UK Inflation Forecast Below 2.0% Next Week

- Written by: Gary Howes

Image © Adobe Images

UK inflation will fall back below the magic 2.0% level next week.

This is according to economists who have been tracking the UK's basket of goods and services that make up the inflation calculation.

The new government and Bank of England will welcome news headline inflation will dip below 2.0%, but it appears one-off factors will be behind the move.

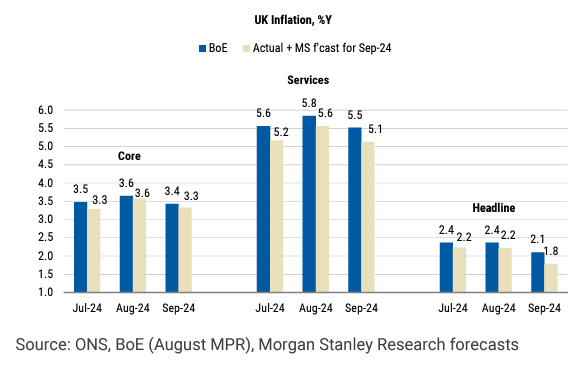

"Oil prices have swung sharply higher more recently, but an earlier drop in fuel prices likely pushed headline inflation to 1.8%Y in September," says Bruna Skarica, Chief UK Economist at Morgan Stanley.

Image courtesy of Morgan Stanley.

"All of the undershoot relative to the MPC’s call is accounted for by falling motor fuel prices," says Robert Wood, Chief UK Economist at Pantheon Macroeconomics.

The Bank of England's most recent forecasts issued in August show headline CPI inflation was expected at 2.10% in September.

Global oil prices fell to their lowest levels since 2021 in September but have since recovered, meaning the bottom for forecourt fuel prices will be in the rearview mirror.

However, analysts at Morgan Stanley think we will also see a solid decline in services inflation, which is a measure that the Bank of England is closely scrutinising when considering interest rates.

This would be driven by falling airfares and hotel costs.

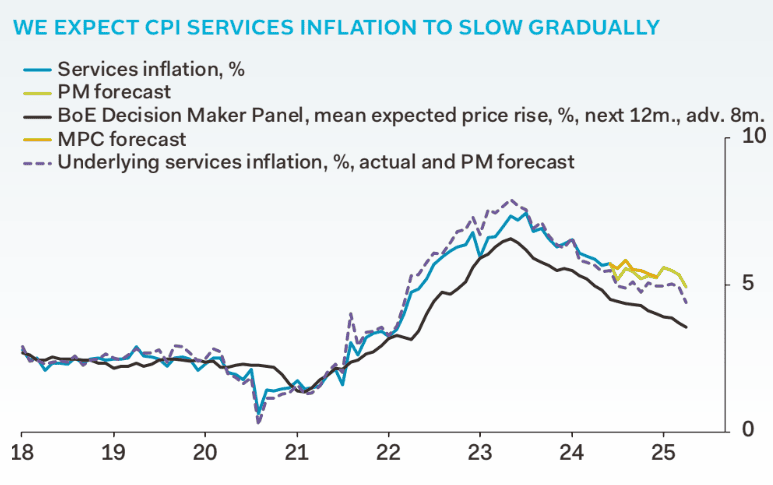

Image courtesy of Pantheon Macroeconomics.

Morgan Stanley also expects to see more signs of labour market slack, too.

"We expect core inflation to again come in below the BoE's forecasts," says Skarica.

The Bank of England forecasted core CPI inflation at 3.42% in September and services at 5.52%.

Pantheon Macroeconomics expects services inflation to slow to 5.4% year-over-year in September from 5.6% in August.

Such a development could prompt markets to speculate that the Bank of England might be inclined to speed up the pace it cuts interest rates, which would in turn weigh on the Pound.