GBP/NZD: Move Lower to Prove Short Lived

- Written by: Gary Howes

- GBP/NZD moves back into favoured range

- Downside risks fade after U.S. jobs surprise

- Housing and consumer data due out of NZ

Image © Adobe Stock

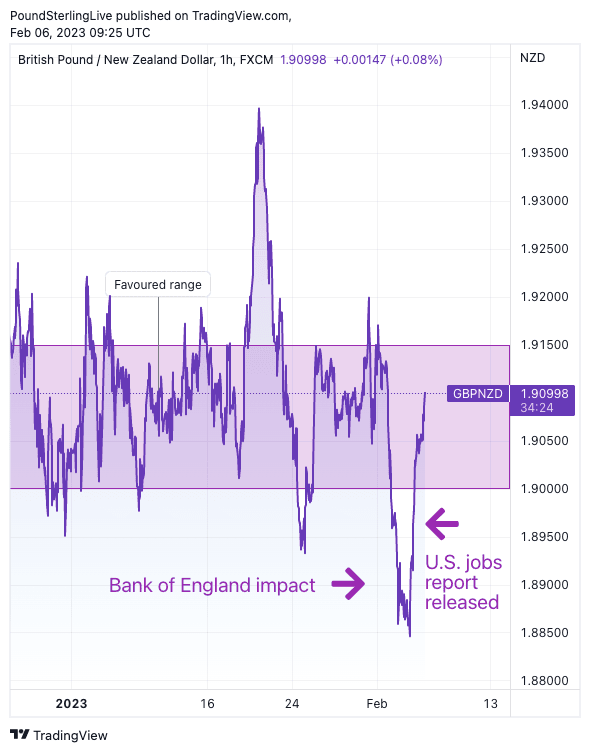

The Pound to New Zealand Dollar exchange rate (GBP/NZD) fell to its lowest level in four months but a strong rebound on Friday propels it back to 'comfortable' levels that are likely to hold over the coming days.

GBP/NZD slumped to a low of 1.8834 on Friday as markets continued to dump the Pound in the wake of the previous day's Bank of England interest rate decision and guidance update.

Sterling was sold as the Bank hiked by 50 basis points but indicated it was not fully committed to further rate hikes.

This prompted a decline in UK bond yields which translated into a weaker currency.

But the U.S. employment report on Friday set markets alight after it was revealed the economy continues to add jobs while wages remained elevated by historical levels, prompting markets to raise expectations for further Federal Reserve rate hikes.

The spike in expectations prompted a fall in global equity markets and investor sentiment, which in turn weighed on the Kiwi Dollar.

Compare GBP to NZD Exchange Rates

Find out how much you could save on your pound to New Zealand dollar transfer

Potential saving vs high street banks:

NZ$5,350

Free • No obligation • Takes 2 minutes

The Kiwi is considered to have a 'higher beta' to global equities than its UK counterpart, resulting in GBP/NZD upside.

The move propelled the exchange rate towards the middle of its medium-term range, roughly between 1.90 and 1.9150.

GBP/NZD is quoted at 1.9070 at the time of writing and the downshift in investor sentiment in the wake of the U.S. labour market data will likely prove a headwind for the NZ Dollar over the coming days, ensuring GBP/NZD won't retest last week's lows.

Above: GBP/NZD at one-hour intervals. Consider setting a free FX rate alert here to better time your payment requirements.

Foreign exchange markets have over the duration of 2023 been lowering expectations for the peak in U.S. interest rates while pricing in the prospect of rate cuts in the second half of the year.

These rate cuts were to be a response to a slowing economy - after all lower interest rates encourage borrowing and therefore investment and spending - but strong data undermines such expectations.

"As we have been arguing for some time now, we believe the market is overly dovish in its expectation of rate cuts, even though in the same presser, Powell said clearly that he didn’t think there would be rate cuts this year, and that a “couple” of hikes were likely. The Friday data jump, as we said, reinforces our view," says John Velis, FX and Macro Strategist at BNY Mellon.

Higher U.S. rates imply greater headwinds for U.S. and global growth as the Fed attempts to stall inflationary pressures.

This provides a global context that has traditionally coincided with New Zealand Dollar weakness.

"On the basis that we expect the market to price out expectations of a Fed rate cut this year, we see the potential for NZD/USD to dip back to its January low in the 0.62 area on a 3 to 6 month view," says Jane Foley, Senior FX Strategist at Rabobank.

Under such a scenario the GBP/USD would also be expected to fall, but at a slower pace than NZD/USD. Therefore, the GBP/NZD cross would be expected to rise over the medium term.

But foreign exchange strategists at Commonwealth Bank of Australia are looking for some of the air to be let out of Friday's post-payrolls move, which could allow the NZD some outperformance.

Joseph Capurso, an economist and strategist at CBA, says the New Zealand Dollar can lift this week as the market's reaction to the jobs report was overdone.

"One number is unlikely to lead market participants to reassess greatly the outlook for the US economy," says Capurso. "The USD is likely to remain heavy in the remainder of the week in the absence of important US economic data."

A weaker USD would see the biggest losers outperform on Friday, including the New Zealand Dollar.

Compare GBP to NZD Exchange Rates

Find out how much you could save on your pound to New Zealand dollar transfer

Potential saving vs high street banks:

NZ$5,350

Free • No obligation • Takes 2 minutes

Therefore the battleline for the GBP/NZD could revolve around the extent to which Friday's figures are interpreted as a blip or a reminder that the Fed has more to do.

On the New Zealand domestic economic release docket this week are REINZ housing data and card spending for January.

Both are anticipated to show the impact of higher interest rates in New Zealand.

"The implied negative wealth effect has combined with higher interest rates and inflation to drive down consumer confidence," says Foley.

Data from CoreLogic New Zealand indicated that house prices dropped 7.2% in January, the largest monthly fall since 2009.

However, this week's data are unlikely to materially shift the dial on the Reserve Bank of New Zealand's intentions for future policy decisions.

"In line with other OECD economies, labour shortages remain widespread. This suggests that wage inflation is likely to remain buoyant and that the RBNZ has more work to do to stem inflationary pressures," says Foley.

Therefore it will be the global picture that continues to matter.