GBP/NZD 5-Day Forecast: Impressively Oversold, Test of 2.0 Beckons, RBNZ in Focus

- Written by: Gary Howes

- GBPNZD heavily oversold

- Consolidation is possible near-term

- But strength of downmove means 2.0 at risk

- RBNZ in focus midweek, hawkish guidance expected

- Nov. rate hike now likely says ANZ

- This could boost NZD further

Image © Adobe Stock

Pound Sterling is now impressively oversold against the New Zealand Dollar and we continue to look for a correction, but an important meeting of the Reserve Bank of New Zealand risks spurring the GBP/NZD exchange rate through the 2.0% if a 'hawkish' tone is struck.

The Pound to New Zealand Dollar exchange rate (GBP/NZD) slumped a further two-thirds of a per cent on the final trading day of September to go to 2.0273, before paring some of that selloff to reach 2.0363 at the time of writing Monday.

As the below chart shows, the selloff has dragged the Relative Strength Index (RSI) to 24, which indicates a notably oversold market.

Above: GBPNZD at daily intervals with the RSI shown in the lower panel.

We look for the RSI to mean-revert back above 30, which would require the exchange rate to stage a recovery, or simply consolidate.

This by no means suggests GBPNZD is about to rally, simply the pace of decline will likely fade and a test of 2.0 could yet be on the cards either this week or next, unless the Pound refinds some support more broadly.

Improved investor sentiment towards the end of last week resulted in a stock market rally that boosted risk-sensitive currencies such as the Aussie and Kiwi Dollars.

"High-beta currencies such as the Australian dollar, New Zealand dollar and Swedish krona rebounded significantly," says Natixis, the investment and commercial bank. "After spending five sessions on the back foot and kicking off the session lower, equity indices rebounded."

Compare GBP to NZD Exchange Rates

Find out how much you could save on your pound to New Zealand dollar transfer

Potential saving vs high street banks:

NZ$5,350

Free • No obligation • Takes 2 minutes

Stock markets have struggled of late as the cost of borrowing across the global economy continues to rise on account of the surge in long-dated bond yields, led by the U.S.

This rise in yields has proven negative for markets while at the same time benefiting the U.S. Dollar which remains on the front foot against the antipodean currencies.

Yet the New Zealand Dollar has been a relative winner having advanced against most of its peers, despite the recent rise in long-term bond yields, suggesting some idiosyncratic strength is at play. And when stock markets do improve, the NZD still takes advantage of its high beta status.

Kiwi strength is particularly evident against the British Pound and Euro, where further gains can be expected, even if near-term indicators suggest the New Zealand Dollar is now deep in overbought territory that screams of a need for either a short-term rebound or sideways action.

There is no data due from the UK this week and domestic attention in New Zealand falls on the Reserve Bank of New Zealand (RBNZ) which will give its latest interest rates decision on Wednesday at 2:00 BST.

"The RBA and RBNZ meet next week. We see rates on hold with a hawkish bias despite weak domestic and global conditions," says Micaela Fuchila, Economist at Merrill Lynch in Australia.

New Zealand headline inflation and inflation expectations have declined but measures of core inflation could be considered too high by the central bank which will also be concerned about the recent rise in global oil prices.

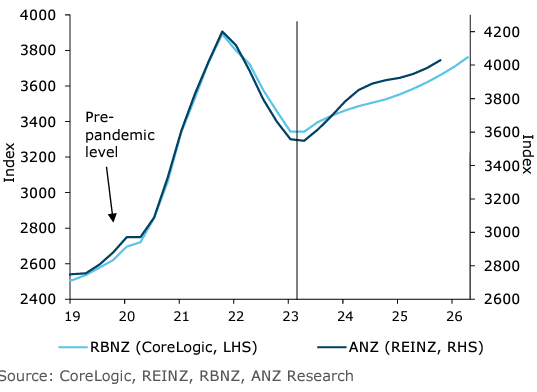

Above: ANZ forecasts NZ houses to continue rising faster than the RBNZ currently predicts, despite rapid interest rate hikes.

Sticky inflation along with the recent rise in oil prices means the RBNZ is likely to retain a "hawkish bias... for longer. Indeed, there is some risk for further policy tightening in November," says Fuchila.

Such a hawkish bias would support New Zealand bond yields relative to elsewhere - particularly against those of the UK which have come off the boil since the Bank of England announced it was holding rates. This would imply further weakness in the Pound-New Zealand Dollar exchange rate.

"We expect a hawkish pause from the RBNZ at this week’s Monetary Policy Review. We continue to expect a hike at the November meeting and risks are tilting towards even more being required in 2024," says Sharon Zollner, Chief Economist at ANZ.

ANZ says almost all major data since the RBNZ's August Monetary Policy Review - except for dairy prices, which fell sharply but subsequently partly recovered - has surprised to the upside.

This could be considered a slight 'second wind' for the New Zealand economy that will need to be addressed by the RBNZ which will be concerned more needs to be done to get inflation down.

"Inflation pressures remain intense across the economy," says Zollner. August food prices rose 0.4% m/m (seasonally adjusted) and new rents rose "a whopping" 1.0% m/m, to be up 6.2% over the last year as huge "population growth kicks in," explains Zollner.

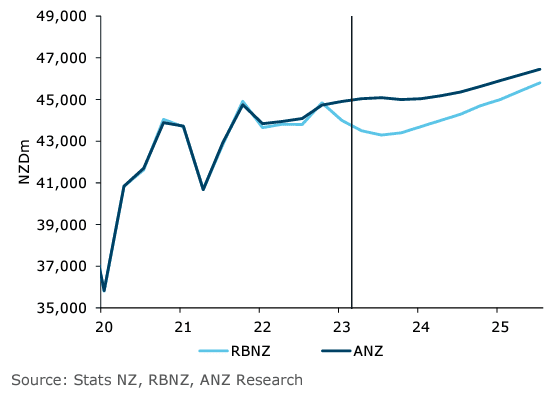

Above: ANZ vs RBNZ private consumption forecast. Image courtesy of ANZ.

ANZBO inflation expectations and pricing intentions continue to fall, but in absolute terms they remain problematically high.

House prices meanwhile rose 0.7% m/m in August.

"The output gap remains positive, pricing pressures remain elevated, and the labour market remains tight," says Zollner, "at some point this will become untenable; we’re expecting the RBNZ to return to the hiking table with a 25bp hike in November."

"We were crossing our fingers that 5.5% would be enough to solve New Zealand’s inflationary problems, but at this point, the data is suggesting that that will not be the case, at least not in a reasonable timeframe," she adds.

Compare GBP to NZD Exchange Rates

Find out how much you could save on your pound to New Zealand dollar transfer

Potential saving vs high street banks:

NZ$5,350

Free • No obligation • Takes 2 minutes