Norwegian Krone Rises 0.5% as Norges Bank Hikes and says More to Come

- Written by: Gary Howes

Above: File image of Norges Bank Governor Ida Wolden Bache. Sourced: Norges Bank.

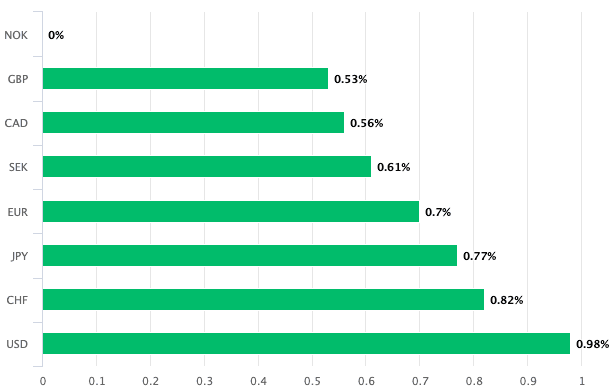

The Norwegian Krone outperformed its major peers on Thursday after the Norges Bank raised interest rates and committed to further rate hikes.

The Pound to Krone exchange rate was half a percent lower at 12.77 after the Norges Bank hiked by 25 basis points and said "if developments turn out as we now expect, the policy rate will be raised further in May".

The Euro to Krone exchange rate fell to 11.28, the Dollar to Krone exchange rate was lower at 10.36.

"The Committee assesses that a higher policy rate is needed to curb inflation. Inflation is markedly above target. Growth in the Norwegian economy is slowing, but economic activity remains high. The labour market is tight, and wage growth is on the rise," said the Norges Bank in a statement.

Above: The NOK outperformed its major peers in the wake of the Norges Bank decision.

Compare Currency Exchange Rates

Find out how much you could save on your international transfer

Estimated saving compared to high street banks:

£2,500.00

Free • No obligation • Takes 2 minutes

"There is considerable uncertainty about future economic developments, but if developments turn out as we now expect, the policy rate will be raised further in May", said Norges Bank Governor Ida Wolden Bache.

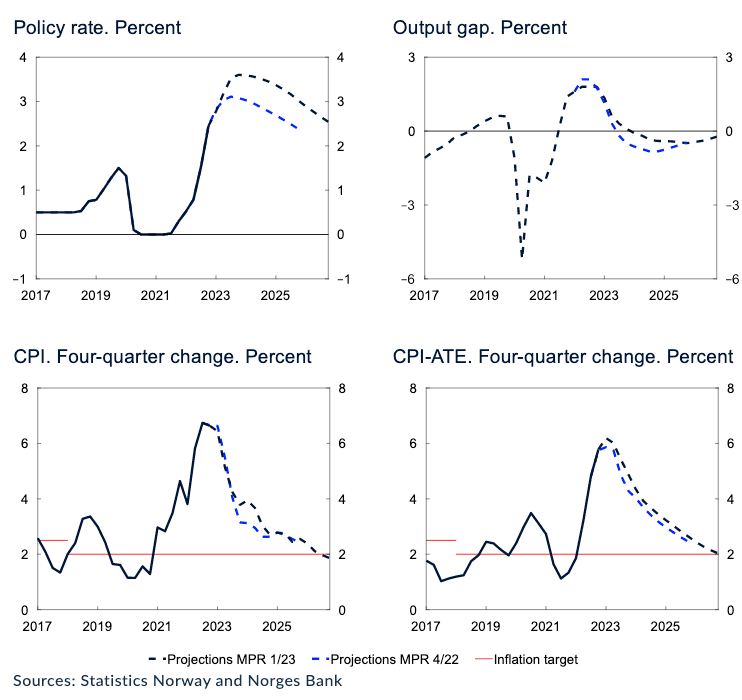

The policy rate now sits at 3.0% and the Norge Bank's projections show policymakers expect a peak at 3.60% to be achieved by the fourth quarter.

On balance, the delivery of further hikes will ensure the interest rate gap between Norway and other major economies does not diverge greatly.

This would underpin the Norwegian Krone over the medium term.

"Today's decision was undoubtedly hawkish," says a note from the strategy team at TD Securities. "In the aftermath of today's hawkish outcome, we have revised up our forecast for the policy rate and now expect Norges Bank to deliver 25bps hikes in both May and June."

The central bank appears to be conscious of the NOK's value and could raise hikes further to underpin value.

"The future path of the policy rate will depend on economic developments. If the krone proves weaker than projected, or pressures in the economy persist, a higher policy rate than currently projected may be needed to bring inflation down to target," said the statement.

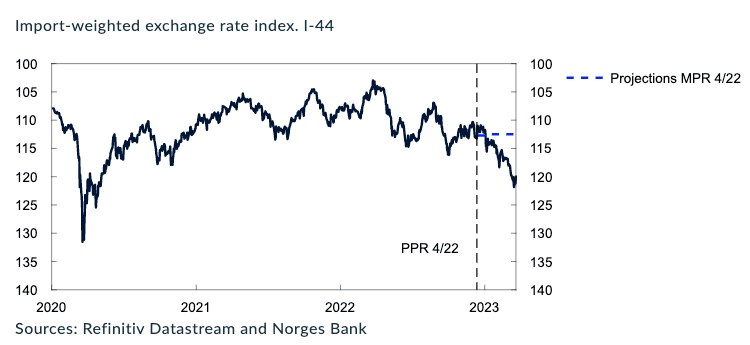

Above: "The Krone has depreciated" - Norges Bank.

"A weak exchange rate and strong domestic demand contributed to lift the rate path since December," says Oddmund Berg, an analyst at DNB Bank ASA. "External factors, such as the outlook for long-term real interest rates also contributed to lift the path."

"We view the risks as being skewed to the upside from there, with risks the Bank delivers another 25bps hike in August if core inflation remains strong and the currency remains weak," says TD Securities.