Euro-Dollar Forecast: "Coiling Just Below Key 1.0900" says Forex.com

- Written by: Mathew Weller

Image © Adobe Images

The Euro to Dollar exchange rate could soon see a technical "bullish continuation" move toward 1.1000 writes Forex.com's Global Head of Research, Matthew Weller.

Looking at the world’s most widely traded currency pair, EUR/USD is respecting its key technical levels.

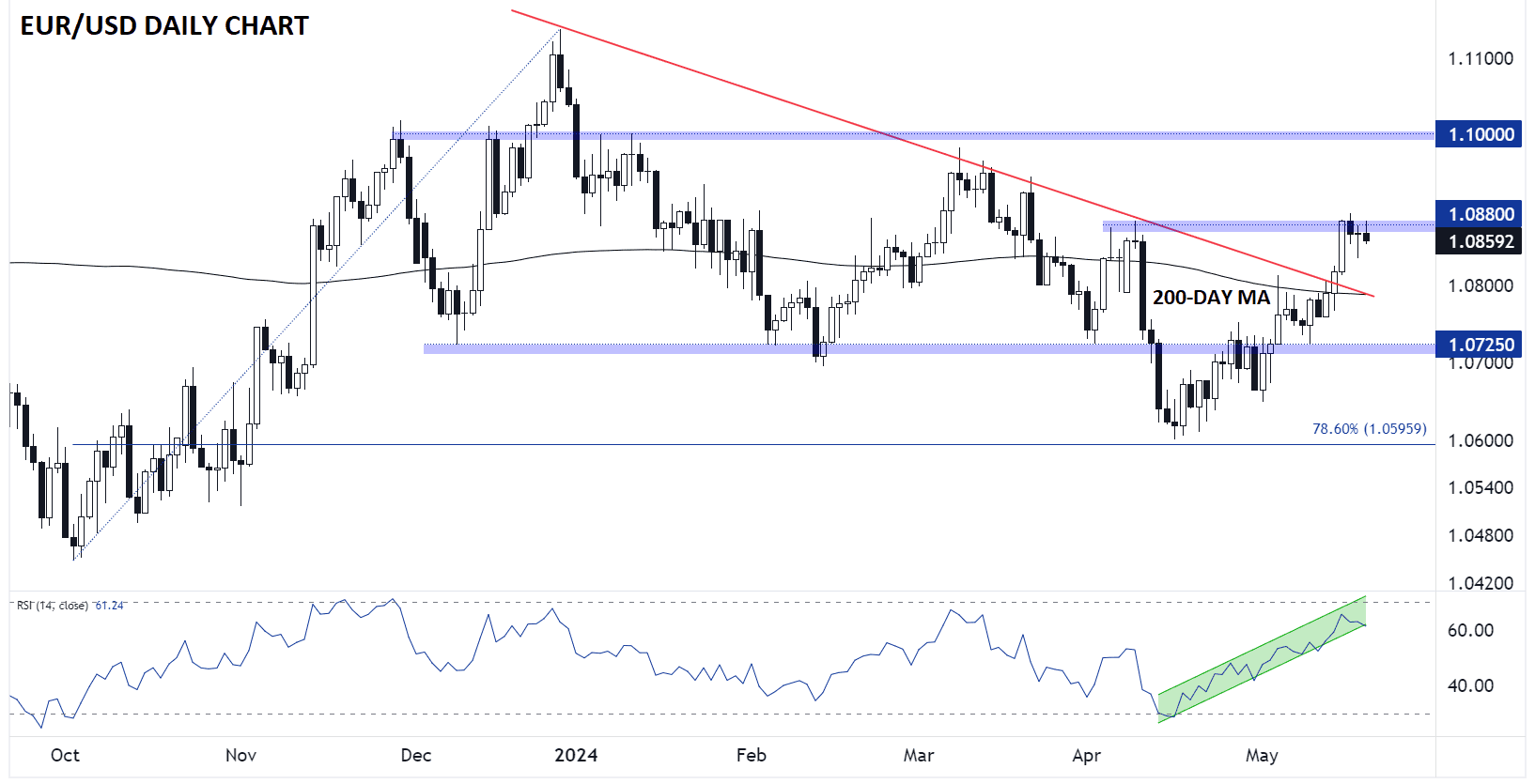

After breaking above the confluence of a bearish trend line and the 200-day MA last week, rates surged to logical resistance at 1.0880 before losing steam into the end of last week.

EUR/USD’s consolidative trade has carried over into this week, leaving the pair still rangebound between resistance in the 1.0880-1.0900 area and support at the 200-day MA near 1.0800.

A definitive close above 1.0890, if seen, would open the door for a bullish continuation toward 1.1000 next.

Track EUR/USD with your own custom rate alerts. Set Up Here

Markets started the trading week a bit groggy amidst lower-liquidity trade. Financial centres like France, Germany, Switzerland, and Canada were out on bank holidays.

As of writing, indices are trading incrementally higher and all major currencies are trading within a +/- 0.3% range against the US dollar.

Compare EUR to USD Exchange Rates

Find out how much you could save on your euro to US dollar transfer

Potential saving vs high street banks:

$2,750.00

Free • No obligation • Takes 2 minutes

With little on the economic data docket today, the focus has shifted to comments from prominent central bankers, highlighted by Fed Vice Chairman Phillip Jefferson.

Echoing the cautious, data-dependent outlook as his colleagues, Jefferson noted that it’s “too early” to tell if the recent slowdown in the disinflationary process will be long-lasting but that April’s lower inflation reading was a positive sign.

Overall, he seemed cautiously optimistic that the Fed was on track to achieve a no/soft landing economy, where inflation recedes to the Fed’s 2% target without a big slowdown in the economy.

Looking ahead, market volatility should pick up as we move through the middle of the week.

Depending on which markets you’re trading, you may want to keep an eye on ECB President Lagarde’s speech in Frankfurt this morning, Bank of England Governor Bailey taking to the mic this afternoon, as well as the UK CPI report, FOMC minutes, and Nvidia earnings release on Wednesday.