EUR/USD Rate Hit by EU Political Risks, Analysts Forecast Further Decline

- Written by: Gary Howes

Above: File image of Marine Le Pen. Source: Global Panorama, Flickr. Licensing: Creative Commons 2.0.

The Euro to Dollar exchange rate is under pressure as political uncertainty returns to haunt the Eurozone, and some analysts see further near-term pressures.

The Euro fell by half a per cent in Monday trade to 1.0740 after European parliamentary elections boosted the standing of parties sceptical to further European integration.

"Although socialist, liberal and centre parties are set to retain a majority in the European Parliament, the surge in Eurosceptic nationalists is likely to make it more difficult for lawmakers to agree and push through reforms and policies that give the Union more power," says Charalampos Pissouros, Senior Investment Analyst at XM.com.

Incoming results show 'far-right' and 'hard-right' parties on course to hold almost a quarter of the seats when the European parliament next sits, up from a fifth in 2019.

Compare Currency Exchange Rates

Find out how much you could save on your international transfer

Estimated saving compared to high street banks:

£2,500.00

Free • No obligation • Takes 2 minutes

"There's still a long road ahead, but the implications are clear. Despite the centre maintaining the majority, this is the most right-wing European Parliament ever elected," says Stefan Koopman, Senior Macro Strategist at Rabobank.

But for analysts and the wider market, events in France are of most concern.

"Most expected a rightward shift in these elections and the results do suggest that Ursula van der Leyen's European People's Party (EPP) will still be able to command a majority in the European Parliament. Yet it is events in France that have hit the headlines," says Chris Turner, head of FX analysis at ING Bank.

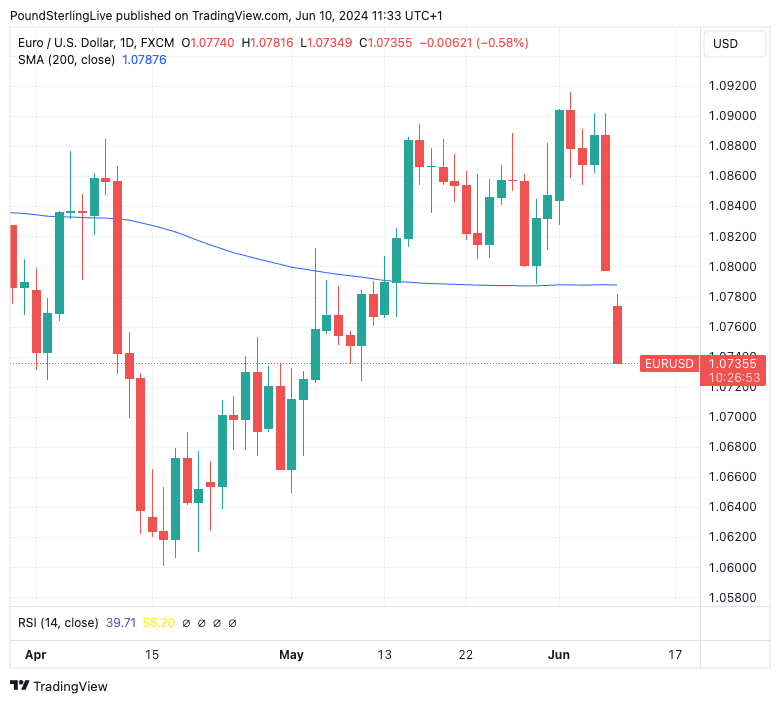

Above: EUR/USD at daily intervals showing a break below the 200-day moving average, which flips the outlook to negative. Track EUR/USD with your own custom rate alerts. Set Up Here

President Emmanuel Macron made a "shock decision" to call snap parliamentary elections after his centrist alliance was trounced by Marine Le Pen's far-right movement in the European parliamentary vote.

"Investors don’t share Macron’s risk appetite. The euro is the worst performing G10 currency this morning, trading at 1.075 at the time of writing," says Koopman.

Macron's party gathered just 15% of the vote, prompting him to call legislative elections for June 30, with the second round of voting coming on July 07.

"This move is widely seen as a gamble either to question the French electorate on whether they really want a far-right government or to give the electorate three years' experience with a far-right government ahead of the next French presidential election in 2027," explains Turner.

Regarding the Euro's next steps, Turner says Euro-Dollar may take another leg lower to the 1.0700/0720 area once U.S. investors fully have a chance to appreciate events in European politics.

Beyond politics, U.S. inflation figures are due for release midweek, and another above-consensus reading here will add to the heavy tone in Euro-Dollar.

"Barring significant downside surprises from US inflation data, the euro could struggle to rise back, staying on the defensive," says Asmara Jamaleh, an economist at Intesa Sanpaolo.