Inflation Concerns Sounded in Lloyds' Business Survey

- Written by: Gary Howes

Image © Adobe Images

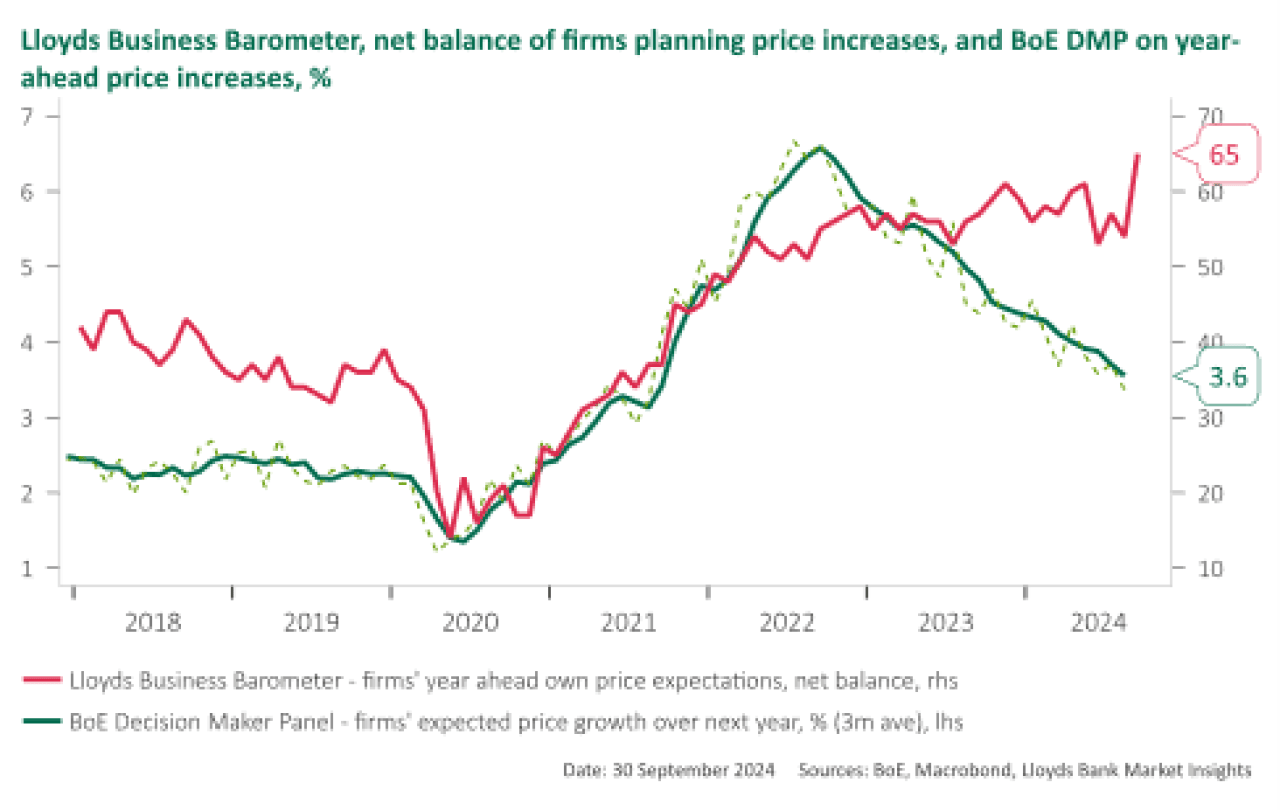

The Bank of England will remain concerned about inflation in the coming months, with a new business survey showing a marked rise in pricing expectations.

The price balance index of Lloyds Bank's Business Barometer rose 11 percentage points to +65% in September, meaning 65% of firms expected to rise prices in the future.

"The standout feature of the report, though, was the 11ppt increase in firms’ own price expectations. In recent months we had remarked on a softening in price expectations relative to anticipated activity levels, but this has more than reversed in September," says Sam Hill, an analyst at Lloyds Bank.

The Bank of England lowered interest rates in August saying it expects UK inflation to steadily decline and fall back to 2.0% in the medium-term (two-year timeframe). But it did not follow the move with a subsequent cut in September, saying there was still work to do and that inflation was expected to rise again into year-end.

These data will affirm that view and underpin market expectations that the Bank will be slower in bringing down interest rates than its peers.

However, the Bank's own survey of firms' pricing intentions reveals a different story to that being told by Lloyds; the Decision Maker Panel shows a steady decline in pricing intentions:

Hill says the message from the Business Barometer of slightly weaker activity growth combined with increasing price pressures chimes with the output of the flash PMIs for September, even if the spike in the price index looks at odds with the BoE Decision Maker Panel.

"The PMIs and Business Barometer point to the risk of firmer news on prices in the September DMP survey when it is released on Thursday," says Hill.

The Business Barometer said the overall measure of business confidence fell back slightly to +47%, from +50% last month, though still well above the long-run average of +28%.

The economic optimism index fell 9ppts to +38% (a six-month low), but the trading prospects component was up 2ppts to +56%, matching the high for 2024.