"USD Will Not Give Up Easily": Euro-Dollar Limits Near 1.10 in H2 2023 Says UniCredit Midyear Forecast Update

- Written by: Gary Howes

Image © Adobe Images

The U.S. Dollar looks set for a summer of resistance says UniCredit Bank in a mid-year assessment of the currency market that shows a concerted break above 1.10 in the Euro to Dollar exchange rate (EURUSD) to be a story for 2024.

Analysis from the Italian-based lender shows the U.S. Dollar is destined to embark on a longer-term period of devaluation, but markets will have to wait for the Federal Reserve to begin cutting rates.

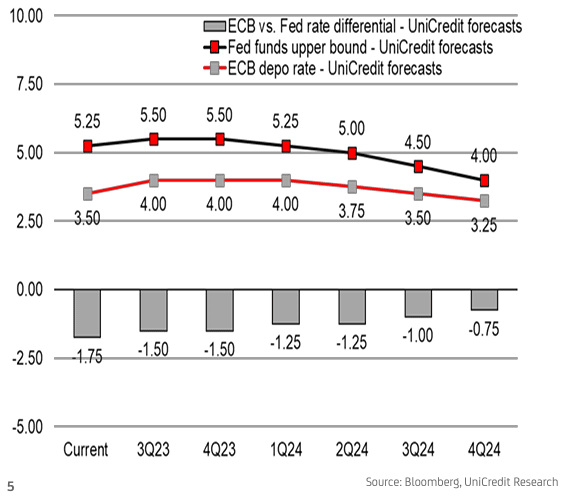

"We think that the USD will not give up easily," says Roberto Mialich, FX Strategist at UniCredit in Milan. "We expect the Fed to hike again to 5.50% in July and remain on hold in the rest of the year. The Fed’s easing is set to start only in 1Q24."

The remaining Fed hikes can offer the Dollar some support and the strategist reckons this will contain Euro-Dollar strength. As such, UniCredit holds a year-end forecast for 1.12, although "the pair's potential to rise above 1.10 remains quite limited."

Compare EUR to USD Exchange Rates

Find out how much you could save on your euro to US dollar transfer

Potential saving vs high street banks:

$2,750.00

Free • No obligation • Takes 2 minutes

Economists at UniCredit meanwhile expect the European Central Bank (ECB) to lift the deposit rate to 4.00% by September, which can keep Euro-Dollar propped up above 1.05 for the remainder of 2023 according to Mialich.

But for 2024 the story in FX will be the scale and speed of interest rate cuts coming from central banks reacting to cooling inflation and slowing economies.

The ECB is tipped by UniCredit to commence rate cuts after the Fed begins, from the second quarter of 2024 onwards, and importantly for the Euro, ECB rate cuts will be less intensive than those offered by the Fed.

The Fed will end 2023 with one of the highest base rates amongst developed market peers following a hiking cycle that has underpinned Dollar strength into late 2022. This also means there is more scope for cuts further out which could prompt a prolonged cycle of Dollar weakness.

It is the relative steepness of rate cuts that will create a ramp for EURUSD to extend beyond 1.10.

"The EUR-USD rebound will likely emerge more next year. We still target 1.16 at the end of 2024," says Mialich.

Compare EUR to USD Exchange Rates

Find out how much you could save on your euro to US dollar transfer

Potential saving vs high street banks:

$2,750.00

Free • No obligation • Takes 2 minutes