Pound Sterling Rallies Following Hot Jobs Report

- Written by: Gary Howes

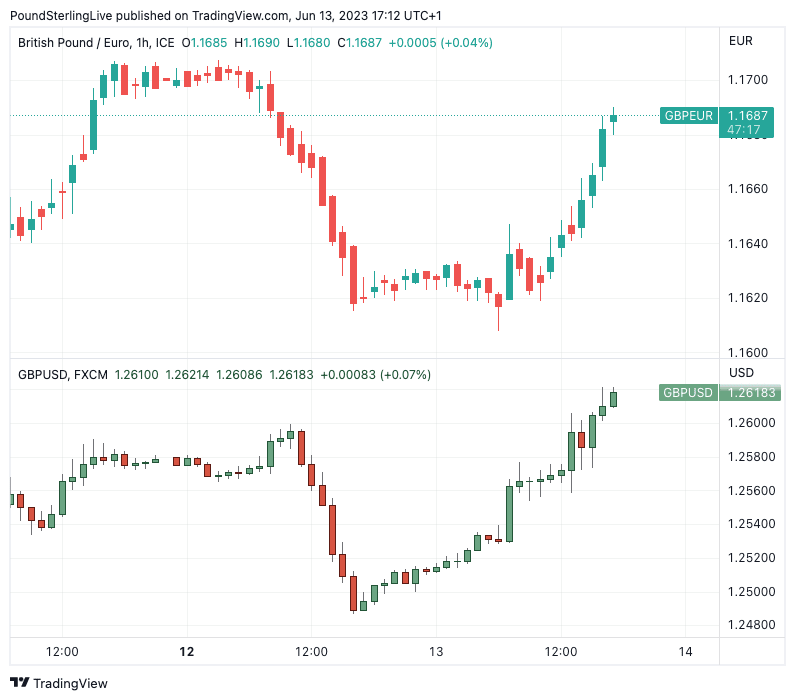

- GBP/EUR looks for a retest of 1.17

- GBP/USD pushes 1.26, aided by U.S. inflation print

- Bank of England rate hike expectations continue upward march

Image © Adobe Images

The British Pound rose in the hours following the release of a UK labour report that roundly trounced analyst expectations and suggested the UK would continue to see high inflation levels as a result of elevated wage settlements.

The slate of above-consensus labour market statistics suggests the Bank of England is still some way off from achieving its inflation target, prompting markets to lift expectations for a peak in Bank Rate at 5.75%.

The UK's June jobs report revealed the unemployment rate unexpectedly fell to 3.8% from 3.9% in March, whereas the market was in fact looking for a pick-up to 4.0%.

The surprise was driven by a strong rise in employment of 250K in the three months to April, surpassing the 182K recorded in the three months to March and consensus expectations for a fall to 150k.

The decline in unemployment comes despite more people entering the jobs market as the ONS reported the economic inactivity rate decreased on the quarter by -0.4pps.

The Pound to Euro exchange rate rose in the immediate aftermath of the data release and steadily built on these gains through the course of the day to reach 1.1685 at the time of writing. The Pound to Dollar exchange rate extended a recovery to 1.2612, also aided by an undershoot in U.S. inflation data.

Above: GBPEUR (top) and GBPUSD showing price action in reaction to the 7AM data release.

Compare Currency Exchange Rates

Find out how much you could save on your international transfer

Estimated saving compared to high street banks:

£2,500.00

Free • No obligation • Takes 2 minutes

The claimant count further highlighted 'tightness' in the UK labour market as it showed a fall in those seeking out-of-work benefits in the month of May (-13.6K), whereas the consensus expected 12.4K to be added to the benefits list. (23.4K were added in April).

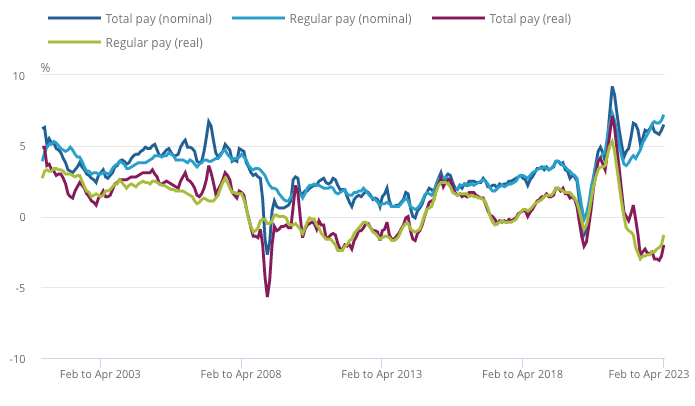

The payrolls report meanwhile provided more surprises with the Average Earnings Index (+Bonus) showing a 6.5% increase in wages in April, surpassing expectations for 6.1% and March's 6.1%.

Excluding bonuses, the index showed a 7.2% increase in wages for April, easily passing expectations for 6.9% and March's reading of 6.8%. "Wage growth has far too much momentum for the MPC to stop hiking Bank Rate yet," says Samuel Tombs, Chief U.K. Economist at Pantheon Macroeconomics.

Above: Inflation-impacted real pay might have turned a corner following the recent decline.

Make no mistake, this is a 'hot' jobs report and suggests the economy is proving far more resilient than economists had expected in the face of high inflation and rising central bank interest rates.

The Bank of England will have little choice but to continue raising interest rates in this environment, for fear inflationary expectations are becoming entrenched.

The evidence provided by the jobs report is that workers are seeking and getting pay awards, which combined with higher pricing intentions at businesses, risk creating a wage-price spiral.

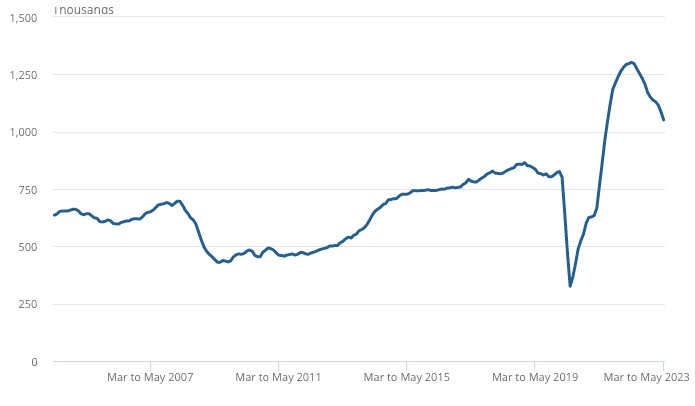

Job vacancies meanwhile continue their decline with the March-May 2023 period showing the estimated number of vacancies fall by 79,000 to 1,051,000, making for the 11th consecutive period of decline since May-July 2022. Vacancies nevertheless remain elevated by historical standards and are well above pre-pandemic levels.

Above: UK job vacancies continue to fall, yet remain elevated by historical standards.

What does this mean for the Pound's prospects?

The Pound remains one of 2023's top performers, driven by consensus-beating economic data releases, of the kind we have seen today.

Therefore, on balance, the jobs report is supportive, particularly as it will firm expectations for at least another 100 basis points of Bank of England interest rate hikes from here.

It must be noted, however, that such a hike in interest rates could well prompt an economic recession on the horizon, something that makes markets nervous.

Indeed, on Monday we saw UK borrowing costs rise (two-year bond yields surged to their highest levels since the mini-budget debacle), yet the Pound fell sharply.

Typically the Pound would be expected to track yields higher, but there is a risk investors turn away from the Pound if they become concerned about the UK economic and fiscal outlook, as was the case around the time of the ill-fated 'mini-budget'.

In short, markets could become worried that the combination of high borrowing costs amidst stubborn inflation is a negative combination for UK assets.

"The renewed pick-up in wage growth in April will add fuel to the recent rise in gilt yields and expectations for the future path of Bank Rate, by fanning the impression that the U.K. has a unique problem with ingrained high inflation," says Tombs.

As such, while upside in the Pound is still preferred, there are some signals that the rally might be at risk.

Looking ahead, GBPUSD could react to the tone set out by the Federal Reserve on Wednesday night when it is expected U.S. policymakers will forgo an interest rate hike but tee up a move in July.

Many analysts are therefore looking to the Fed to prove supportive of the Dollar.

The European Central Bank's Thursday interest rate decision and guidance meanwhile form the Euro's key risk event for June with another 25 basis point hike anticipated.

But as some analysts note, it will all be about the tone and guidance coming from Frankfurt where policymakers will likely signal the end of the hiking cycle is drawing closer, something that could weigh on the Euro.

Compare Currency Exchange Rates

Find out how much you could save on your international transfer

Estimated saving compared to high street banks:

£2,500.00

Free • No obligation • Takes 2 minutes