EUR/USD Week Ahead Forecast: 200 DMA Breach, U.S. Inflation

- Written by: Gary Howes

Image © Adobe Images

The Euro has now completed four consecutive weekly advances that speak of ongoing resilience which can continue if the midweek release of U.S. inflation and retail sales data underwhelms.

The Euro to Dollar exchange rate is approaching the psychologically significant 1.08 level but will require an unambiguously soft set of U.S. numbers to catapult this level.

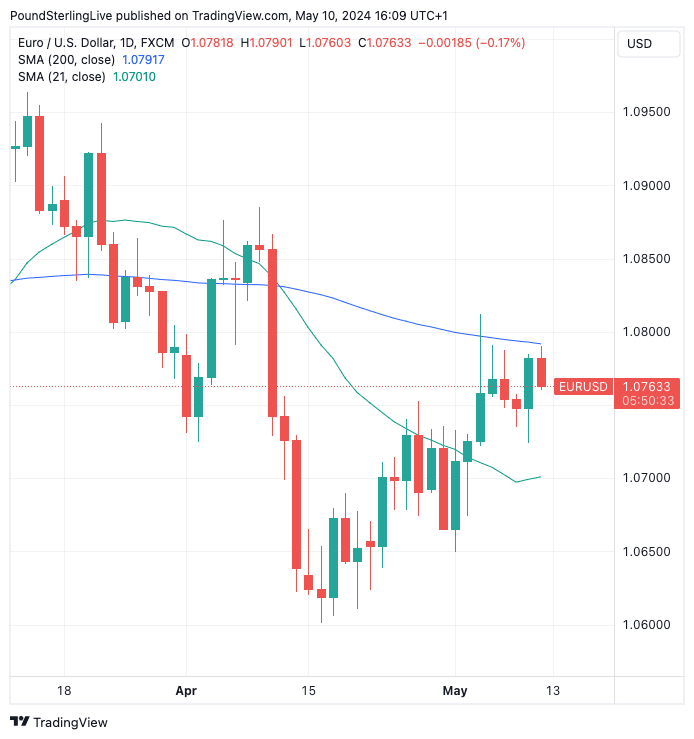

The 200-day moving average is located near 1.08, as per the chart below, which emphasises the difficulty of this level from a technical perspective. Traders widely consult the 200 DMA for signs of resistance and support in the market and if Wednesday doesn't produce some soft U.S. prints, the Euro-Dollar may remain trapped below the 200 DMA glass ceiling.

Above: EUR/USD at daily intervals with the 200-day MA and 21-day MA annotated. Track EUR/USD with your own custom rate alerts. Set Up Here

"EUR/USD is sandwiched in a triangle formation, bounded from above by 50- and 200-day SMAs situated just below $1.08, and supported from below by the 21-day SMA at the $1.07 level. Further dollar weakness is a necessary requirement for the pair to break higher above the $1.08 level, given the strong technical resistance barriers ahead," says Ruta Prieskienyte, FX Strategist at Convera.

Turning to this week's data, market consensus looks for an inflation reading of 3.4% y/y (0.3% m/m) and retail sales (0.4% m/m)

"The CPI report in the US due Wednesday will be the key data release next week. It follows a number of strong inflation prints but also signs of a cooling economy seen in other indicators, so it will be important as investors assess the likelihood of rate cuts from the Fed this year," says Galina Pozdnyakova, Research Analyst at Deutsche Bank.

Compare EUR to USD Exchange Rates

Find out how much you could save on your euro to US dollar transfer

Potential saving vs high street banks:

$2,750.00

Free • No obligation • Takes 2 minutes

Recent Euro-Dollar strength comes on the back of softer-than-expected U.S. data that suggests U.S. economic exceptionalism might be fading. Should inflation and retail sales undershoot expectations the recent USD pullback can extend as the market grows confident the Fed will cut interest rates more than twice this year.

"Our bullish USD view has been based on two motivating pillars: the dollars carry advantage despite being a defensive currency and persistent U.S. exceptionalism. The former remains intact, but the latter appears to be in the early stages of losing its sheen," says Meera Chandan, an analyst at JPMorgan in London.

Applications for initial jobless claims - unemployment benefits - rose by a brisk 231K last week, which is usually an early sign of workers being laid off. "The highest reading in nearly nine months supported the case for rate cuts," says analyst John Meyer at SP Angel.

The Dollar started 2024 with up to 150 basis points of cuts expected by the markets, but this was whittled down to just 25bps by mid-April, taking USD to its highs for the year.

Of late a further 25bps cut has been priced into the outlook, explaining some of the Dollar's recent softness. It can soften further if confidence in an additional cut begins to build.

Also keep an eye on the Federal Reserve's Jerome Powell, who is expected to speak on Tuesday and inject some potential near-term volatility into markets ahead of the midweek data dump.