Pound Under Renewed Pressure as Markets Balk at Hot U.S. Data

- Written by: Gary Howes

- GBP slides amidst global stock market decline

- Investors react to strong U.S. jobs report

- Markets in "good news = bad news" mode

- U.S. ISM data also smashes expectations

- Raises prospect of further Fed rate hikes

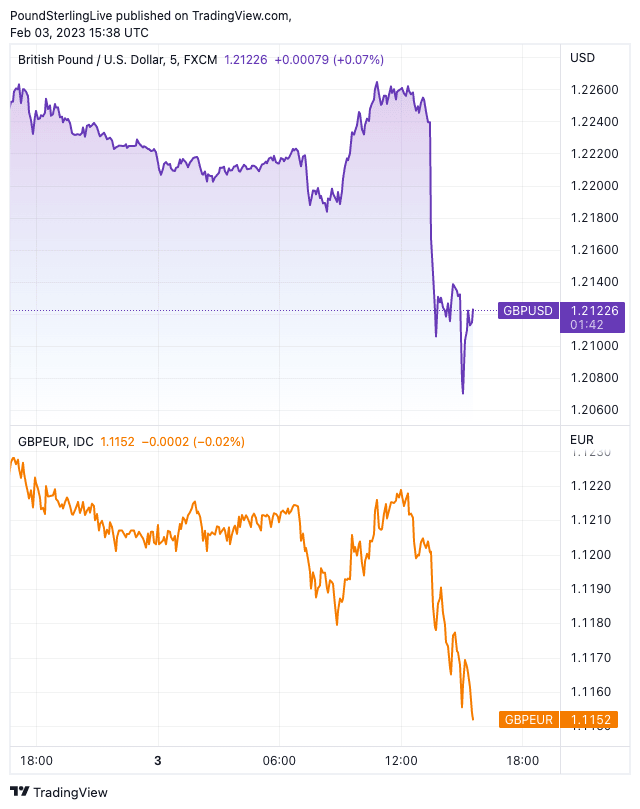

The British Pound came under significant pressure against the Euro and Dollar ahead of the weekend following the release of surprisingly strong U.S. Data, which prompted a pullback in global risk sentiment.

Stocks and risk-sensitive assets, such as the Pound, retreated after U.S. jobs and survey data for January showed the U.S. economy to be in surprisingly robust shape, despite a series of activity-constricting interest rate hikes from the U.S. Federal Reserve.

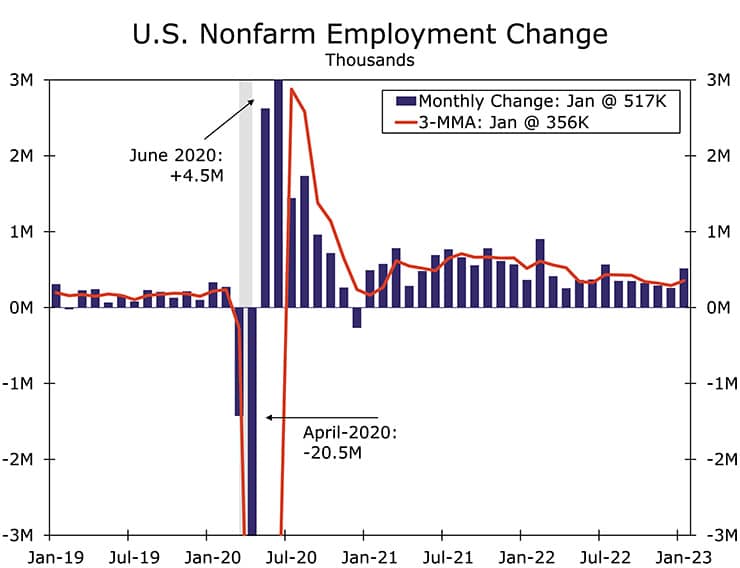

A better-than-expected increase in jobs during January - 517K were created according to the non-farm payroll report - suggests the Fed will need to do more by way of raising interest rates if it is to tame inflation.

The jobs report defied expectations for a 185K increase, while also being sharply up on December's 260K reading.

Above: U.S. non-farm payrolls, image courtesy of Wells Fargo.

Compare Currency Exchange Rates

Find out how much you could save on your international transfer

Estimated saving compared to high street banks:

£2,500.00

Free • No obligation • Takes 2 minutes

Stock markets fell as investors feared interest rates would need to go higher than they were anticipating, raising U.S. bond yields, boosting the Dollar and placing yet further pressure on the Pound.

The Pound is a 'high beta' currency that tends to underperform the Dollar and Euro when investor sentiment retreats and markets fall.

The Pound to Dollar exchange rate fell 1.40% on the day and is quoted at 1.2057 at the time of writing on Monday.

"The U.S. dollar jumped after a surprisingly and resoundingly bullish jobs report added traction to the Fed’s assertion that it’s not done raising rates," says Joe Manimbo, Senior Markets Analyst at Convera.

The Euro to Dollar rate retreated 1.00% to 1.0783.

The Pound to Euro exchange rate fell a third of a percent and is trading at 1.1179 at the time of update on Monday. (If you are looking to protect or boost your international payment budget you could consider securing today's rate for use in the future, or set an order for your ideal rate when it is achieved, more information can be found here.)

Above: GBP/USD (top) and GBP/EUR fell after the NFP report, confirming GBP's sensitivity to broader market sentiment. Consider setting a free FX rate alert here to better time your payment requirements.

The jobs report revealed the U.S. unemployment rate fell to 3.4% from 3.5%, defying expectations for unemployment to rise to 3.6%.

Average hourly increased 0.3% in January, meeting expectations, and December's figure was revised higher to 0.4%. Year-on-year earnings fell to 4.4% from 4.8%, but this was still stronger than the 4.3% the market was expecting.

The jobs market is therefore 'tight' and companies would be expected to deliver strong wage packages to retain and attract talent. This in turn underpins domestically-generated inflation and flies in the face of the Fed's objective of bringing inflation down.

The bet is therefore that more hikes must come and a rate cut by at least the third quarter - as the market had been expecting - would not materialise.

"We suspect members of the FOMC will take January's blowout employment report with somewhat of a grain of salt. That said, it will be hard to completely ignore the reading at a time when policymakers want to ensure that their policies help durably return inflation to 2%," says economist Sarah House at Wells Fargo.

This raises U.S. bond yields higher and attracts capital into U.S. assets, thereby boosting the Dollar.

The pro-USD theme was further underscored by economic survey data from ISM that showed the services sector in the U.S. rebounded sharply in January.

The ISM Non-Manufacturing PMI read at 55.2, well ahead of expectations for 50.4, as it recovered from December's 49.2, a level consistent with contraction.

The Dollar could make further gains if markets melt further for fear of higher Fed interest rates.

"The strong payrolls report has encouraged markets to assess the likelihood the FOMC will keep the Funds rate higher for longer. Indeed, we see upside risks to our call for one final 25bp hike at the FOMC’s March meeting," says strategist Carol Kong at CBA.

The Pound would meanwhile be expected to come under further pressure amidst any retreat in sentiment.

Compare Currency Exchange Rates

Find out how much you could save on your international transfer

Estimated saving compared to high street banks:

£2,500.00

Free • No obligation • Takes 2 minutes