Euro-Dollar Upside Case Still Intact: UOB

- Written by: Gary Howes

Image © Adobe Images

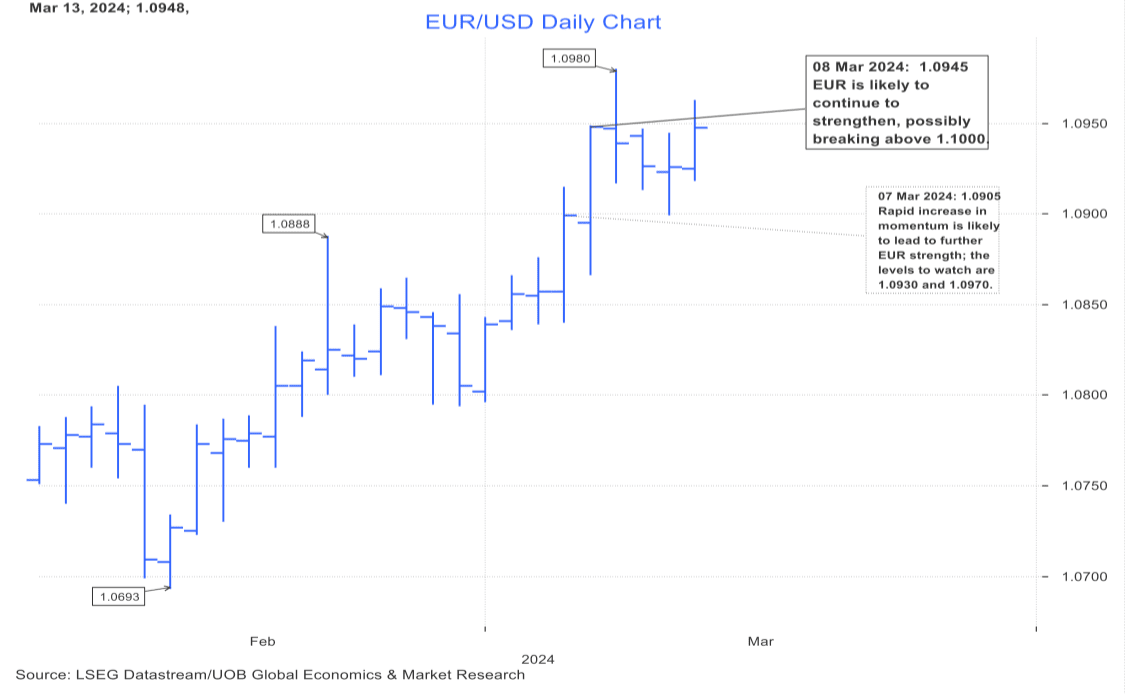

The Euro to Dollar exchange rate remains set on an upward path, according to a new analysis from UOB.

The Singapore-based bank monitors the Euro-Dollar outlook over three timeframes: daily, 1-3 weeks and 1.3 months. For now, all are positively aligned, although in the near-term, some consolidation can be expected.

"Upward momentum has increased, albeit not much. Today, EUR could continue to edge higher even though the major resistance at 1.1000 is unlikely to come under threat. Note that there is another rather strong resistance level at 1.0980," says Quek Ser Leang, Markets Strategist at UOB.

Image courtesy of UOB.

The Euro, Pound, and other G10 currencies have weathered an attempted U.S. Dollar rebound following above-consensus U.S. inflation figures released Tuesday.

The data confirmed U.S. inflation remains elevated and reinforced market expectations that it won't be until June/July when the Fed cuts rates. For now, it appears that it will require a more drastic repricing in expectations (a pushback in the start date) for the Dollar to materially advance.

"EUR is likely to continue to strengthen, possibly breaking above 1.1000," says Leang, when considering the 1-3 week view.

Compare EUR to USD Exchange Rates

Find out how much you could save on your euro to US dollar transfer

Potential saving vs high street banks:

$2,750.00

Free • No obligation • Takes 2 minutes

UOB strategy's house view remains that the Euro-Dollar can extend its uptrend unless the EUR breaks below the "strong support" level at 1.0880.

"A breach of the strong support would mean that the EUR strength has run its course.

Image courtesy of UOB.

On a 1-3 month timeframe, UOB says EUR/USD appears poised to rise above the top of the weekly Icihmoku cloud (see above). As momentum is only beginning to build, any advance might struggle to break the strong resistance at 1.1100.

"As of early March, upward momentum appears to be building. This is indicated by the weekly MACD, which is turning higher. The buildup in momentum suggests that EUR/USD could rise above the top of the Ichimoku cloud again," says Leang.