Jumbo ECB Rate Hike Unlikely to Boost Euro Against Dollar: Soc Gen

- Written by: Gary Howes

Image © European Central Bank, reproduced under CC licensing

The European Central Bank (ECB) should hike interest rates by a massive 75 basis points on Thursday, but such a surge in Eurozone lending rates will unlikely boost the Euro according to new analysis.

Société Générale says the ECB is likely to raise interest rates by 75bp, up from their previous expectation for a 50bp move but for currency markets it is what happens in European gas markets that ultimately matter for the single currency.

Such a sizeable rate hike would have been unthinkable, a mere few months ago.

But surging inflation, which reflects gas price surges, means the ECB is expected to sharply lift their inflation forecast from June's projections of 6.8% for 2022, 3.5% for 2023 and 2.1% for 2024.

Further hikes beyond Thursday are therefore likely and should take the central bank's deposit rate to 1.50% by year-end, according to Soc Gen.

But, "support for the single currency if the ECB hikes 75bp this week is likely to be muted," says Kenneth Broux an analyst and strategist at Société Générale, a view which suggests euro bulls might be disappointed with Thursday's outcome.

Compare EUR to USD Exchange Rates

Find out how much you could save on your euro to US dollar transfer

Potential saving vs high street banks:

$2,750.00

Free • No obligation • Takes 2 minutes

The call comes as the Euro continues to struggle against the Dollar, remaining caught in a trend of decline.

This week saw the Euro to Dollar exchange rate (EUR/USD) print a new low of 0.9877 on Monday, despite expectations for a more forceful interest rate response by the ECB.

A recent stabilisation of the selling pressure prompts a recovery back to 0.9930 at the time of writing, bank accounts are offering rates in the region of 0.9660 for Euro payments and independent specialists are offering in the region of 0.9908, according to our data.

The Euro therefore looks set to enter Thursday's meeting below parity, with recent market dynamics even suggesting what central banks do might no longer matter at all to near-term Euro moves:

Above: EUR/USD vs. short-term rate differentials. Image courtesy of Intesa Sanpaolo.

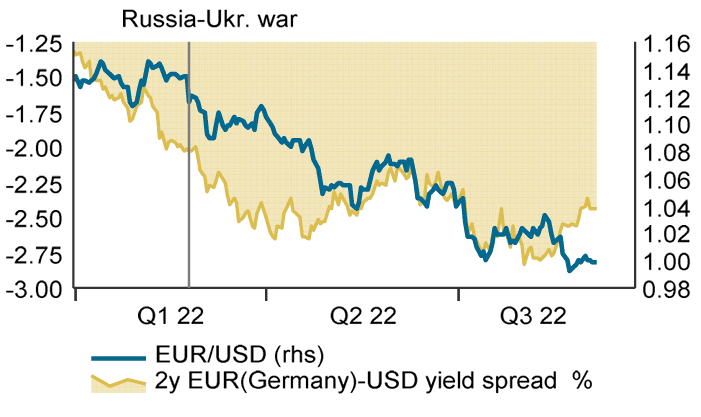

The above chart suggests the Euro-Dollar exchange rate has stopped responding to interest rate differentials, which are heavily influenced by central bank interest rate expectations.

Therefore, relative changes in Eurozone and U.S. monetary policy might no longer be of relevance, with markets instead focussing on the Eurozone's energy crisis for cues.

"Higher bond yields are backfiring on the euro and reflect scepticism in the ability of the ECB to bring inflation under control," says Broux.

"Tactically, we are not ruling out new lows for the currency pair if confidence remain shaky in the earnings outlook for European equities and credit, especially for consumer discretionary, real estate and industrials," adds Broux.

Separately, from a technical angle, Soc Gen tells clients EUR/USD has renewed its downward momentum after facing resistance near the upper band of a descending channel at 1.0360.

"Ongoing decline could persist towards next projections at 0.9700. Daily Kijun line at 1.0080/1.0150 caps upside," says a research note from the bank out Monday.

Compare EUR to USD Exchange Rates

Find out how much you could save on your euro to US dollar transfer

Potential saving vs high street banks:

$2,750.00

Free • No obligation • Takes 2 minutes