Euro to be Supported in Wake of ECB Update says MUFG

- Written by: Gary Howes

Above: File photo of ECB President Christine Lagarde. Photo by Dirk Claus/ECB.

The European Central Bank's shift in monetary policy is supportive for the Euro according to analysis released in the wake of the June policy update.

The ECB confirmed it would hike interest rates in July and would do so again in September, adding further sustained tightening would be required beyond this point leading analysts at MUFG to say this trajectory is supportive of the Euro.

Lee Hardman, Currency Analyst at MUFG, says the updated guidance has encouraged European rate markets to price in the ECB raising the policy rate closer to 2.00% in the coming years; "the higher yields on offer in the eurozone should offer the euro more support with spreads continuing the recent narrowing trend."

Euro exchange rates initially rose in the wake of the ECB's policy statement but fell sharply during President Christine Lagarde's press conference as investors paid particular attention to how the ECB intends to prevent fragmentation risks growing as interest rates rise.

Italian bond yields surged as investors feared higher rates would hit the country's ability to fund its debt obligations.

The market wanted to hear how the ECB would prevent such concerns arising going forward and a lack of a clear plan might have spooked investors who sold the Euro.

"More attention was given to this topic than we expected in the press conference and the 13bps widening of the spread may have weighed somewhat on the performance of the euro," says Derek Halpenny, Head of Research for Global Markets EMEA at MUFG.

Compare Currency Exchange Rates

Find out how much you could save on your international transfer

Estimated saving compared to high street banks:

£2,500.00

Free • No obligation • Takes 2 minutes

But MUFG expects the ECB to set out more detailed plans at some point in coming weeks and this should shore up the single currency.

"This topic will be discussed in more detail in July and we are very sceptical of the view that fragmentation risks will become a driver of euro performance going forward," says Hardman.

Should financial conditions remain stable MUFG expects the Euro to be better supported going forward.

"The ECB today has laid out in very clear fashion the commencement of its monetary policy tightening cycle," says Hardman.

MUFG now expects the ECB to deliver a 25bps rate hike in July followed by a 50bps rate hike in September from where it will revert back to hiking in 25bps increments at the remaining policy meetings this year.

Money markets now show 75 basis points worth of hikes are now priced into the market for the next two meetings meaning a 50bp hike in September is fully expected.

A further 10bps worth of hikes was added to 2022 as a whole.

For the Euro to be supported the ECB must meet these expectations, which MUFG expects as being likely.

"If financial conditions do not tighten further then there is certainly scope for the ECB to hike by at least 125bps by year-end," says Hardman.

He says the movement in the interest rate differential between the EU and U.S. is starting to move in a direction that favours a stronger Euro.

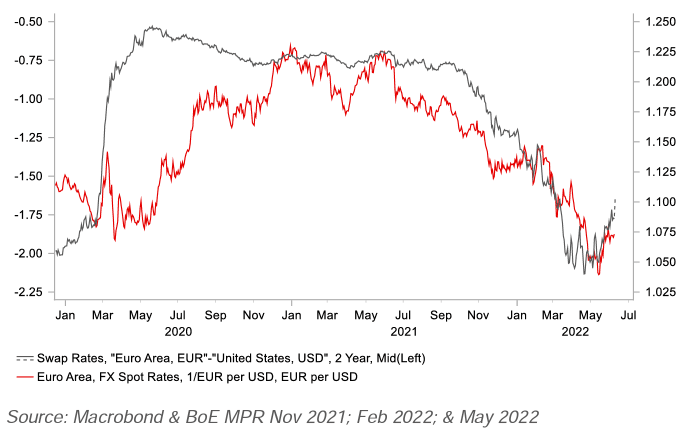

Above: "ECB adds to eroding USD yield support" - MUFG.

"Based on three years of data, the 2year swap spread now clearly implies the potential for EUR/USD to rally to around the 1.1000 level," says Hardman. "The 2year spread is now consistent with the level prevailing just prior to the onset of the covid pandemic when EUR/USD was trading around 1.1000."

On a 10 year government bond yield basis MUFG finds the spread has fallen sharply to 160bps.

"This level last traded in early 2021 when EUR/USD was trading at levels over 1.2000. before the pandemic the 10year spread traded around the 160 level in 201516 when EUR/USD traded the bulk of the time between 1.10 and 1.15," says Hardman.