Bank of England Could Go With Mini Rate Cuts

- Written by: Gary Howes

Image © Adobe Images

The Bank of England could opt to cut in smaller increments than 25 basis points, according to a new economic analysis.

The British Chamber of Commerce says the Bank of England could cut at 10 basis point increments in the future, with the first such cut coming before the end of the year, which will take Bank Rate to 4.9%.

"The Bank is expected to adopt a more cautious approach and make a series of 0.1pp cuts, bringing the interest rate to 4.3% by the end of 2025, and falling to 3.8% by the end of 2026," says the BCC.

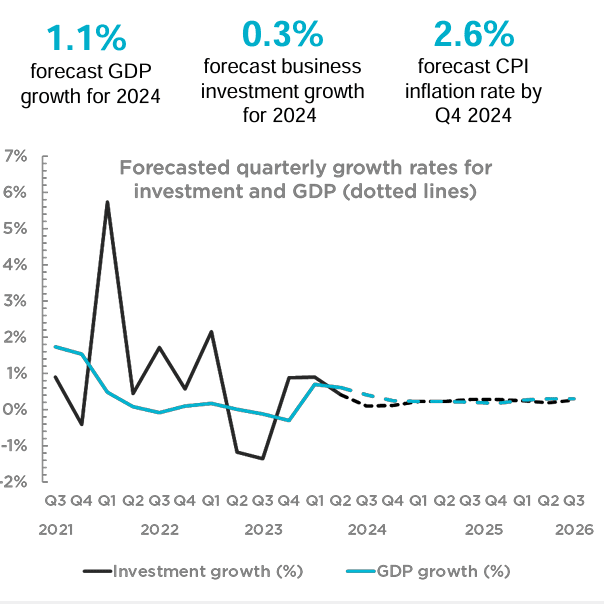

The BCC's latest quarterly forecasts showed inflation would not fall back to 2.0% in the medium-term, staying above 2.0% until 2027. The BCC's economic forecasts are well regarded, having won the 2024 FocusEconomics award for best GDP forecast.

Image: BCC.

'Mini' rate cuts would be unusual by historical standards and signal the Bank still sees risks associated with cutting interest rates in an above-target inflation environment.

The BCC forecasts inflation will reach 2.6% in 2024 before falling to 2.2% in 2025 and 2.1% in Q4 2026.

The Bank is more optimistic in its thinking, with the August MPR showing inflation will likely increase to around 2.75% in the second half of the year but then fall to 1.7% in two years' time and to 1.5% in three years.

But the BCC says inflation is expected to be slightly higher than previously forecast due to global trade uncertainties, pay growth, and rising energy costs.

Average earnings are expected to grow more slowly over the forecast period but continue to remain above inflation. Annual wage growth is expected to be 4.0% in Q4 2024, remaining at the same level in Q4 2025 before falling to 3.5% in Q4 2026.

The average unemployment rate is expected to be 4.3% in 2024, rising slightly next year to 4.4%, before easing to 4.1% in 2025.