GBP/NZD Rate Week Ahead Forecast: Key Support Tested

- Written by: Gary Howes

- GBP/NZD has eased back of late

- Amidst clear NZD outperformance

- Watch China for further cues

- RBNZ rate hikes proving supportive

- GBP/NZD sitting on a major support line

Image © Adobe Stock

The New Zealand Dollar has been a top-performing major currency in recent days and a combination of factors could see it maintain this dominance into year-end.

The Kiwi is finding support as markets expect further hikes from the Reserve Bank of New Zealand (RBNZ) and as China continues to ease Covid restrictions, in turn aiding global investor sentiment.

The New Zealand Dollar started the week in a strong fashion on Covid-related news out of China and the currency will be sensitive to further such developments over the coming days, particularly as there is nothing of consequence on New Zealand's data and event calendar for this week.

"In China, several cities announced a further relaxation of Covid restrictions over the weekend, which may see risk assets (and the NZD and AUD) start the week on the front foot," says Nick Smyth, an economist at BNZ.

Shanghai, China's commercial capital, eased testing requirements for outdoor activities in what amounts to another step down the road to a more relaxed approach to dealing with the Covid pandemic in New Zealand's most important trading partner.

Compare GBP to NZD Exchange Rates

Find out how much you could save on your pound to New Zealand dollar transfer

Potential saving vs high street banks:

NZ$5,350

Free • No obligation • Takes 2 minutes

This was just the latest in a string of decisions to ease restrictions taken by numerous regional authorities, in line with a broader national policy to evolve away from the strict zero-Covid policy of recent years.

"While the easing of some restrictions does not equate to a wholesale shift away from the dynamic covid zero strategy just yet, it is further evidence of a shifting approach and financial markets look to be firmly focussed on the longer-term outlook over the near-term hit to activity as virus cases look set to continue," says economist Taylor Nugent at NAB.

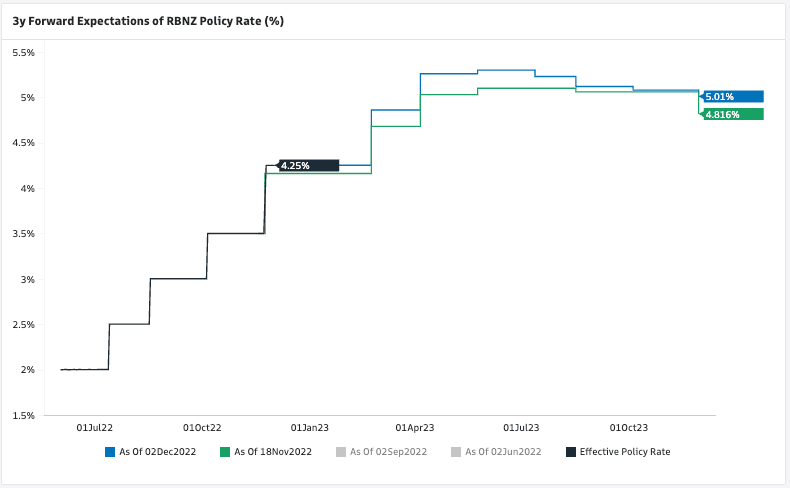

Also underpinning the currency's outperformance are expectations for further RBNZ interest rate hikes that should take the peak in the OCR to 5.3%, according to current market pricing.

Of late, the market has lifted its expectations for the degree of tightening at the RBNZ, whereas expectations have fallen for other major central banks, thus offering NZD support via the rates channel.

Above: Expectations for the peak in the OCR have risen of late, aiding NZD. Image courtesy of Goldman Sachs.

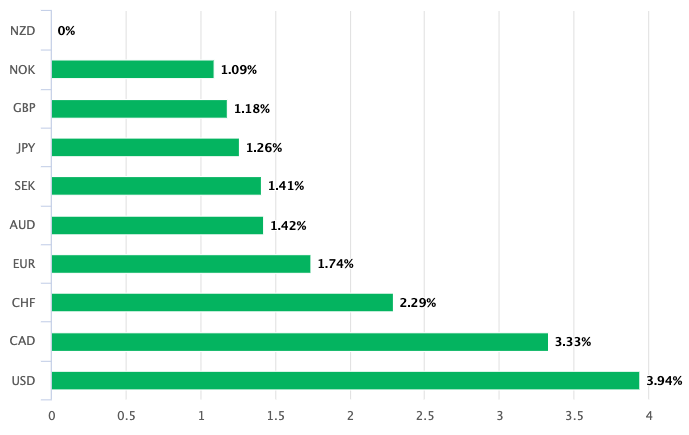

Smyth says the NZ Dollar was the standout performer in the FX market last week as it continues its "recent stellar run".

The New Zealand Dollar rally was boosted after the RBNZ came across as unexpectedly 'hawkish' on November 23 when it raise interest rates again and warned they still have a long way to rise if inflation is to be returned to its target.

The RBNZ hiked by three-quarters of a percentage point but surprised investors by saying it had considered lifting it by a full percentage point.

"The NZD has been the best G10 performer over the past two months, helped in part by the RBNZ’s shift to an even more hawkish stance," says Damien McColough, strategist at Westpac.

Above: The NZD has been the best performer of the past week.

The Pound to New Zealand Dollar exchange rate (GBP/NZD) has however been remarkably stable over recent weeks as Sterling has also entered a period of outperformance, therefore allowing it to match its Kiwi cousin.

Gains come amidst stabilising global market conditions and an easing of political uncertainty in the UK, combined with a recommitment by the government of Rishi Sunak to fiscal responsibility.

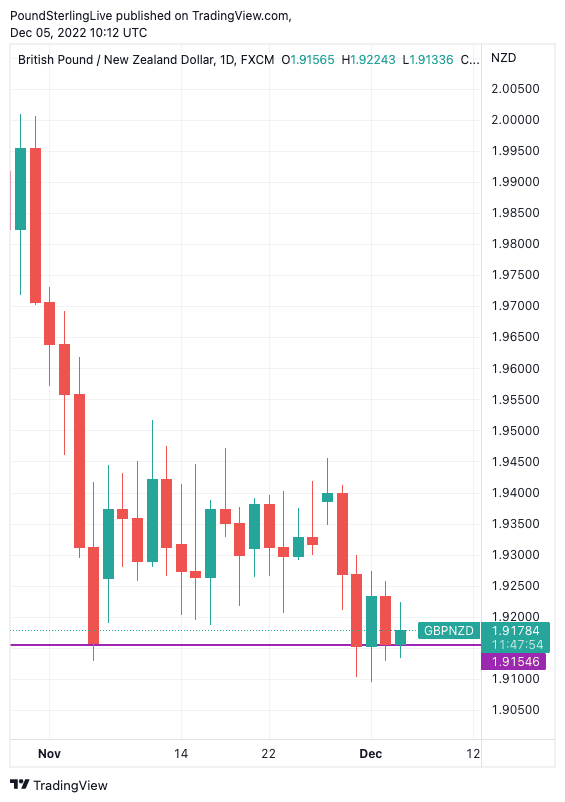

As unremarkable as GBP/NZD trade has been of late, the NZD's outperformance has nevertheless ensured a key area of support is now being tested.

The below daily chart reveals the pair has failed to close under 1.9154 since September, with attempted breaches bought into, particularly over recent days:

Above: GBP/NZD at daily intervals. Consider setting a free FX rate alert here to better time your payment requirements.

This area of support is proving particularly sticky and therefore minimises the risk of a major decline.

But a fresh bout of New Zealand Dollar strength could result in a break of this support and open the door to a weaker GBP/NZD ahead of year-end, thereby shaking the seaming monotony offered up by this pair.

Factors that could aid such a move are another repricing higher of RBNZ interest rate hike expectations or an extension of the China-relief rally.

Watch the mid-month Bank of England interest rate decision for further cues as the Pound has tended to weaken following the Bank's decisions thus far in 2022.

Westpac's McColough meanwhile caution the New Zealand Dollar now looks stretched against the U.S. Dollar.

As such, it is "due a correction soon," he says.

"We expect NZD to consolidate after outsized gains and having outperformed last week. Risks remain skewed to the downside with deteriorating business confidence amid elevated inflation levels and labour shortages," says Ashish Agrawal, analyst at Barclays Bank in Singapore.

Any corrective decline in NZD/USD could ease pressure on GBP/NZD and allow a retracement back into its now well-defined range, confirming the likelihood of a steady sideways trend remaining intact.

(If you are looking to protect or boost your international payment budget you could consider securing today's rate for use in the future, or set an order for your ideal rate when it is achieved, more information can be found here.)