New Zealand: Westpac's Forecast Snapshot

- Written by: Gary Howes

Image © Adobe Stock

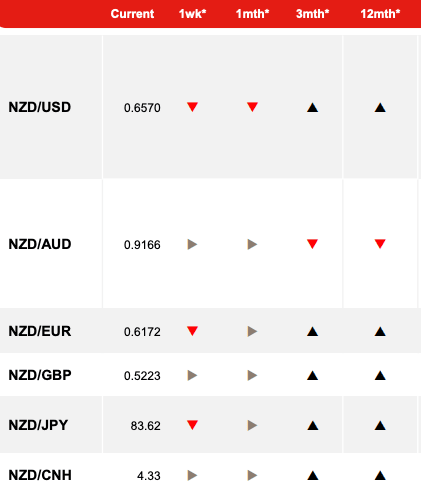

Foreign exchange strategists at Westpac - the New Zealand and Australian lender - have updated their forecast views for the New Zealand Dollar.

Westpac analysts say in a weekly briefing that the New Zealand Dollar's downward correction against the U.S. Dollar continues and there is potential for some near-term losses against the Pound and Euro.

Imre Speizer, currency strategist at Westpac in New Zealand, says NZD/USD’s downward correction continues and they are targeting a move to 0.6530 near term, "but potentially much lower if that gives way".

The view aligns with the broader rally in the U.S. Dollar that is currently the dominant theme in global FX.

But longer-term Westpac are bullish on the New Zealand Dollar's prospects:

"A strong commodity price outlook should be the main source of support for the NZD in H2, and USD strength should start to fade in H2 once markets have fully priced the Fed cycle. We expect NZD/USD to test 0.7000 in H2," says Speizer.

Regarding the New Zealand-Pound exchange rate, Speizer says after peaking above 0.5300, a correction reached 0.5135 but has since stalled. (Set yor FX rate alert here).

"Potential for lower," says Speizer, "7% headline CPI should affirm BoE tightening and support GBP."

Compare GBP to NZD Exchange Rates

Find out how much you could save on your pound to New Zealand dollar transfer

Potential saving vs high street banks:

NZ$5,350

Free • No obligation • Takes 2 minutes

For those looking at the pair from a Pound to New Zealand Dollar angle, 0.5300 in the above equates to 1.8867 and 0.5135 equates to 1.9474.

The New Zealand-Euro exchange rate also appears to be correcting lower from a peak just above 0.6400, Westpac is targeting 0.6085 next.

The New Zealand Dollar-Australian Dollar exchange rate is meanwhile seen potentially completing a multi-month decline at 0.9090 on 21 April.

"While further losses below 0.9090 are possible during the weeks ahead... the decline since September looks mature," says Speizer.

"A break above 0.9240 would then target 0.9330," he adds, "allowing the cross to rise near term will be reduced pressure recently from both yield spreads and relative commodity prices."

But further ahead, in the second half of the year, the cross could weaken again says the analyst, as commodities are expected to re-emerge as a major driver.

Westpac says "a thermal energy crisis unfolding globally which will favour the AUD over the NZD."

Above image courtesy of Westpac.