Pound / Euro Week Ahead Forecast: Could Attempt Foray Above 1.20

- Written by: James Skinner

- GBP/EUR could attempt a recovery of 1.2000

- Facing resistance at 1.1998, 1.2015 & 1.2051

- Supports at 1.1910, 1.1880, 1.1855 & 1.1825

- UK’s Nov GDP, EZ jobs & ECB speech in focus

Image © Adobe Images

The Pound to Euro exchange rate hit the ground running in the opening week of the new year and may attempt a foray above the nearby 1.20 handle over the coming days, although momentum could be difficult to sustain for Sterling in light of a recently resilient performance from the single currency.

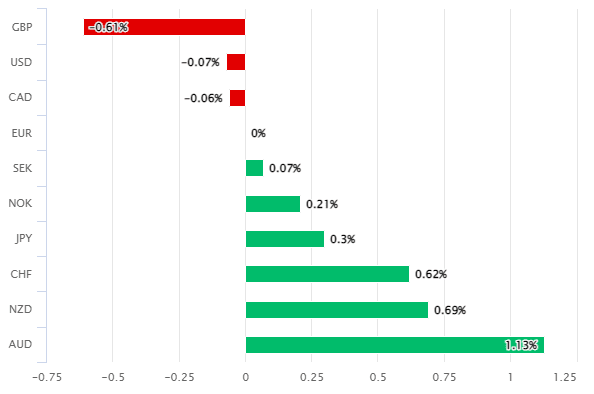

Pound Sterling was quick out of the blocks when rising against all other major currencies last week, taking a tentative lead for the fledgling year of 2022 and coming close to the 1.20 against the Euro for the first time since opening the scenes of the coronavirus pandemic.

Europe’s single currency has however surprised many in the market with a resilient performance that has made it a close contender for the runner up spot, which has left little to differentiate its performance from that of the U.S. Dollar, Canadian Dollar, Swedish Krona and Pound Sterling.

“On a trade-weighted basis, GBP is now trading at the highest levels since that fateful summer of 2016. The strength of sterling seems to correlate with moves in the sterling rates and yield markets, where UK gilt yields have seen by far the largest adjustment in the G10 space over recent weeks,” says Francesco Pesole, an FX strategist at ING.

Above: Euro performance against G10 currencies in opening week of 2022. Source: Pound Sterling Live.

The Euro’s resilience could mean that Sterling quickly finds itself locked into a neck-and-neck race that would serve to limit the upside GBP/EUR, and with the effect that Sterling could potentially struggle to build on any possible foray above the nearby 1.20 handle this week.

“EUR/GBP downside remains intact; however, we are already approaching our 0.83 target [GBP/EUR: 1.2048] for Q1,” says Jordan Rochester, a strategist at Nomura, writing in a research note last week.

“We find it difficult to not expect further GBP strength vs EUR; however, we maintain our view that USD should outperform GBP with too much priced for the BoE and not enough for the Fed,” Rochester and colleagues also said.

Above: GBP/EUR at 4-hour intervals with Fibonacci retracements of December rally indicating possible areas of technical support.

- Reference rates at publication:

GBP to EUR: 1.1986 - High street bank rates (indicative): 1.1660 - 1.1750

- Payment specialist rates (indicative: 1.1870 - 1.1920

- Find out more about specialist rates and service, here

- Set up an exchange rate alert, here

One possible reason for the resilience of the Euro is recent price action in the U.S. Dollar exchange rates, which were a mixed picture last week but had otherwise rallied for six months in advance of the now-in-progress normalisation of Federal Reserve (Fed) monetary policy.

“It’s been a choppy start to the year for the broad Dollar—with FX markets instead dominated by sizable moves in a number of non-USD crosses—due to a complex set of macroeconomic drivers,” says Zach Pandl, co-head of global foreign exchange strategy at Goldman Sachs.

“We continue to think our global macroeconomic outlook should be consistent with broad USD depreciation for the year as a whole, but would prefer to see more evidence that US inflation pressures are easing before positioning for this outcome in portfolios,” Pandl and colleagues also said.

Above: GBP/USD shown at daily intervals alongside EUR/USD.

Secure a retail exchange rate that is between 3-5% stronger than offered by leading banks, learn more.

The market built up hefty “long positions” that lifted the Dollar sharply last year, although the greenback struggled to rise further in December and if market bets were to be pared back for any reason then it’s possible the Euro might be a notable beneficiary, given how heavily sold it was in 2021.

There is much to be determined, as a result, by the response of the Euro and Dollar to the raft of economic data due out in the week ahead, which includes Eurozone employment figures at 10:00 am London time on Monday and U.S. inflation numbers at 13:30 on Wednesday.

“November's GDP report, released on Friday, looks set to beat expectations. We think that GDP rose by 0.6% month-to-month, above the 0.4% consensus. Omicron, however, has derailed the economic recovery since then, so the MPC likely will not see November's data as a green flag to raise Bank Rate again at its next meeting on February 3,” warns Samuel Tombs, chief UK economist at Pantheon Macroeconomics.

{wbamp-hide start}

{wbamp-hide end}{wbamp-show start}{wbamp-show end}

Pound Sterling will also contend over the coming days with the release of UK GDP data for November, although with economists suggesting the latest derivation of the coronavirus likely slowed the economy in December; there’s a chance of the November data going overlooked by the Pound on Friday at 07:00.

“That movements in consumer credit and households’ savings in November returned to levels more akin to pre-Covid norms offered further indication that activity was growing at a decent pace in Q4 before Omicron struck,” says Andrew Goodwin, chief UK economist at Oxford Economics.

“However, a sharp drop in December’s services PMI and a deterioration in some high-frequency indicators illustrated the consequence of surging Covid cases. A weaker starting point means we have cut our growth forecast for 2022,” Goodwin also wrote in a research briefing last week.

Above: GBP/EUR shown at weekly intervals with Fibonacci retracements of late 2015’s referendum-induced decline indicating possible areas of technical resistance to a further medium and long-term recovery by Sterling.

Other important events for Sterling this week include remarks from Catherine Mann, one of the latest additions to the Bank of England Monetary Policy Committee, who’s set to participate in a panel discussion about the European economy at the European Investment Bank Annual Economics Conference at 08:45 on Thursday.

“The EURGBP pair has traded below the prior cycle low near 0.8380, leaving only the major range support since the Brexit vote of late 2016 near 0.8275 [GBP/EUR: 1.2084] as the next focus,” says John Hardy, head of FX strategy at Saxo Bank.

In addition, and during the latter half of the week, European Central Bank (ECB) President Christine Lagarde and Vice President Luis de Guindos will speak publicly at 13:30 on Friday and 10:30 on Thursday respectively, with President Lagarde covering the Conference of Parliamentary Committees for Union Affairs while Vice President de Guindos participated in a a virtual Q&A event hosted by UBS.

In the meantime, and along the way the Pound to Euro exchange rate could benefit in the event of any weakness from technical support levels located at 1.1910, 1.1880, 1.1855 and 1.1825, although it could face some resistance on advances to 1.1998, 1.2015 and 1.2051.

Above: GBP/EUR shown at daily intervals with spread, or gap between 02-year British and German government bond yields.