Euro-Dollar: The Next Downside Targets, by City Index

- Written by: Fawad Razaqzada, Analyst at City Index

Image © Adobe Images

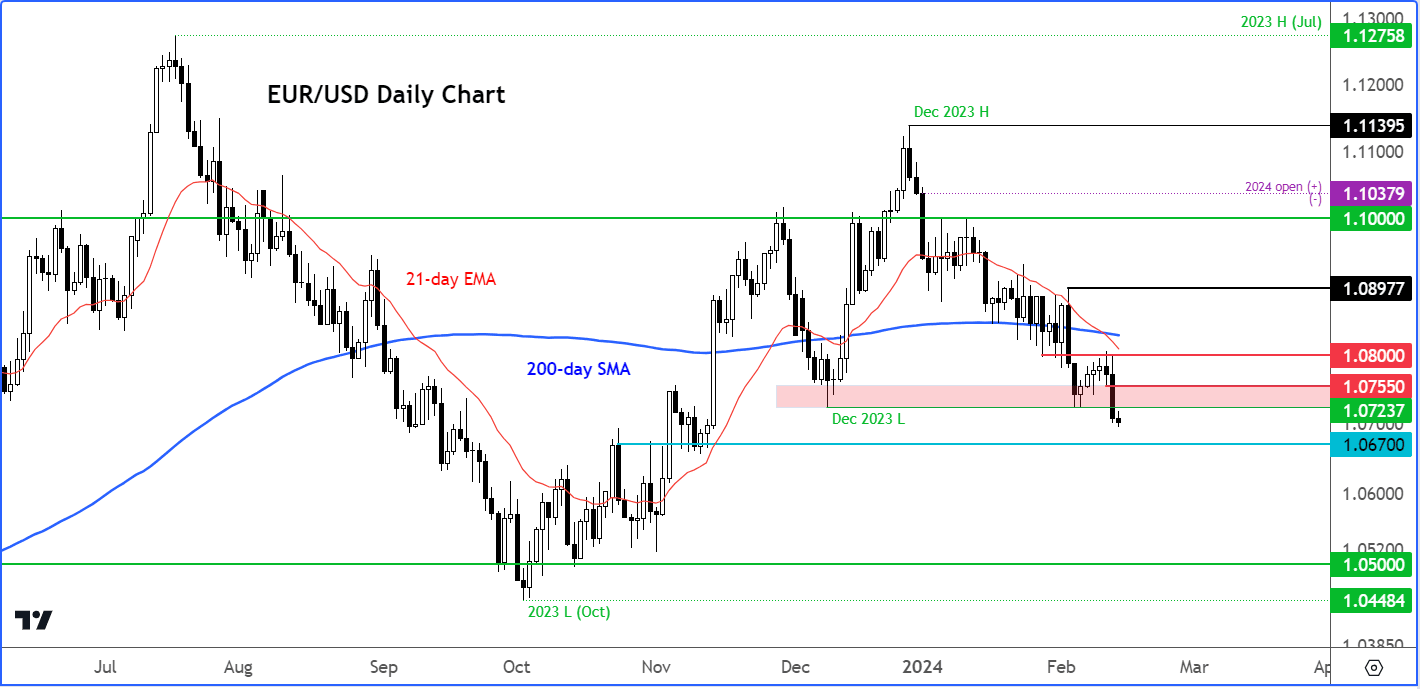

The EUR/USD broke below yet another key support area around 1.0720 to 1.0755, where it had previously found strong support back in December and, to a much lesser degree, on a couple of occasions earlier this month.

This zone is now the key resistance zone to watch moving forward. Only a daily close above the 1.08 handle would represent a bullish technical development. Otherwise, the path of least resistance would remain to the downside.

From here, the EUR/USD could head down to the next potential support at 1.0670, followed by 1.0580 and finally 1.0500 handle.

The dollar’s bullish momentum may well continue, and yields remain elevated for a while yet.

A quick recovery in the EUR/USD exchange rate looks unlikely in the short-term outlook.

Incoming U.S. data will have to weaken significantly for that to change. Up next, we have retail sales, industrial production, jobless claims, and Manufacturing indices from Philadelphia and New York, all scheduled for release on Thursday.

Compare EUR to USD Exchange Rates

Find out how much you could save on your euro to US dollar transfer

Potential saving vs high street banks:

$2,750.00

Free • No obligation • Takes 2 minutes

A day later, on Friday, we will have PPI, building permits, and UoM Consumer Sentiment.

If this week's upcoming data, especially retail sales, continue to showcase economic resilience in the U.S., it is likely to bolster the U.S. dollar further and hurt the EUR/USD.

The Eurozone narrowly avoided a technical recession as GDP came in flat after falling 0.1% in Q3, but with anaemic growth throughout 2023 and economic data remaining weak at the start of 2024, it is increasingly becoming difficult to be hopeful over a sharp, unexpected, recovery in the EUR/USD.

Track EUR/USD with your own custom rate alerts. Set Up Here

The stronger industrial production data (+2.6%) may well be an outlier, given weak indications we have seen from several other data releases, especially for Germany.

There’s not much in the way of Eurozone data this week, which means the focus will remain firmly on the US and the dollar.

The EUR/USD dropped with everything else after US inflation came in hotter than expected on Tuesday, which further disappointed those who had perhaps thought that the Fed would be close to cutting interest rates.

U.S. inflation eased to 3.1%, but this was still higher than expected, and core CPI was unchanged at 3.4%, with both measures suggesting that further patience is needed from the Fed.

Alarmingly, the trend on the monthly prints has turned higher on both the headline and core bases. At 0.4% m/m, core CPI reached a 9-month high and well above its long-term average of 0.3%.

The data has raised questions as to whether the Fed might start talking up the prospects of a rate rise, although we don’t think they will consider such a move just yet.

Historically, the Fed has always been slow to act, and I don’t see why they will now change that and deliver a knee-jerk reaction by tightening its belt further. Still, if CPI continues to rise at this pace, then who knows, the Fed may have to act.

Compare EUR to USD Exchange Rates

Find out how much you could save on your euro to US dollar transfer

Potential saving vs high street banks:

$2,750.00

Free • No obligation • Takes 2 minutes