Pound Sterling Struggling Following a Soggy GDP Data Release

- Written by: Gary Howes

Image © Adobe Images

It was a sea of disappointment from the ONS, who released a tranche of UK economic data that printed below market expectations, boosting the odds for Bank of England interest rate cuts in 2024 and weighing on the Pound.

The British Pound was softer after it was reported the UK economy shrank 0.3% month-on-month in an exceptionally wet October, a marked slowdown from the 0.2% growth recorded in September and disappointing against market expectations for a flat 0%.

Year-on-year, the economy expanded 0.3% in October, reported the ONS, which was half the 0.6% the market expected and well below the 1.3% output recorded in September. The rolling three-month-on-three-month measure of GDP was flat at 0% in October, unchanged from the previous month but below the consensus of 0.1%.

Manufacturing production rose 0.8% year-on-year, which was half the 1.9% the market expected and sharply lower than the previous month's 3.0%. Industrial production shrank 0.8% y/y in October, down from 0% and below the -0.1% the market expected.

The Pound to Euro exchange rate dropped to 1.1618, having been at 1.1640 ahead of the release. The Pound to Dollar exchange rate went from 1.2552 to 1.2528.

Above: GBPEUR at one-minute intervals. Track GBP with your own custom rate alerts. Set Up Here.

"This sharp decline in the British pound came with the disappointing data of the British economy, which recorded a decline in its various major sectors last October," says Samer Hasn, Market Analyst at XS.com.

The soft data will encourage markets to bet the Bank of England will be primed to cut interest rates on a number of occasions in 2024, weighing on UK bond yields and the Pound.

Following Tuesday's softer-than-expected UK wage numbers, markets are fully priced for a June rate cut, having been priced for the first cut to come in August at the start of the week.

Compare Currency Exchange Rates

Find out how much you could save on your international transfer

Estimated saving compared to high street banks:

£2,500.00

Free • No obligation • Takes 2 minutes

The Bank of England will keep interest rates unchanged on Thursday and repeat that it is too soon to consider interest rate cuts, which can put a floor under the pound if the market takes heed.

But the squeeze of higher interest rates - and poor weather - are being blamed by economists for the disappointing GDP figures, including a fall of 0.2% in the services sector, which is the largest sector of the UK economy.

"Given the dominance of the service sector, its output fall alone accounted for more than half of the decline in total GDP," says Sandra Horsfield, an economist at Investec.

The ONS said "exceptionally wet weather" contributed to the drag in services output, with construction, retail, pubs and tourism (outdoor recreation activities) faring poorly.

The impact of higher interest rates cannot be ignored either.

"Our measures of GDP by interest-rate sensitivity suggests this easing has been driven by a weaker performance of those sectors that have a high or medium sensitivity to interest rates," says Paul Dales, Chief UK Economist at Capital Economics. "In other words, the drag from higher interest rates appears to be growing."

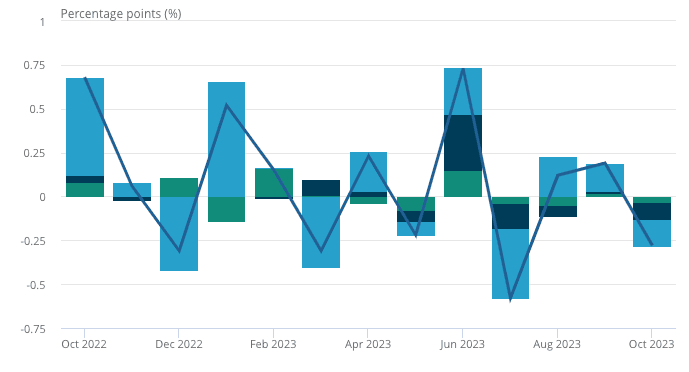

Above: Contributions to UK economic growth. The data confirm a random dance that ultimately leaves the UK economy flat. Source: ONS.

Capital Economics says the coming months will see subdued activity, forecasting UK GDP to grow 0.1% in 2024, which is weaker than the consensus forecast of +0.5%.

While disappointing, the ONS economic growth data is backwards-looking and confirms a soft patch for the economy.

Friday's PMI survey data for December will likely be of more interest to markets, as these will give a more accurate update on conditions and determine how the Pound trades into the weekend.

Compare Currency Exchange Rates

Find out how much you could save on your international transfer

Estimated saving compared to high street banks:

£2,500.00

Free • No obligation • Takes 2 minutes