Pound to New Zealand Dollar Week Ahead Forecast: Appreciation Mode

- Written by: Gary Howes

Image © Adobe Images

The technical and fundamental outlook advocates for further gains by Pound Sterling against the New Zealand Dollar in the coming week, according to our Week Ahead Forecast.

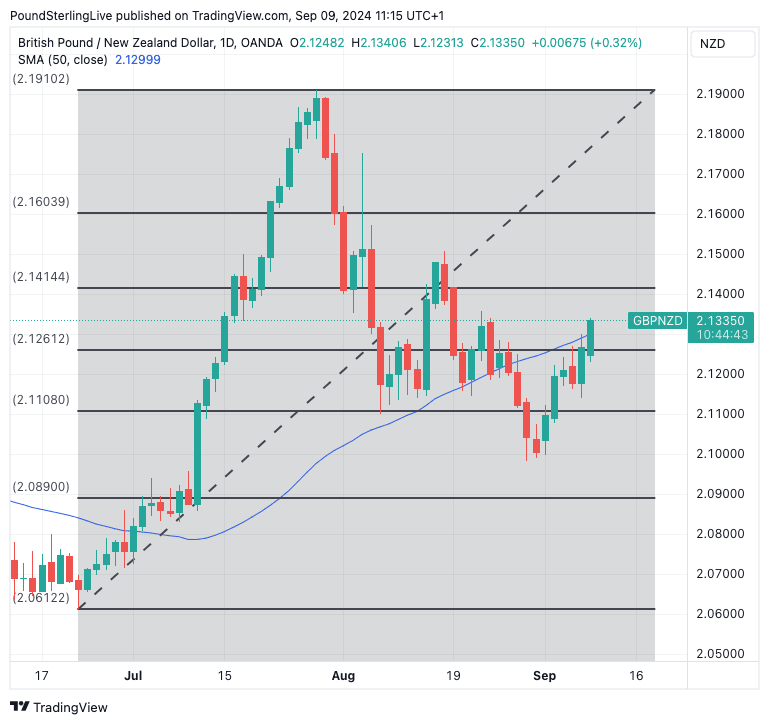

The Pound to New Zealand Dollar exchange rate (GBP/NZD) is putting in another advance on Monday as it builds on the previous week's gains and a look at the daily chart shows a break above the 50-day moving average is underway:

A break and daily close above the 50 DMA at 2.13 would further bolster the technical picture in favour of GBP/NZD upside. We now target a move to the 38.2% Fibonacci retracement of the GBP/NZD's June-August rally at 2.1414.

The Relative Strength Index (RSI) is at 55 and is pointed higher, which confirms positive near-term momentum.

Last Monday's Week Ahead Forecast opined that the technical picture was still advocating for weakness, and we were inclined to respect the signals that suggested we should prepare for further declines.

🎯 GBP/NZD year-ahead forecast: Consensus targets from our survey of over 30 investment bank projections. Request your copy.

But we also said the fundamental picture challenges such expectations and that we thought the NZ Dollar would weaken on account of developments in the U.S., where we expected the odds of a 50 basis point rate cut at the Federal Reserve to fade.

The fundamental reading was correct, with Friday's robust U.S. jobs report and speeches from two Federal Reserve members pushing back against expectations for an aggressive U.S. rate cutting cycle. We think this week will see the technical and fundamental drivers gel in favour of GBP/NZD gains.

"Markets are giving up on a 50bp Fed cut," says Kit Juckes, head of FX research at Société Générale. This has resulted in higher U.S. bond yields and weaker equity markets, which has weighed on NZD, which is highly sensitive to equity performance.

Compare Currency Exchange Rates

Find out how much you could save on your international transfer

Estimated saving compared to high street banks:

£2,500.00

Free • No obligation • Takes 2 minutes

If Wednesday's U.S. inflation print beats expectations, then the Kiwi Dollar will come under further pressure as any lingering hopes of a 50bp cut in 2024 fade entirely. "There’s no doubt the US economy is slowing, but by the same token, no reason to label it a 'hard landing' yet. We will see if the CPI data change anything, but we’d need a 0.1% core monthly gain to shake the market at all," says Juckes.

In short, it will be challenging to shift the NZD-negative forces coming out of the U.S. at present.

GBP/NZD will also monitor Tuesday's UK jobs report: The market looks for employment to have risen 84K in the three months to July, with the unemployment rate at 4.1%. It will be the wage figures that will potentially be of more significance for the Pound as this is something that Bank of England will be watching closely.

Average earnings are predicted to have risen by 4.1% in the three months to July, down from 4.5%. The Bank is not expected to cut rates again in September, but there is some debate over whether they will move again in October and November. Weaker figures will boost the odds of an October cut, which will weigh on GBP/NZD.

Wednesday will see the release of UK GDP figures for July, with the market looking for 0.2% growth, up from the previous month's flat 0% outturn. On paper, the GDP figure is secondary to the wage release, but any sizeable surprises (i.e. more than 2pps) can shake the market, with Sterling likely to weaken on any disappointments and rise on any surprising strength.

There are no calendar events scheduled for New Zealand this week.