts at the bank also note the NZD has come under pressure given higher energy prices linked to tensions in the Middle East are a negative terms-of-trade shock for the NZD.

Therefore, we will be watching developments concerning Israel and Iran over the coming days, with any shocks to oil prices likely to undermine the Kiwi Dollar.

Last week's underperformance by NZD reminds us this is a currency that remains highly correlated with risk sentiment, tending to rise when investors are in a bullish mood but underperform when stock markets come under pressure.

Another worry for markets is the seemingly relentless rise in U.S. bond yields, which acts to constrict global finance and undermine the global growth pulse. This is an obvious risk to sentiment in the coming days and potentially the single largest threat to NZD performance.

We note last week's spike in U.S. ten-year yields took the move into overextended territory and a pullback in yields could offer investors some relief over the coming days, which could offer the Kiwi some support following three weeks of difficult trading conditions.

If markets turn bullish, and UK data disappoints, look for GBPNZD to retrace from Friday's high 2.0868.

Image © Adobe Stock

UK employment figures were due last week but were delayed by the ONS for technical reasons and are now set for release on Tuesday at 07:00 BST, and investors will be looking for signs of 'slack' in the labour market to back a growing expectation that the Bank of England has completed the rate hiking cycle.

The headline unemployment rate is expected to be unchanged at 4.3% in August. Meanwhile, the rolling three-month employment figure is expected to show a contraction of 195K workers.

Should the numbers beat expectations, the Pound could find itself supported, but we would expect gains to be limited simply by observing the Pound's inability to rally on upbeat data (the inflation beat last week is a case in point).

"As has been seen in past meetings, singular data points can have the power to influence a rate decision (even if they are then revised). The risks are certainly tilted towards a further hike from the Bank of England," says Ellie Henderson, an economist at Investec.

Should expectations for a further hike build, it could prove supportive of Pound Sterling.

The UK PMI survey comes at 09:30 on Tuesday and gives a timely snapshot of economic performance. The PMIs have been increasingly important to the currency market, which is now heavily invested in relative economic growth rates.

This means currencies with higher growth potential are favoured over those with a weaker outlook, as interest rates are likely to remain elevated for longer in the outperformers.

A services PMI of 49.5 is expected, with the manufacturing PMI anticipated at 44.6. The rule of thumb is that the Pound will move according to whichever side of expectation the data lands: higher on a beat, lower on a miss.

"If the forward-looking balances in recent activity surveys are anything to go by, October's flash S&P Global/CIPS PMI surveys are likely to signal a further contraction in private sector output," says Andrew Goodwin, Chief UK Economist at Oxford Economics.

Compare GBP to NZD Exchange Rates

Find out how much you could save on your pound to New Zealand dollar transfer

Potential saving vs high street banks:

NZ$5,350

Free • No obligation • Takes 2 minutes