EURUSD Forecast: What a "Harmonic Butterfly" Pattern is Telling Us

- Written by: Sam Coventry

Image © Adobe Images

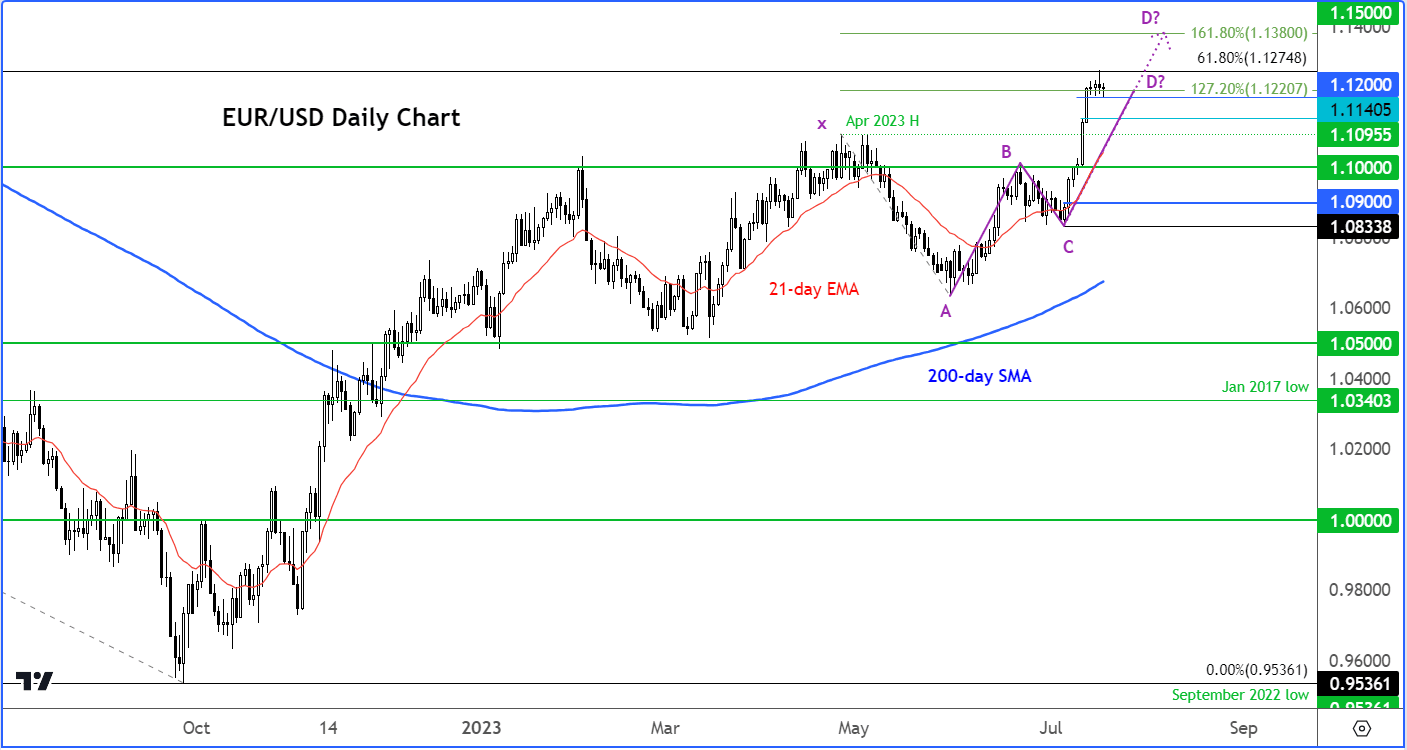

New technical analysis from City Index shows the Euro to Dollar exchange rate (EURUSD) can retreat in the near-term ahead of an extension of the broader rally, with a rare 'harmonic butterfly technical pattern being observed.

City Index analyst Fawad Razaqzada says the recent tight range seen in EURUSD comes amidst "clearly overbought" conditions in the short-term and some weakness can come into play from here.

Weakness can establish around the long-term 61.8% Fibonacci retracement level against the 2021-2022 downswing, at 1.1275.

"However, the longer-term EUR/USD outlook remains positive. The explosive breakout we saw last week suggests the EUR/USD bulls will likely remain in control of price action for a while yet, especially as the long-term trend is also bullish – look no further than the slope of the 200-day moving average," says Razaqzada.

"Interestingly, there’s a Fibonacci-based price action in the making, namely a hormonic Butterfly – see the annotation on the chart. With price points X, A, B and C already established, the key question is where will point “D” occur," queries Razaqzada.

He explains this is usually where the price would be expected to find resistance and turn lower.

"Fibonacci extension levels can be our guide. The 127.2% extension of the BC leg comes in at 1.1220. Here, we have also seen some resistance, so it could be that the point D has already been reached, and a short-term top is in play," says Razaqzada.

Compare EUR to USD Exchange Rates

Find out how much you could save on your euro to US dollar transfer

Potential saving vs high street banks:

$2,750.00

Free • No obligation • Takes 2 minutes

But given the sharper move in this CD leg compared to the AB wave, the anlyst says he wouldn’t be surprised if the CD leg turns out to be bigger than the AB leg.

Thus, a continuation towards the 161.8% Fibonacci extension level at 1.1380 is possible, before we potentially see a temporary or a long-term top in the EUR/USD.

"In terms of support, last Wednesday’s high at 1.1140 is now very important to hold insofar as the short-term EUR/USD outlook is concerned. If that breaks, then the April high at 1.1095 will be the next level to potentially provide support or else we will see a revisit of the more significant support around the 1.10 handle," says Razaqzada.

Compare EUR to USD Exchange Rates

Find out how much you could save on your euro to US dollar transfer

Potential saving vs high street banks:

$2,750.00

Free • No obligation • Takes 2 minutes