Euro Strengthens Against Pound and Dollar Following ECB Rate Cut, Guidance

- Written by: Gary Howes

Image source ECB. Photo: Felix Schmitt for the ECB.

Euro exchange rates strengthened after the European Central Bank cut interest rates but failed to commit to further rate cuts, instead saying it would watch the data and decide on a meeting-by-meeting basis.

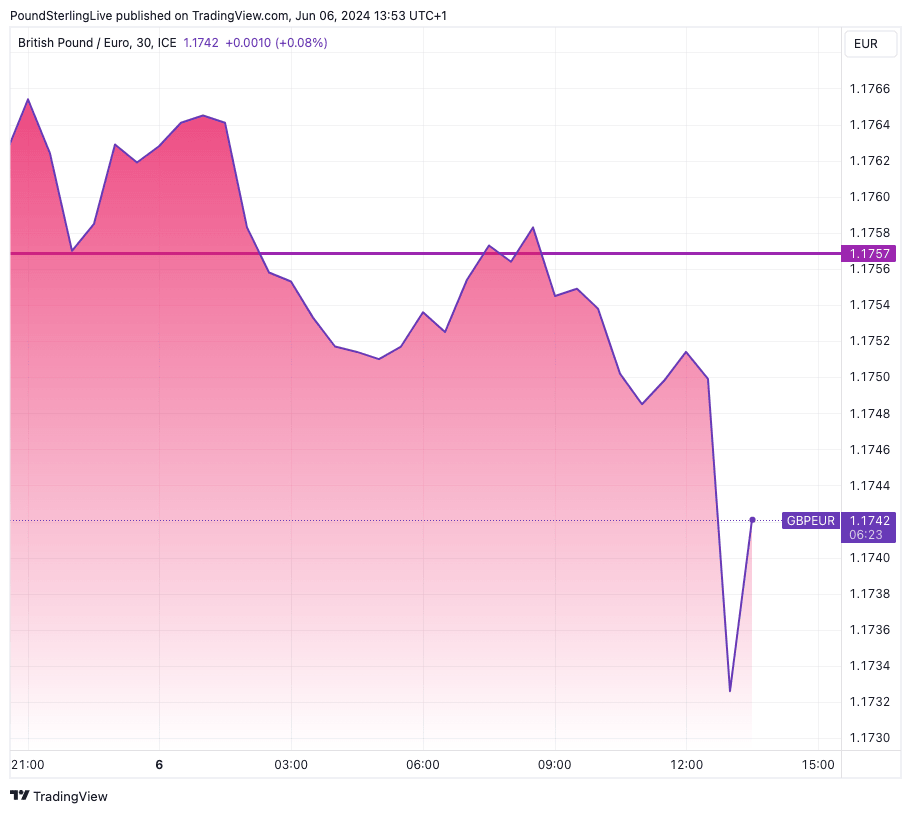

The Pound to Euro exchange rate fell to 1.1733 in the wake of the decision, having been as high as 1.1765 earlier in the day. The Euro to Dollar exchange rate is up 0.30% on the day at 1.0908, having been as low as 1.0862 in the hours ahead of the decision.

The rate cut was never in doubt and was fully discounted by financial markets and baked into the value of the Euro. Instead, the market reaction was always going to be about where the ECB steered expectations regarding further cuts.

The Euro would have fallen sharply had the ECB signalled that another rate cut was likely in July or August. Instead, the ECB was non-commital, saying, "the Governing Council will continue to follow a data-dependent and meeting-by-meeting approach to determining the appropriate level and duration of restriction," said the ECB.

Compare Currency Exchange Rates

Find out how much you could save on your international transfer

Estimated saving compared to high street banks:

£2,500.00

Free • No obligation • Takes 2 minutes

It added interest rate decisions will be based on its assessment of the inflation outlook in light of the incoming economic and financial data, the dynamics of underlying inflation and the strength of monetary policy transmission.

"The Governing Council is not pre-committing to a particular rate path," read the statement.

Above: GBP/EUR at 30-minute intervals. Track GBP/EUR with your own custom rate alerts. Set Up Here

The ECB's vague guidance has introduced a level of uncertainty in the market, potentially pushing back expectations for the pace of the rate cutting cycle. This could lead to one of the slowest and shallowest cycles on record, a scenario that some economists are already considering. Such insights can help the audience to better understand and prepare for the potential future trends in exchange rates.

If this is the case, the Euro can remain supported over the coming months.

"The statement arguably gave less guidance than might have been expected on what comes next. In that sense, the immediate tone is a "hawkish cut". This is not a central bank in a rush to ease policy," says Mark Wall, Chief European Economist at Deutsche Bank.

The ECB's latest economic forecasts are another important signal: the Bank's economists revised up forecasts for both headline and core inflation slightly for this year and next. This implies a reduced necessity to cut again soon.

Both measures of inflation are forecast to be at 2.2% next year, rather than 2.0% and 2.1% respectively. This means inflation will remain above the 2.0% target rate.

"This implies that the future path of rate cuts may be a little slower than previously anticipated," says Andrew Kenningham, Chief Europe Economist at Capital Economics.