Pound to New Zealand Dollar Week Ahead Forecast: Pointed Higher

- Written by: Gary Howes

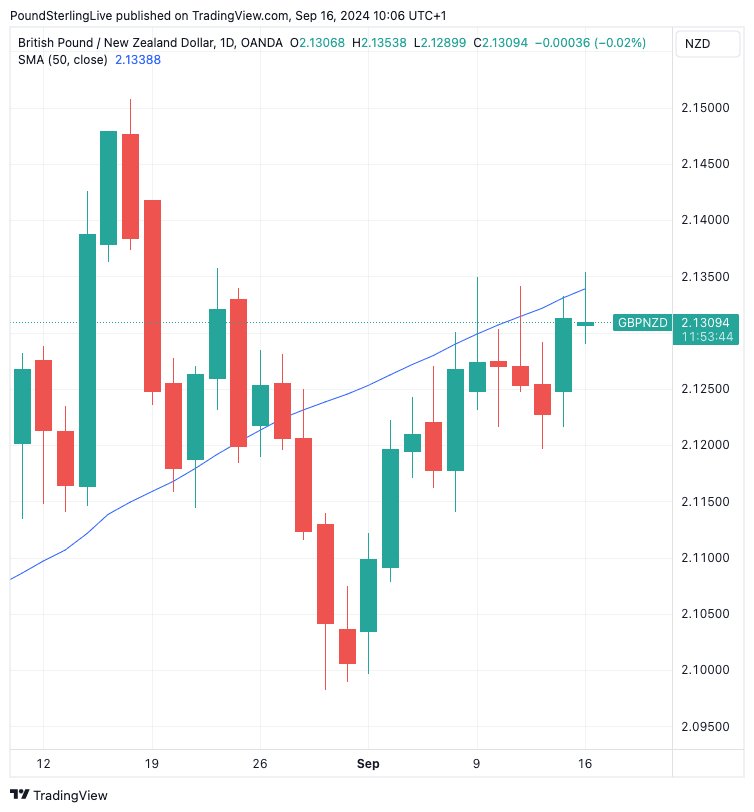

Look at the chart of the Pound to New Zealand Dollar exchange rate below; you will notice the blue line running along the top of the recent daily bars.

This is the 50-day moving average (DMA) and we think it is providing a decent technical steer with regard to near-term price action.

As can be seen, it is serving to limit the upside. Yet, importantly, it is pointed higher, telling us that gains should be expected in the near term, but the going will be slow until a clear and decisive break of the DMA occurs.

As a result, the Week Ahead Forecast model places a conservative topside target at 2.1350, with the level lifted on a successful break.

Although the technical setup for GBP/NZD is constructive, bear in mind that this week has the potential to impart some volatility given the momentous occasion of a midweek interest rate cut at the Federal Reserve.

Compare GBP to NZD Exchange Rates

Find out how much you could save on your pound to New Zealand dollar transfer

Potential saving vs high street banks:

NZ$5,350

Free • No obligation • Takes 2 minutes

There is increased chatter in the market that the Fed will commence with a generous 50 basis point hike, with a number of press reports out last Thursday alluding to such a move.

Such a decision would boost stocks, commodities and associated currencies such as the NZ Dollar. On paper, the GBP/NZD should come under pressure if the Fed follows through.

However, when rumours of a 50bp cut emerged last week, the fall in GBP/NZD was relatively well contained. Indeed, the exchange rate rose into the weekend and looks well supported on Monday.

🎯 GBP/NZD year-ahead forecast: Consensus targets from our survey of over 30 investment bank projections. Request your copy.

This reflects the strong upmove in GBP/USD to the adjustment in Fed expectations (whereas the NZD/USD rally is less pronounced, in turn helping the GBP/NZD cross).

This tells us that any boost to the NZD from a 50bp rate cut would match the potential boost to the GBP, ultimately containing the GBP/NZD.

It looks to us that NZD continues to be weighed down by the ongoing negative sentiment towards China, which explains why the positive reaction to Fed developments has been relatively limited.

A new research note from Barclays out on Monday says China is experiencing a weak credit impulse, which will ultimately weigh on commodity-related currencies. The NZD is considered one such currency.

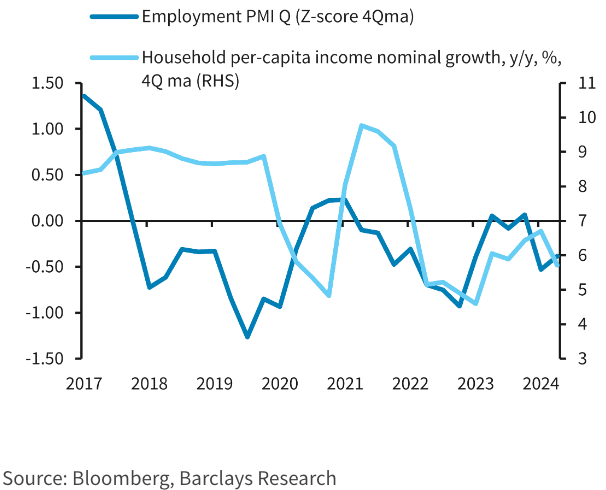

"Chinese economic activity into H2 24 is likely to remain soft, led by weakness in consumption amid a worsening jobs market," says Mitul Kotecha, an analyst at Barclays in Singapore.

Above: "Slowing household income growth amid a worsening jobs market" - Barclays.

"We find that CLP, THB, BRL and ZAR in EM, alongside the NZD and AUD in G10, are the most exposed currencies to further downside in China's credit impulse," he adds.

Keep an eye on the GBP side of the equation as Wednesday's inflation report and Thursday's Bank of England decision offer some domestic flavour.

Core CPI inflation is expected by the consensus to have risen from 0.0% to 0.4% month-on-month, taking the annual rate from 3.3% to 3.5%. Headline CPI is forecast to have jumped from -0.4% m/m to 0.3%, while the annual rate is expected to have remained at 2.2.%.

Any undershoot in the data would weigh on the Pound. But, survey data continues to show a resilient economy and there are no signs of massive disinflation taking hold. The Bank of England and institutional economists think inflation will inch up over the remainder of 2024, and this week's data should confirm this.

The Bank of England will acknowledge these inflation dynamics on Thursday by keeping interest rates unchanged at 5.0% and communicating that it will continue to watch the data when deciding on future interest rate cuts.

Because there is no Monetary Policy Report or press conference this week, markets will instead keep a close eye on the minutes from the meeting and the vote composition of the Monetary Policy Committee.

"The focus could be on the voting pattern among committee members. We are bracing for either an 8-1 or 7-2 vote, with ultra-dove Swati Dhingra to potentially be joined by Dave Ramsden in opting for an immediate rate reduction," says Matthew Ryan, Head of Market Strategy at Ebury.

"A closer vote, whereby we see more of a balance between the hawks and the doves, could trigger a sell-off in sterling, as markets ramp up bets in favour of cuts at a pace more frequent than one per quarter," explains Ryan.

The base case assumption amongst economists is that the vote will land at either 8-1 or 7-2, which, if correct, will would underpin our bullish stance on GBP/USD.