GBP/EUR Week Ahead Forecast: Strong Wage Data Can Secure a Recovery

- Written by: Gary Howes

Image © Pound Sterling Live

After two consecutive weeks of decline, the Pound to Euro exchange rate will need a strong wage print to end this week in the green.

Pound Sterling retreated last week as investors prepared for the Bank of England to indicate it was nearing an interest rate cut, which was confirmed by Thursday's policy update.

The Bank says it will carefully consider the next two wage and inflation prints before deciding whether or not a June rate cut is appropriate. With this in mind, if Tuesday's all-important wage figures from the ONS print at weaker-than-expected levels then expect GBP weakness to resume over the coming days

The more the market sees a June cut as being likely, the more downside we can expect in Pound-Euro. Market-implied expectations for a June rate cut are now at 45%, meaning there is ample space for a repricing that can weigh on this exchange rate.

Compare Currency Exchange Rates

Find out how much you could save on your international transfer

Estimated saving compared to high street banks:

£2,500.00

Free • No obligation • Takes 2 minutes

However, if earnings growth comes in above the 5.3% y/y figure the market expects, look for a decent rebound in Pound-Euro towards 1.17 over the coming days.

"Our focus will be on the pay data, both due to its importance to the MPC and because of February's upside surprise. Timelier indicators from HMRC and the BoE's Decision Maker Panel have suggested that pay growth has continued to cool, while our own sentiment data points to a more severe slowdown. We expect headline total pay growth to cool to 5.3% in March, with regular pay growth at 5.8%," says Andrew Goodwin, Chief UK Economist at Oxford Economics.

If the print beats these estimates, the Pound can stage a short-term bounce.

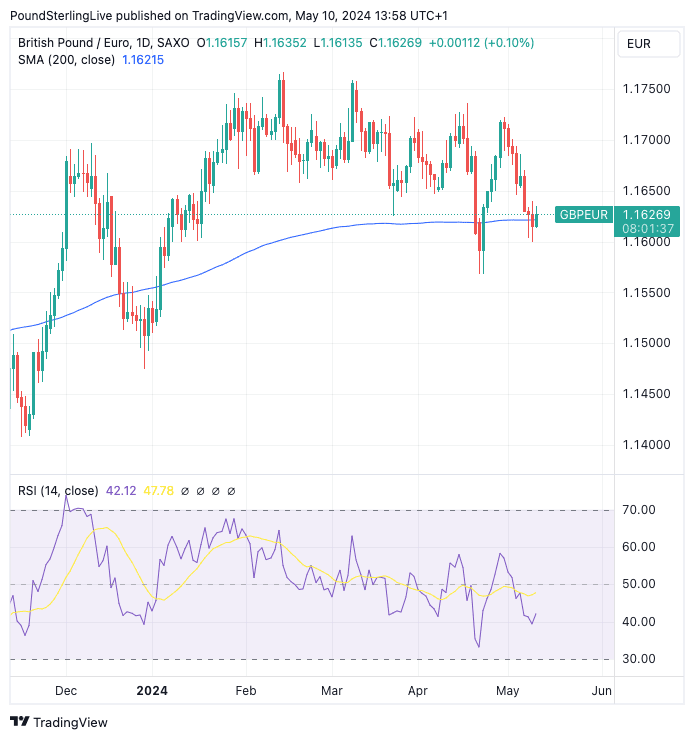

Looking at the charts, GBP/EUR is supported just above the 200-day moving average at 1.1618, downside momentum in GBP/EUR has meanwhile faded somewhat, helped by Sterling's post-GDP rebound on Friday.

Above: Technicals suggest recent weakness can fade around the 200 day moving average (blue line). The RSI is pointing up again (lower panel), suggesting downside momentum is fading. Track GBP with your own custom rate alerts. Set Up Here

So we are seeing some evidence of technical support building, which suggests the bar to further weakness might be rather high from here.

The exchange rate is already below its 2024 comfort zone, and we would anticipate a measure of 'mean reversion' in the coming days (data-depending, of course) that could potentially take the market back towards the 1.17 level.

For now, we don't expect the 2024 highs to be on the menu for the simple reason the market needs some convincing evidence that a June hike has been taken off the table. For this to happen, upcoming inflation data prints must come in hot.

The importance of the inflation release in two weeks' time cannot be overstated as any undershoot will see the odds of June hike soaring above 50/50, and this will weigh on Sterling into month-end.

Bear in mind that June's labour market and inflation prints will precede the Bank of England decision, so we really do believe the data will answer the questions hanging over a June hike.