Pound Cheered by Bullish Labour Statistics

- Written by: Gary Howes

Image © Adobe Images

UK wages are rising at a faster than expected pace while unemployment in the UK has fallen to its lowest level since 1974, developments that will maintain pressure on the Bank of England to keep raising interest rates.

The data was on balance supportive for the Pound, with the currency rising against the Euro, Dollar and most other major currencies in the wake of the release.

The ONS said the UK unemployment rate fell to 3.6% in July, down from 3.8% in June and beating expectations for 3.8%.

From a currency market perspective, it is potentially the wage data that is of most significance: average earnings rose 5.5% in July, beating expectations for 5.4% and a figure that represents a rise from June's5.2%.

The Bank of England is particularly concerned with inflation that is driven by domestic developments; notably wage settlements and price setting intentions by firms.

The Bank is expected by markets to raise interest rates by 75 basis points on September 22 as it tries to get on top of inflation, and as we note here, if they fail to do so the Pound will likely decline.

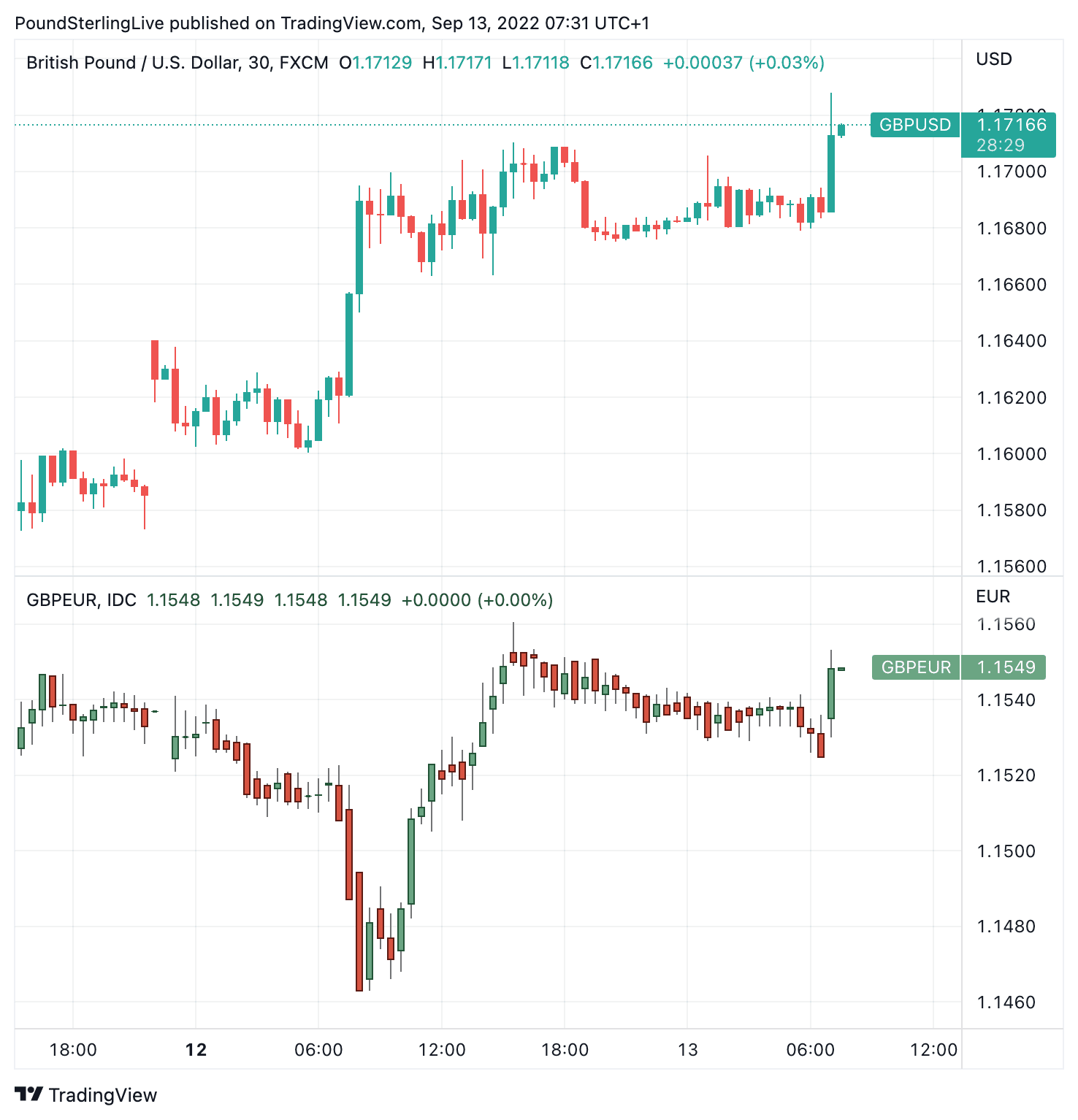

Above: GBP vs. USD (top) and EUR (bottom) at 30 minute intervals, showing the market reaction to the labour market release. To keep on top of the market set your free FX rate alert here.

The labour market data out Tuesday therefore serves to reinforce the narrative the Bank must act fast and decisively to deal with inflation and expectations for that 75 basis point hike will therefore be reinforced.

But there are nevertheless signs of cooling in the labour market as the number of jobs added in the three months to July to 40K, much less than the 128K expected and June's 160K.

Those seeking out of worke benefit claims were also higher.

"It's great to have such a tight labour market heading into a downturn, but jobless claims rose in August by 6.3K (the first monthly rise since Feb-21), with one possible conclusion being that evidence of a moderate wage price spiral in the UK is beginning to erode labour demand," says Stephen Gallo, Head of European FX Strategy at BMO Capital Markets.

The number of jobs vacancies is meanwhile coming down too, vacancies in June to August 2022 were 1,266,000, a decrease of 34K from the previous quarter and the largest quarterly fall since June to August 2020.

Interestingly, the economic inactivity rate actually increased as more people opted to stay away from the jobs market. It was estimated at 21.7%, 0.4 percentage points higher than the previous three-month period, and 1.5 percentage points higher than before the coronavirus pandemic.

Illness and the desire to take up study were cited by the ONS for the increase in inactivity.

The Pound to Euro exchange rates was nevertheless higher at 1.1555 in the wake of the data, the Pound to Dollar exchange rate was up a third of a percent at 1.1720.

Above: GBP is outperforming all major peers on the day UK labour market data is released.

Compare Currency Exchange Rates

Find out how much you could save on your international transfer

Estimated saving compared to high street banks:

£2,500.00

Free • No obligation • Takes 2 minutes

"With further evidence that the weaker economy is leading to a cooling in labour demand, the renewed fall in the unemployment rate to a new 47-year low of 3.6% was driven by a shortfall in labour supply rather than strong demand. The upshot is that the Bank of England still has much more work to do," says Ruth Gregory, Senior UK Economist at Capital Economics.

Economist Sandra Horsfield at Investec says the broader picture facing the UK economy is that a 'tight' labour market combined with the additional government spending (energy price cap) means the basic interest rate will need to rise further than the current 1.75%.

"With the huge energy bill support package and likely other fiscal support forthcoming, we are minded to pencil in a later and more shallow economic downturn. That might well mean the MPC chooses to press on the brakes for longer to bring inflation back down to target. How far it needs to go is uncertain, but it may require a peak Bank rate in the range of 3.50%-4.00%," says Horsfield.