GBP/NZD Rate Week Ahead Forecast: A Bounce then a Fall?

- Written by: Albert Townsend

- GBP/NZD in short-term downtrend

- Has now reached a major long-term trendline

- There may be a near-term bounce off this level

- But there are no signs of the bear trend reversing

Image © Adobe Stock

The Pound to New Zealand Dollar exchange rate is trading at around 1.8940 at the time of writing after falling 0.71% in the week before.

Studies of the charts suggest the pair could stall at this level but that it will eventually continue falling in line with the dominant downtrend.

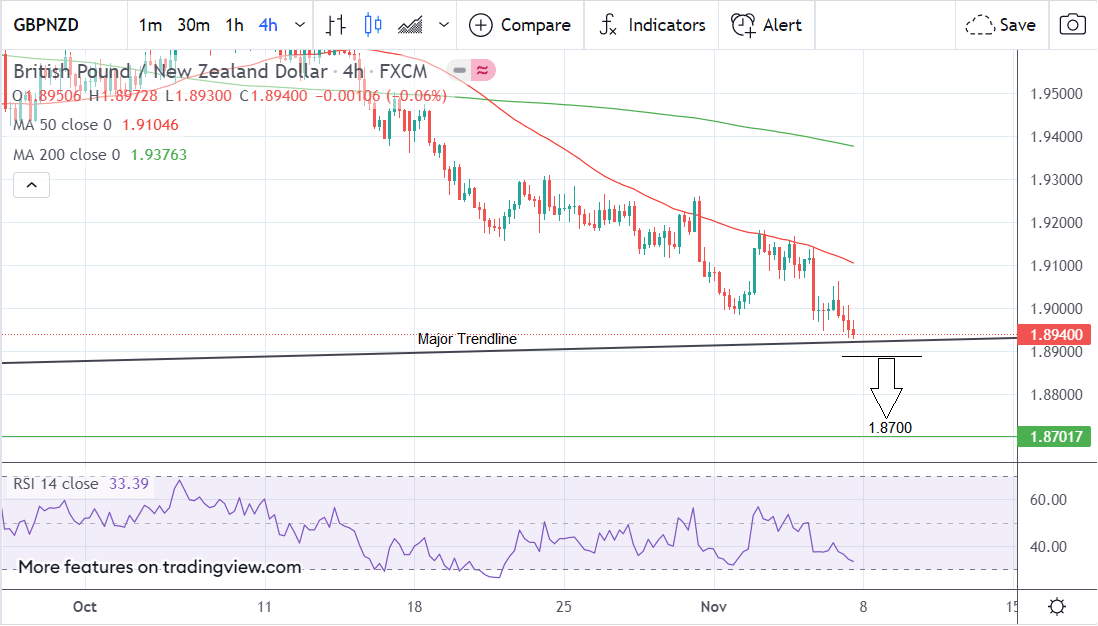

The 4 hour chart shows the pair falling in a descending series of lower highs and lower lows which has just reached support at a major trendline drawn from the November 2016 lows.

There is a good chance it will bounce off the trendline in a short-term recovery, but that the dominant downtrend will eventually reassert itself and continue pushing the pair lower.

Penetration of the trendline and a clear daily close below, would be necessary for confirmation of more downside.

Assuming those conditions are met, the pair is expected to extend lower to a near-term initial target at 1.8700, calculated by extrapolating the last move prior to the trendline break lower.

The 4hr chart is used to determine the short-term outlook, which includes the coming week or next 5 days:

Above: GBP/NZD four-hour chart.

- GBP/NZD reference rates at publication:

Spot: 1.883 - High street bank rates (indicative band): 1.8222-1.8354

- Payment specialist rates (indicative band): 1.8713-1.8789

- Find out about specialist rates, here

- Or, set up an exchange rate alert, here

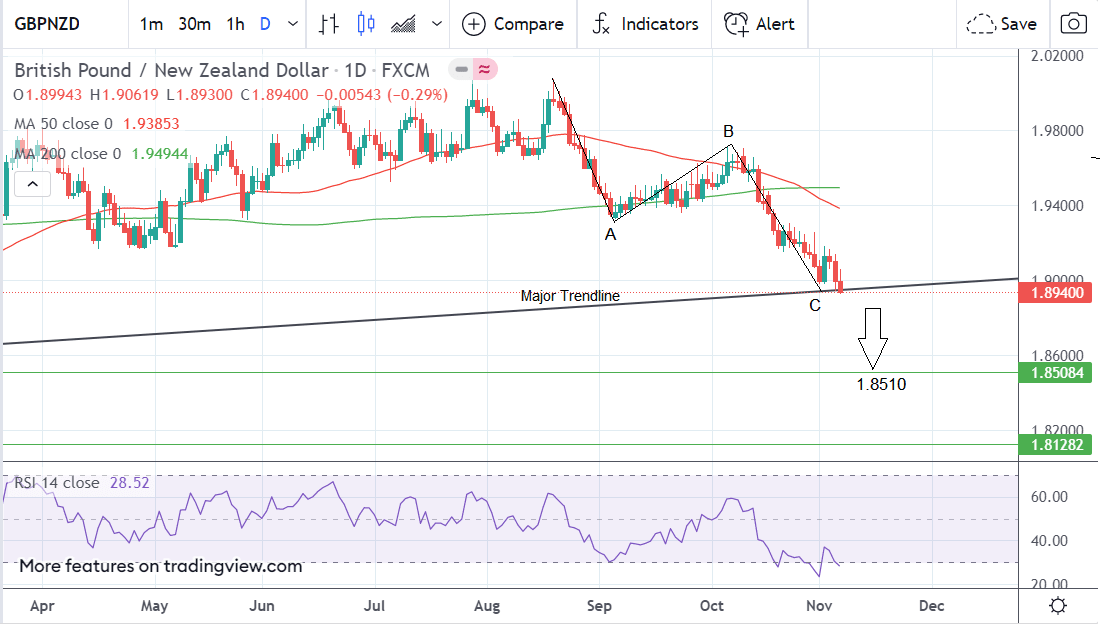

The daily chart shows the pair close to completing a measured move pattern that started at the August 19 highs.

Measured moves are symmetrical 3-wave zig-zags, where the final 3rd wave down (C) is usually of a similar length to the first wave (A), or fibonacci extension thereof.

The pattern on GBP/NZD has now probably finished since wave C is of a similar length to wave A.

The pair has also touched down at the level of the major trendline. The fact that it has both completed a price pattern and found support at a major trendline suggests there is a high likelihood of a bounce - the bullish RSI signal after it exited oversold on Nov 1 is a further sign such a rebound may be on the cards.

However, it is likely to be short-lived given the overall trend lower, and once it has finished, the bear trend will probably continue, pushing the exchange rate down through the trendline and lower.

A probable downside target for the pair in the medium term - or next week to month - for which the daily chart is used, is 1.8510.

Above: Daily GBP/NZD chart.

Secure a retail exchange rate that is between 3-5% stronger than offered by leading banks, learn more.

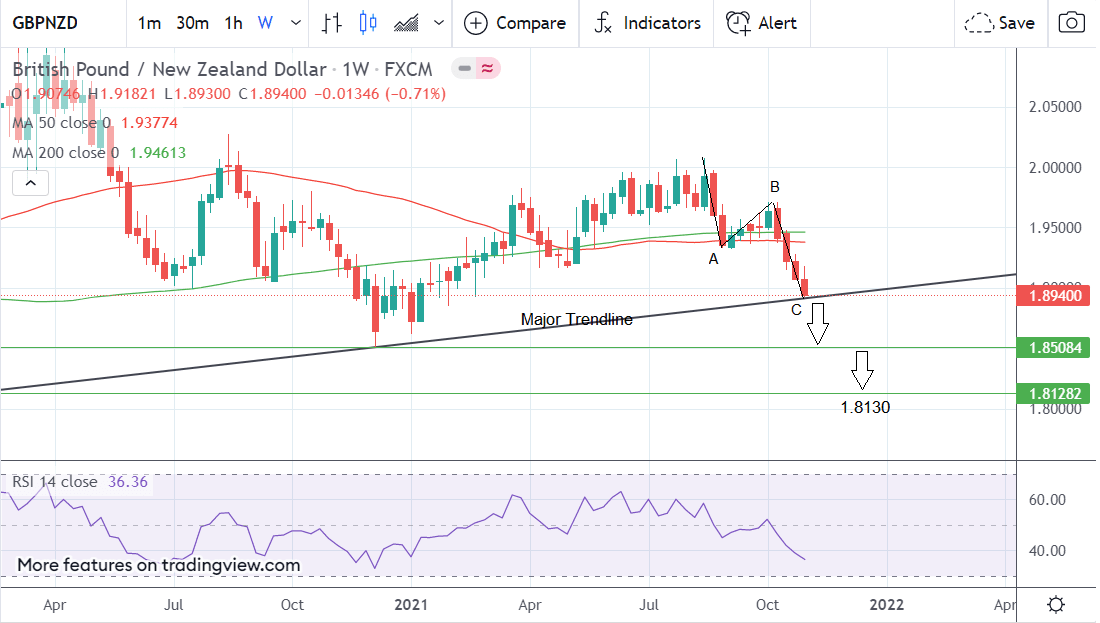

The weekly chart is showing much the same thing as the daily only over the longer-term view, which includes the next few months.

The pair has declined for four straight weeks in a row. It has successfully broken below both the 50 and 200-week moving averages; now it has finally reached a key long-term trendline.

It remains to be seen whether it can break through the trendline and continue south.

If it can, it will probably fall to a target at 1.8130 eventually, albeit in a step progression.

The New Zealand Dollar: What to Watch

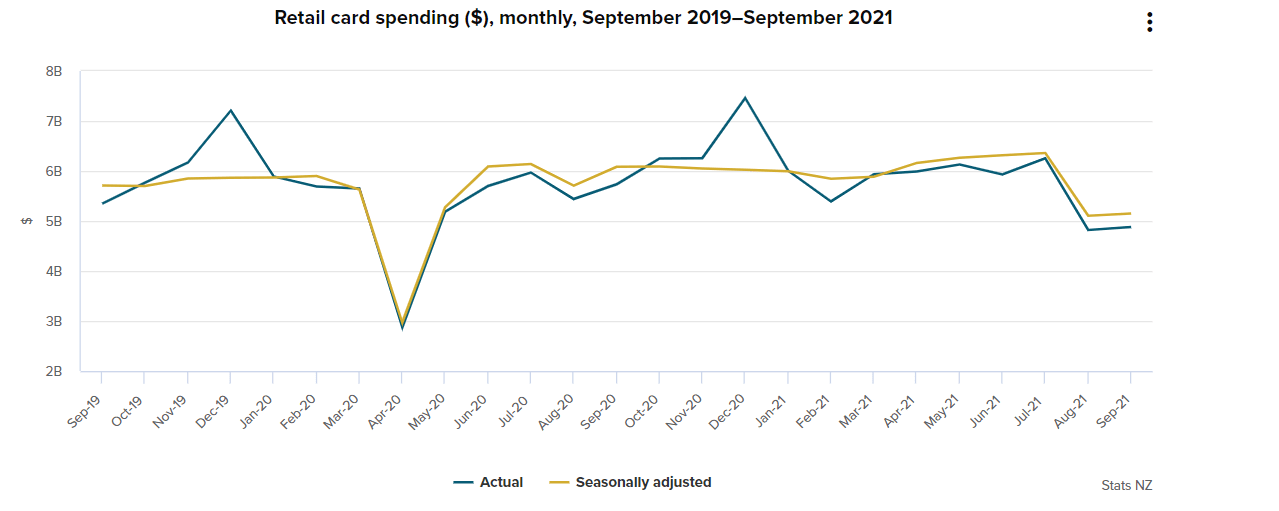

There are no tier one releases for the Kiwi Dollar in the week ahead but on Monday, November 8, a respected indicator of retail sales - Electronic Card Retail Sales - will be released at 21.45 GMT.

In the previous month of October, electronic card spending rose 0.9% month-on-month, but it was relatively unchanged in core retail industries.

One key positive was that spending on durable goods rose 17.5%, suggesting consumers felt confident enough to splash out on big ticket items.

Spending on Apparel, however, showed the greatest fall of any group, declining 10.4%.

A substantially higher result may lend support to the New Zealand Dollar, although it would have to be a big surprise leap to push the exchange rate higher - and vice versa for a miss, given the relatively low priority given to this data point.