GBP/EUR: The Strategist Targetting Another Retest of March Lows

- Written by: Gary Howes

Image © Adobe Images

Pound Sterling can fall further against the Euro, according to a strategy call by a Reuters market analyst.

Peter Stoneham, from the Reuters strategy desk, says Thursday he maintains a target for further declines in the Pound against the Euro as recent technical developments have proven supportive, although he says the formation of a number of doji stars "are a concern".

"Doji candles are where the open and close are tight: hints at indecision," explains Stoneham.

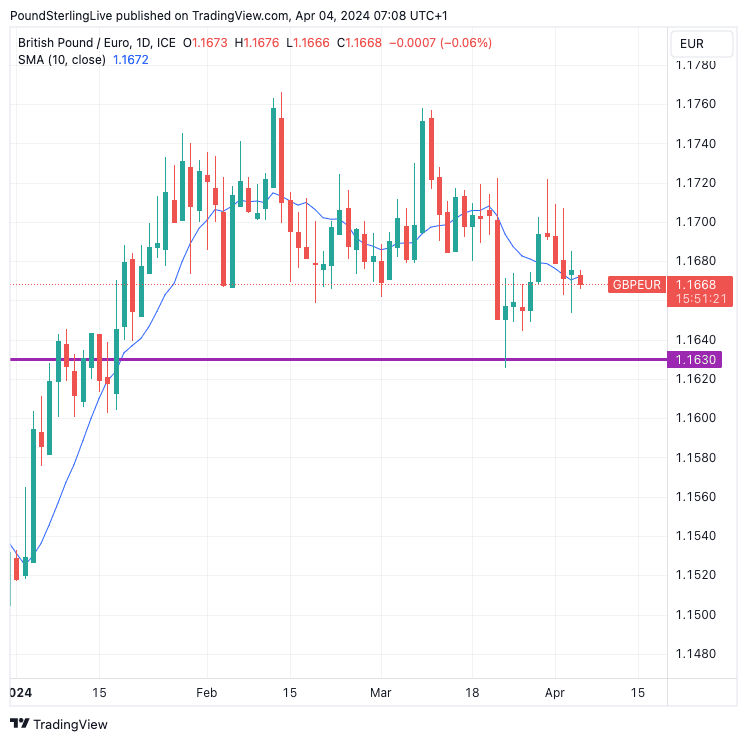

The daily Pound to Euro exchange rate chart below shows these patterns to have been a feature of recent trade:

Above: GBP/EUR at daily intervals with the downside target and the 10-day moving average. Track GBP/EUR with your own custom rate alerts. Set Up Here

Nevertheless, the analyst maintains a tactical 'long' position on the Euro-Pound exchange rate, i.e. a trade that benefits on further Euro gains, noting other technical developments have proven constructive.

"EUR/GBP rallied above the 10-day moving average Wednesday," he says, "the cross struck a five-session high of 0.8582 before slipping into the close."

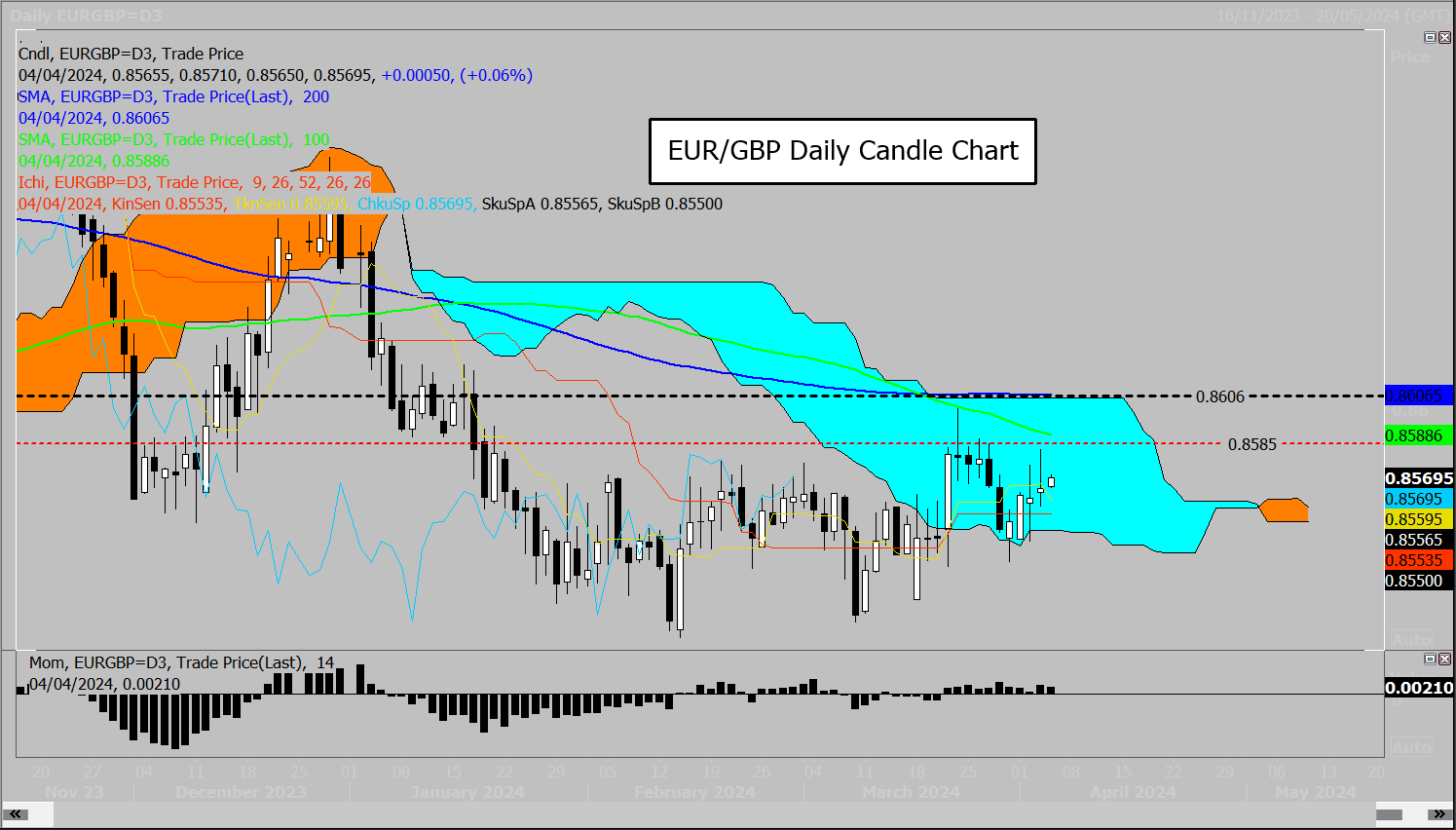

According to Stoneham, the daily monthly RSIs are rising, and the pair remains above the daily cloud base:

Image courtesy of Reuters.

Compare Currency Exchange Rates

Find out how much you could save on your international transfer

Estimated saving compared to high street banks:

£2,500.00

Free • No obligation • Takes 2 minutes

Fourteen-day momentum remains positive amidst "encouraging signs for our 0.8551 long play," says Stoneham.

His target remains 0.8600 for now "but may be raised".

When looking at the inverse GBP/EUR, this makes for a downside target at 1.1630, but as mentioned, this might be lowered.

The Euro is enjoying another positive week against the Pound, courtesy of Wednesday's Eurozone inflation data.

The headline figure missed expectations and resulted in an initial selloff in the Euro, but the services inflation figure remained unchanged at 4.0%.

In addition, some economists pointed out that inflationary momentum in the Eurozone had actually picked up since the start of the year, suggesting little chance of a rate cut at next week's policy decision.

The data also suggests the ECB can afford to be patient when cutting interest rates beyond June, resulting in a firming of Eurozone bond yields and the Euro.