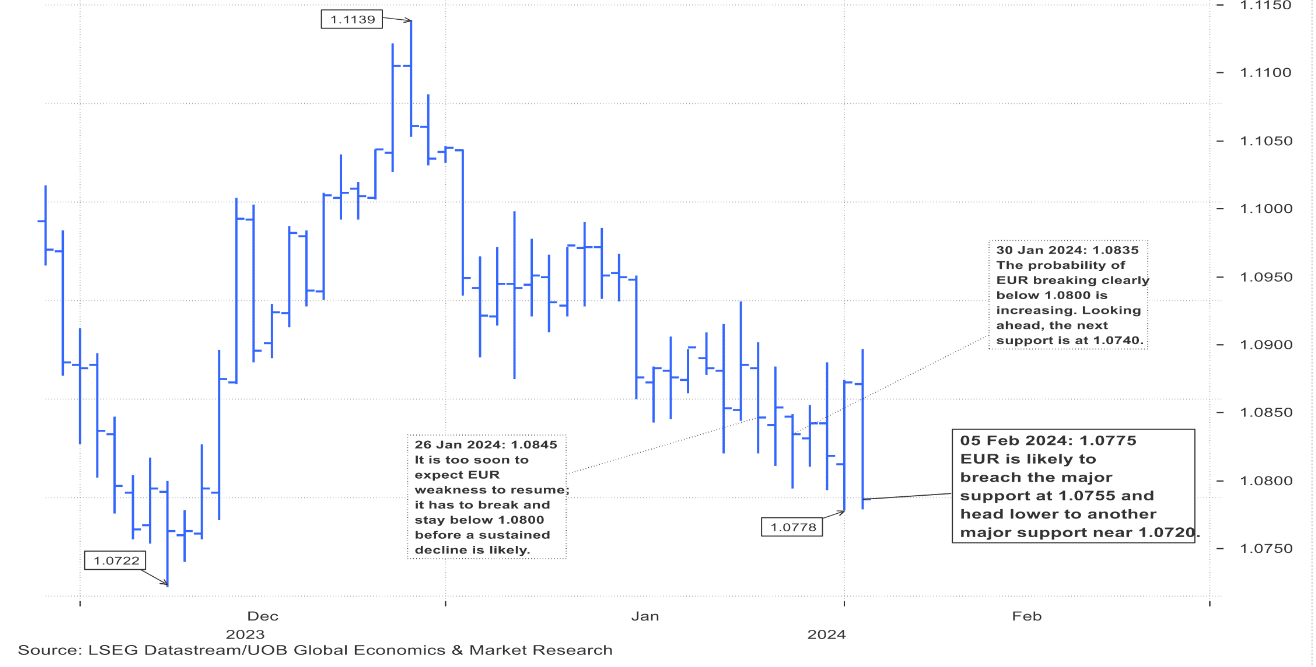

EUR/USD Week Ahead Forecast: 1.0755 Next?

- Written by: Gary Howes

Image © European Central Bank

The Euro to Dollar exchange rate is trending lower and the balance of probabilities favours another weekly loss for the exchange rate as markets factor in a delayed start to the Federal Reserve's interest rate cutting cycle.

The Euro-Dollar fell a sizeable 0.78% on Friday following the release of stronger-than-expected U.S. job numbers that all but erased bets for a March rate cut at the Fed.

The exchange rate is quoted at 1.0775 at the time of writing as Friday's selloff extends into the new week. The key momentum indicators are pointed lower and advocate for further downside.

"EUR/USD broke through its 100-day moving average around 1.0784 and has opened up a test of that swing low from December around 1.0730, but if we break that, it should be relatively smooth sailing to 1.0600 in the pair," says W. Brad Bechtel, Global Head of FX at Jefferies.

Quek Ser Leang, Markets Strategist at United Overseas Bank (UOB), says the Euro is likely to continue to weaken against the Dollar in the very short term, with a move below 1.0755 now on the radar.

Image courtesy of UOB. Track the USD and EUR with your own custom rate alerts. Set Up Here

"The sharp drop in EUR from last Friday has not stabilised. In other words, EUR is likely to continue to weaken," says Leang.

A breach of support at 1.0755 is not ruled out by the UOB analyst, with the next major support near 1.0720.

"The price action suggests EUR is likely to breach the major support at 1.0755 (previously at 1.0740) and head lower to another major support at 1.0720. To keep the momentum going, EUR must stay below 1.0850," says Leang.

Compare EUR to USD Exchange Rates

Find out how much you could save on your euro to US dollar transfer

Potential saving vs high street banks:

$2,750.00

Free • No obligation • Takes 2 minutes

The fundamental backdrop favours the Dollar, with Friday's job report indicating the market has all but given up on hopes for a March rate cut.

"USD bulls continue to charge, owing to blockbuster NFP report last Fri," says Christopher Wong, FX Strategist at OCBC Bank.

The U.S. added 353k jobs in January, with job gains seen broadly across different industries, while the past two months of NFP saw an upward revision of +126k. Topping it all off, wages jumped to a 3-month high at +4.5% y/y vs. 4.1% prior.

The data communicates what the Fed was trying to say just days earlier in its February interest rate decision: it is still too soon to talk about rate cuts.

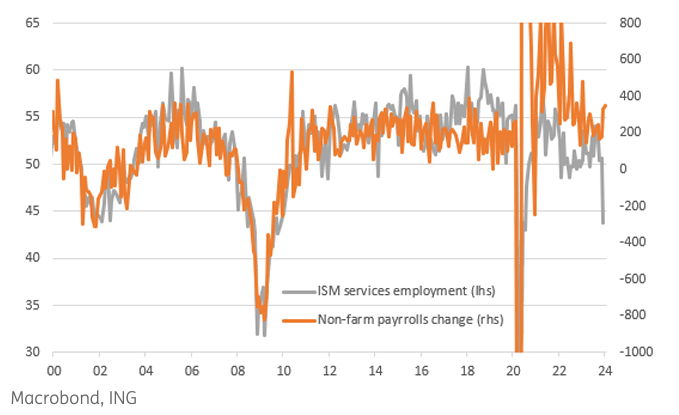

But analysis from ING Bank finds that the non-farm payroll report is at odds with other data prints which suggest a cooling jobs market.

"Labour market surveys are far, far weaker, with both the ISM manufacturing and services sector surveys in contraction territory - indicating job shedding," says James Knightley, International Economist at ING.

Above: ISM's employment monitor suggests the labour market is not as strong as the non-farm payroll report suggests.

Economists will therefore keep a close eye on the ISM services employment index update due Monday at 15:00 GMT.

"It collapsed in January, and if it doesn’t dramatically rebound, then we would be worried that payrolls could soon start to roll over," says Knightley.

Such an outcome would put a lid on Dollar's exuberance early in the week and underpin the support level mentioned in the above technical analysis.

However, should the data point to a robust employment situation, the Dollar can rally as it will cast aside any doubts about Friday's non-farm payroll report.

Compare EUR to USD Exchange Rates

Find out how much you could save on your euro to US dollar transfer

Potential saving vs high street banks:

$2,750.00

Free • No obligation • Takes 2 minutes