Pound / New Zealand Dollar Week Ahead Forecast: Downtrend Bias Endures

- Written by: Albert Townsend

- GBP/NZD remains in an overall short-term downtrend

- Trend expected to continue unless it breaks above 1.8992

- RBNZ’s inflation expectations main release in the week ahead

Image © Adobe Stock

The Pound to New Zealand Dollar rate is trading at around 1.9020 at the time of writing after rising 0.42% in the week before, studies of the charts suggest the overall bias remains to the downside in the week ahead.

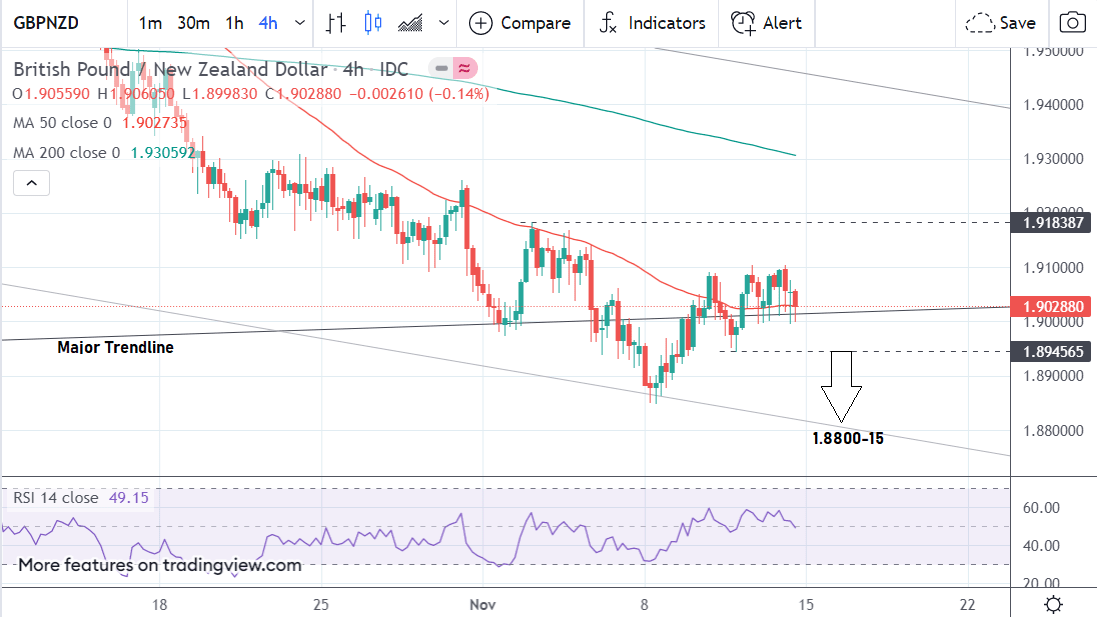

The 4 hour chart shows the pair trading in a sideways consolidation following a steep sell-off.

This has taken the pair back above a major trendline it recently penetrated on the way down:

Despite this short-term recovery the downtrend remains intact and expected to extend unless the pair can rise substantially higher and flip the dominant trend.

A break below the 1.8962 Nov 10 lows would provide confirmation of a sell-off down to a target at 1.8800-15 and the base of a descending channel.

It would require a break above the 1.8992 peak highs (dotted line) to negate the bearish short-term bias and suggest a reversal higher.

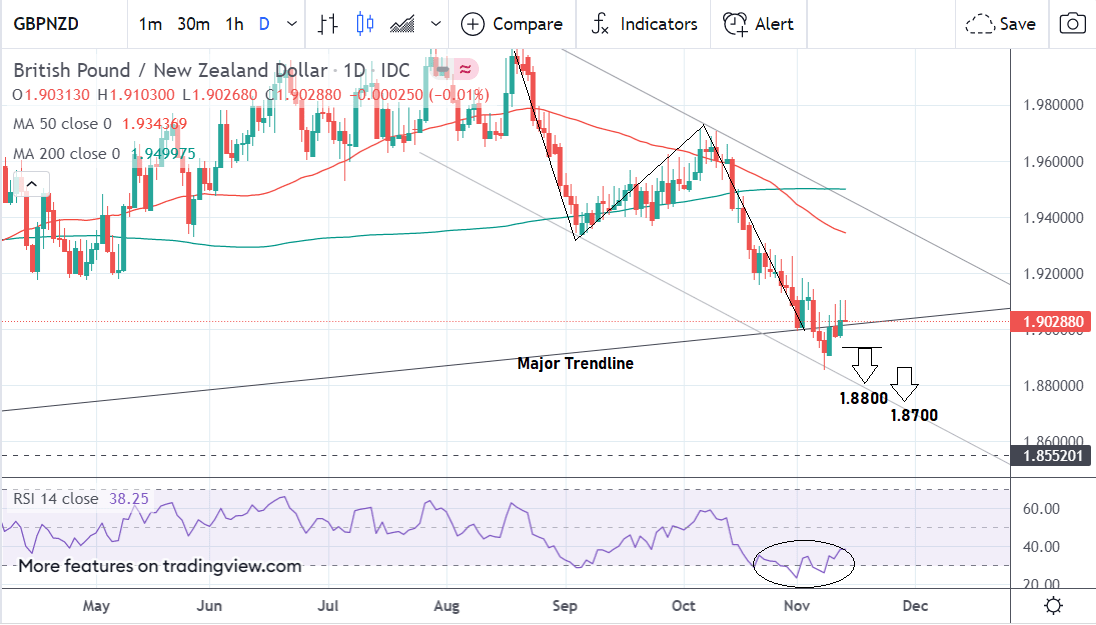

The daily chart shows the pair having completed a three wave measured move down from the August highs. After temporarily piercing below the major trendline it has recovered, however, the bearish bias endures and is likely to pull the exchange rate lower.

- GBP/NZD reference rates at publication:

Spot: 1.8990 - High street bank rates (indicative band): 1.8325-1.8458

- Payment specialist rates (indicative band): 1.8819-1.8895

- Find out about specialist rates, here

- Or, set up an exchange rate alert, here

As in the 4-hr chart, a break below the 1.8962 lows is likely to lead to a continuation down to an initial target at 1.8800 at the bottom of a trend channel, followed by a subsequent target at 1.8700.

The RSI indicator in the lower pane has formed a bullish double bottom price pattern in oversold territory which is signalling the possibility of more bullishness on the cards.

Given the mixed signals - that the RSI is giving a buy signal yet the overall trend is bearish - it could suggest the pair will continue to consolidate sideways for a time.

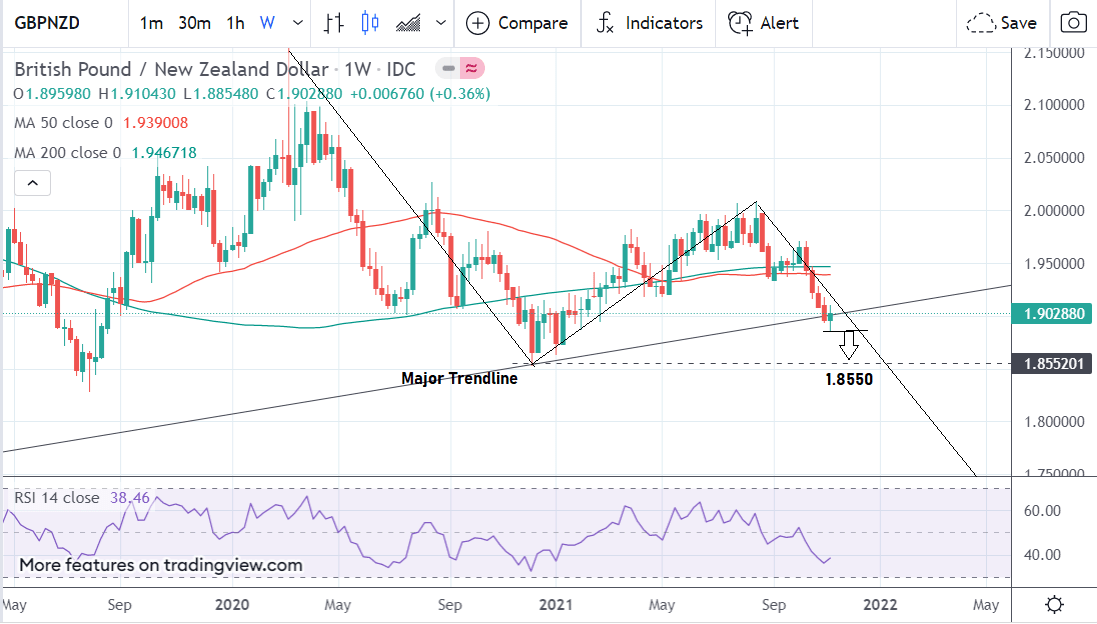

The weekly chart - used to forecast the long-term trend, or next few months - shows the pair having fallen in three broad waves since the start of 2020.

Secure a retail exchange rate that is between 3-5% stronger than offered by leading banks, learn more.

The first was a downmove in 2020, followed by a recovery during most of 2021, and then the final move down which started in August.

The overall tone is bearish, therefore, which suggests the current move will extend lower.

An initial move down to the next major support level at the 2020 lows (dotted line) at 1.8550 is expected, although further declines to 1.8000 below are also possible if price is indeed tracing out a larger measured move.

The New Zealand Dollar: What to Watch

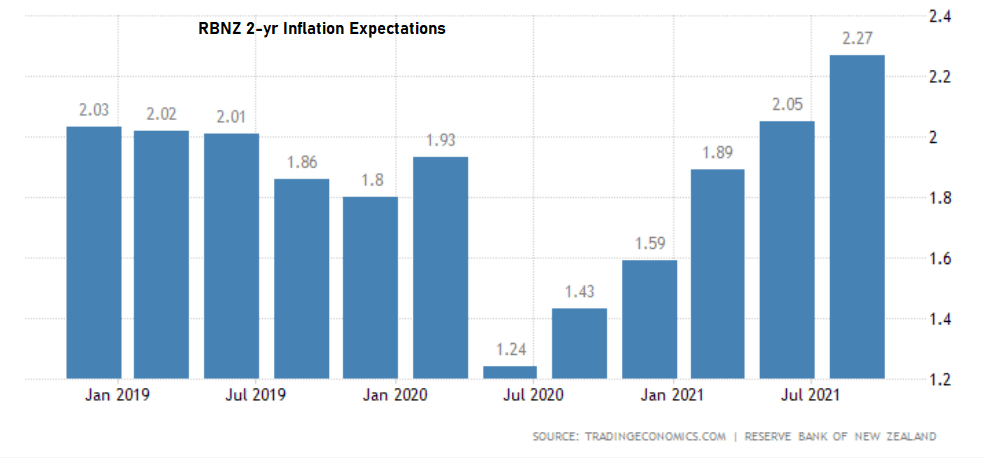

In the week ahead the main release for the Kiwi will be Inflation Expectations for Q4 out on Wednesday, November 18, at 02:00 GMT.

Inflation expectations is an RBNZ gauge which measures expectations of inflation two years from now.

It is an important indicator with which to gauge the economic recovery after Covid.

The previous result was 2.27% but if it is higher this time it may raise expectations of a rate hike and trigger some support for the Kiwi.

{wbamp-hide start}

{wbamp-hide end}{wbamp-show start}{wbamp-show end}

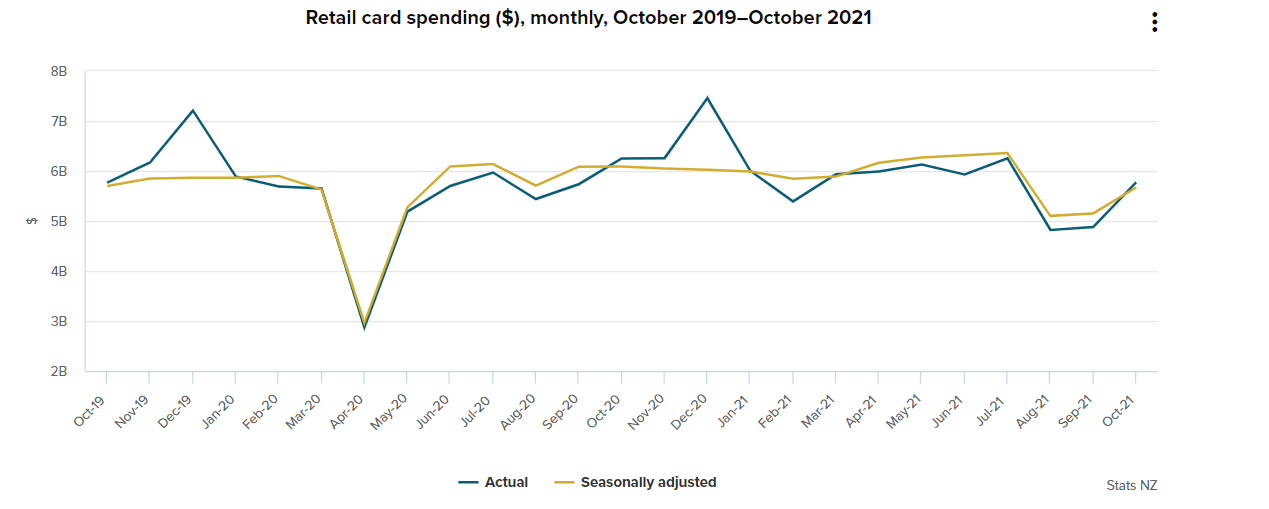

Last week saw the release of Electronic Card Retail Sales which rose 10.1% MoM in October, a substantial increase from the 1.0% rise in the previous month.

Other data showed a slight fall in the Food Price Index for October of -0.9% MoM and an increase in New Zealand Business Conditions to 54.3 from 51.4 in the previous month.

Overall the data was positive for the Kiwi suggesting a continued recovery in the economy after Covid and the likelihood of higher interest rates on the horizon.