EUR/USD Week Ahead Forecast: Pausing the Selloff

- Written by: Gary Howes

- EUR/USD tipped to be supported this week

- As 2024 downtrend put on pause

- However, the big caveat is Tuesday's U.S. inflation report

- Eurozone GDP is key EUR data event

Image © Adobe Images

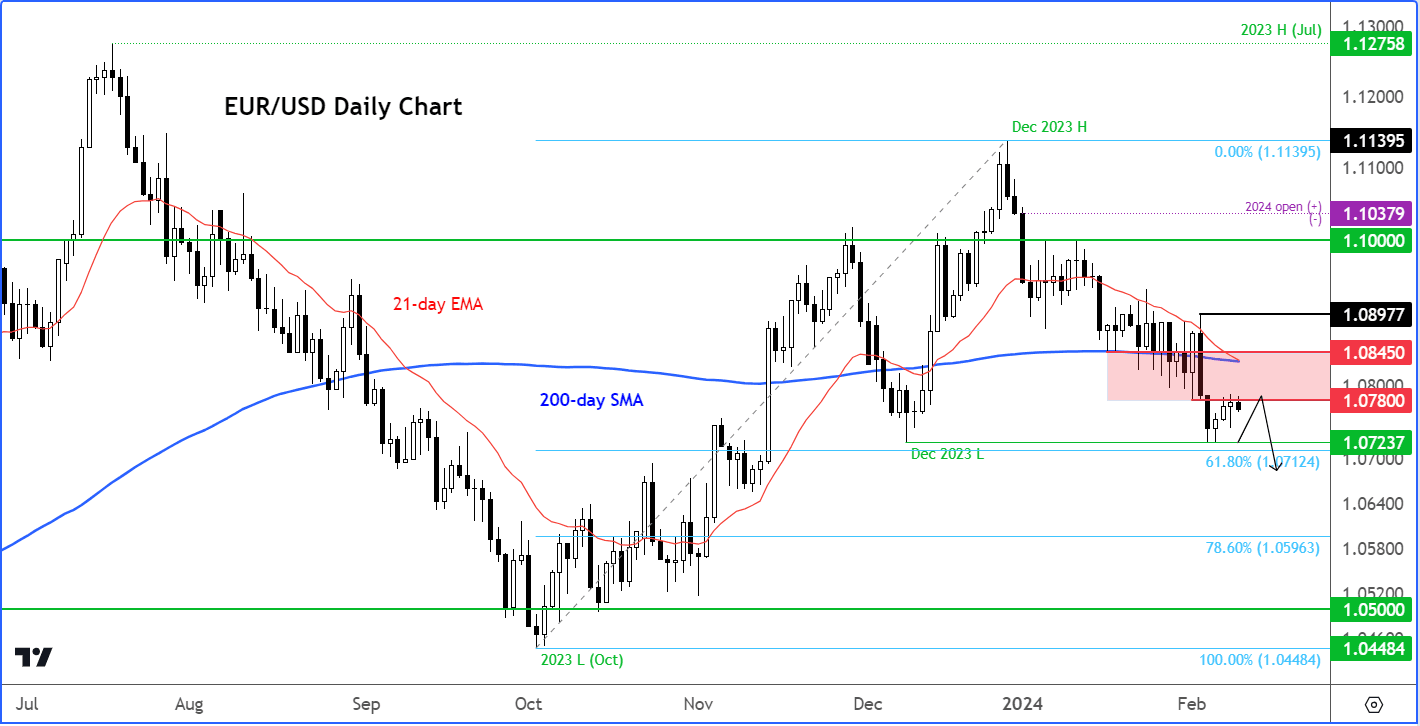

The Euro to Dollar exchange rate has been under pressure in 2024 but will unlikely break below 1.0723 in the coming week unless we receive a blow-out U.S. inflation report.

It's been a strong run for the Dollar already this year, and markets appear happy to unwind some of the recent strength; in fact, the Euro rose against the Dollar for four consecutive days last week in price action that hints at a tiring USD uptrend in the short term.

We now note Euro-Dollar support comes in at the December low at 1.0723, which is not far off from current levels at around 1.0780.

Compare EUR to USD Exchange Rates

Find out how much you could save on your euro to US dollar transfer

Potential saving vs high street banks:

$2,750.00

Free • No obligation • Takes 2 minutes

To be sure, the broader picture remains one of USD outperformance and any Euro-Dollar strength will therefore remain limited to a multi-day timeframe.

Given the significant pushback against U.S. Federal Reserve interest rate cut expectations seen thus far in 2024, we would anticipate another potential break lower in Euro-Dollar over the coming weeks.

"For the time being, the EUR/USD has found support at its December low of 1.0723, though there remains a good possibility of it breaking below this level soon," says Fawad Razaqzada, Market Analyst at City Index.

Image courtesy of City Index.

"Under current circumstances, I would only consider bullish trades on the EUR/USD if we witness a clear bullish reversal pattern emerge first, or if there's a potential breakthrough above the most recent high, just shy of the 1.09 mark, to invalidate the prevailing bearish trend in the EUR/USD," adds Razaqzada.

Data surprises from the U.S. have been resolutely strong over recent weeks, and we will need to see this pattern repeated in the coming days to keep the positive USD momentum going.

We question whether we have reached 'peak surprise' on the U.S. economy and the Dollar; i.e. expectations are already so elevated that the biggest currency reaction will be to any disappointments from data undershoots. It might just be the case that we need increasingly eye-popping releases to keep the USD impetus going.

Track EUR/USD with your own custom rate alerts. Set Up Here

"The latest USD rebound has brought it more in line with our currency forecast for Q1 and thus may warrant a more neutral outlook from here. Furthermore, the recent repricing of Fed rate cuts seems to align more closely with our view that the easing cycle should start around the summer," says Valentin Marinov, Head of G10 FX Strategy at Crédit Agricole.

Tuesday's U.S. CPI inflation release will be important: expect further USD upside that pushes the Euro to Dollar exchange rate back down to the medium-term support at 1.0723 (tested last week) if we get a consensus-busting report.

The market expected a reading of 0.2% month-on-month, with the year-on-year number anticipated at 3.0%.

Should the U.S. inflation numbers undershoot expectations, we would look for a solid rebound in Euro-Dollar back towards the 1.09 level. Also watch U.S. retail sales on Thursday, where a beat on the expected 0.1% m/m growth can signal the U.S. consumer remains unfazed by the Fed's interest rate rises, which can signal upside risks to inflation.

Above: Contributions to U.S. CPI inflation, image courtesy of ANZ.

There are two data points of interest in the Eurozone next week, starting with the German ZEW survey for February, where investors will get another gauge of how the region's biggest economy is faring.

The economic sentiment figure is expected to print at 17.5, the current situation at -79.

Watch Eurozone GDP on Wednesday at 10:00 AM to get a sense of how under pressure the economy was in December and the year's final quarter. A -0.3% m/m reading is expected for December and 0% q/q for the final quarter.

We note sentiment towards the Eurozone is already pretty poor, and another set of disappointments will likely be ignored by the Euro.

This leads us to expect the Euro to be more responsive to any better-than-expected outcomes, which could push Euro-Dollar a little higher.

"With some negatives in the price of the EUR already, it would take downside data surprise or dovish ECB comments to send the single currency lower on a sustained basis once again," says Crédit Agricole's Mainov

Compare EUR to USD Exchange Rates

Find out how much you could save on your euro to US dollar transfer

Potential saving vs high street banks:

$2,750.00

Free • No obligation • Takes 2 minutes