EUR/USD Week Ahead Forecast: Looking For A Reboot

- Written by: Gary Howes

- Downside targets in play this week

- But broader uptrend still intact

- Seasonality favours EURUSD upside

- But building ECB rate cuts could spoil the party

- U.S. labour market data on tap

Image © Adobe Images

The Euro's rally against the Dollar suffered a setback last week, but the uptrend remains intact from a technical perspective, and a soft U.S. labour market report on Friday could offer a reboot.

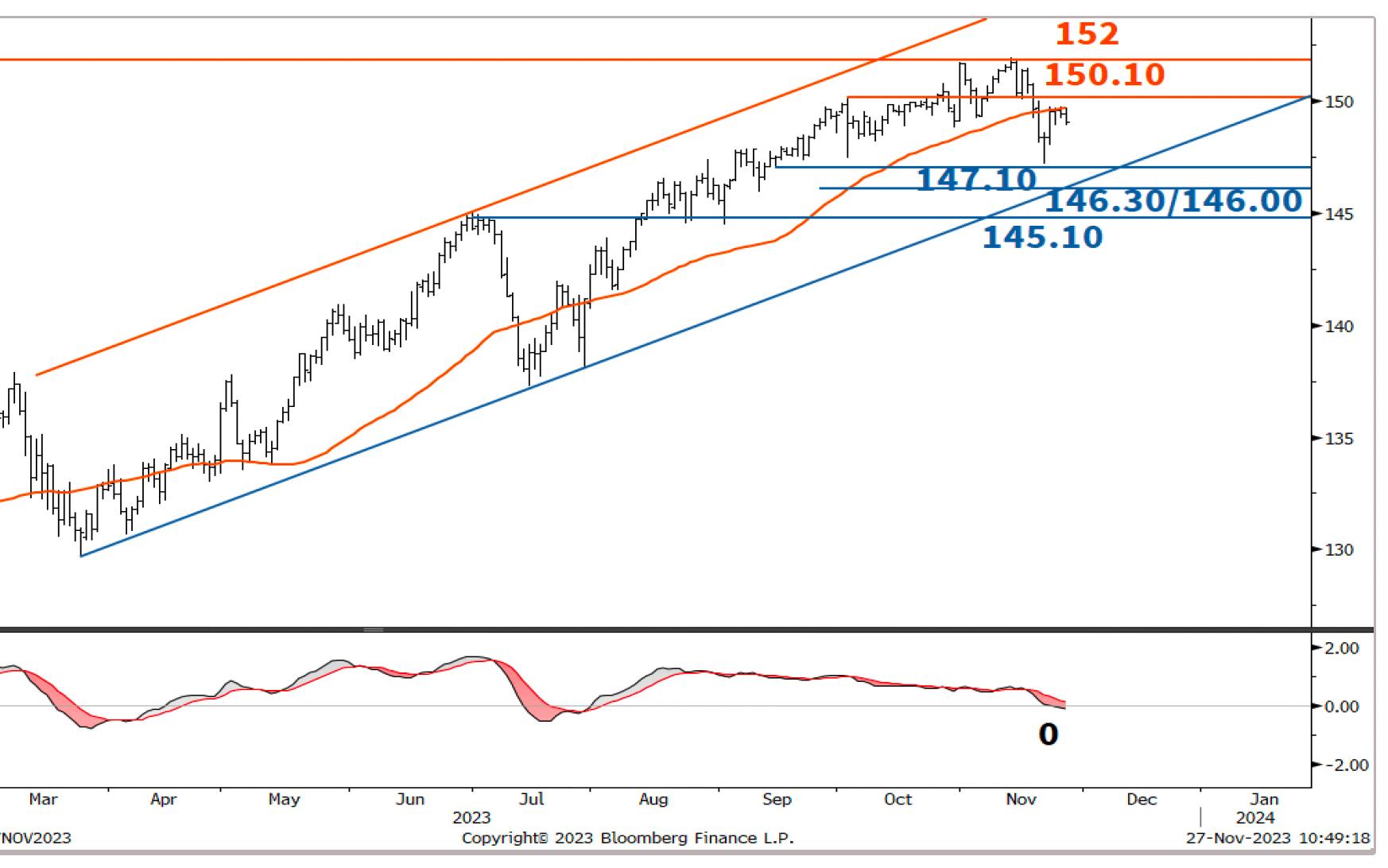

"EUR/USD has undergone a brief pause after reaching interim resistance of 1.0960," says Tanmay G Purohit, an analyst at Société Générale.

He says a "flattish" 200-day moving average meanwhile denotes a pause in the recent uptrend, which could be reflected in soft price action of the coming days.

Any weakness could take Euro-Dollar back to 1.0750, which is expected to be short-term support for the exchange rate.

"Defence of this could lead to continuation in the up move," says Purohit. Upside targets are 1.0960, 1.1065 and then 1.1080.

Above image courtesy of Société Générale. Track EURUSD with your own custom rate alerts. Set Up Here.

We reported last week that December is typically a favourable month for the Euro against the Dollar, with MUFG research showing that 14 Decembers from the last 20 years have seen a higher EUR/USD, with an average gain over those 14 occasions an "impressive" 2.6%.

This seasonality is linked to the Santa Rally phenomenon, whereby global stock markets typically advance in the final month of the year, which is unfavourable for the Dollar.

Seasonality therefore advocates for Euro-Dollar upside, but George Saravelos, an analyst at Deutche Bank, warns that the Euro faces a growing headwind in the form of increasing bets for European Central Bank rate cuts.

Compare EUR to USD Exchange Rates

Find out how much you could save on your euro to US dollar transfer

Potential saving vs high street banks:

$2,750.00

Free • No obligation • Takes 2 minutes

Markets are increasingly confident the ECB will be the first major central bank to cut interest rates following last week's Eurozone inflation data that showed inflation is rapidly falling to the ECB's target at 2.0%.

Deutsche Bank has argued in recent months that there is a real possibility that the ECB is forced to cut rates before the Fed.

The Bank's economists believe the trends in inflation suggest the risks of an ECB rate cut as soon as Q1 have risen.

"We see no reason to be chasing EUR/USD higher above 1.10," says Saravelos.

There will be nothing from the Eurozone this week to push back against these expectations; the U.S. is where the focus lies.

The key macroeconomic event in foreign exchange will be Friday's non-farm payroll report, which will indicate how far the U.S. labour market has 'loosened'.

The market consensus sees a print of 175K, and should the figure undershoot this by a decent margin, then the recent selloff in the Dollar can extend as this would verify the recent rise in expectations for the number of Federal Reserve rate cuts due in 2024.

"All eyes will be on the November jobs report in the US, with the trend expected to point towards weaker hiring," says James Knightley, Chief International Economist at ING Bank.

The Dollar has fallen over the past four weeks as the market anticipates an increasing amount of interest rate cuts from the Federal Reserve in 2024. The market now anticipates more than 100bp of rate cuts; "we are looking for 150bp of cuts next year on the basis that consumer weakness will drag the US growth story much lower," says Knightley.

The market will raise expectations if U.S. labour market data comes in softer, which would weigh on the Dollar.

However, should payrolls come in stronger than expected, then the market could reverse some of its recent assumptions and trigger a sizeable rebound in the Dollar.

Compare EUR to USD Exchange Rates

Find out how much you could save on your euro to US dollar transfer

Potential saving vs high street banks:

$2,750.00

Free • No obligation • Takes 2 minutes