Consumer Confidence Continues to Improve: GfK

- Written by: Sam Coventry

Image © Adobe Images

The UK's most authoritative survey of consumer confidence continues to show an ongoing improvement, led by firming household finances and expectations for the economy.

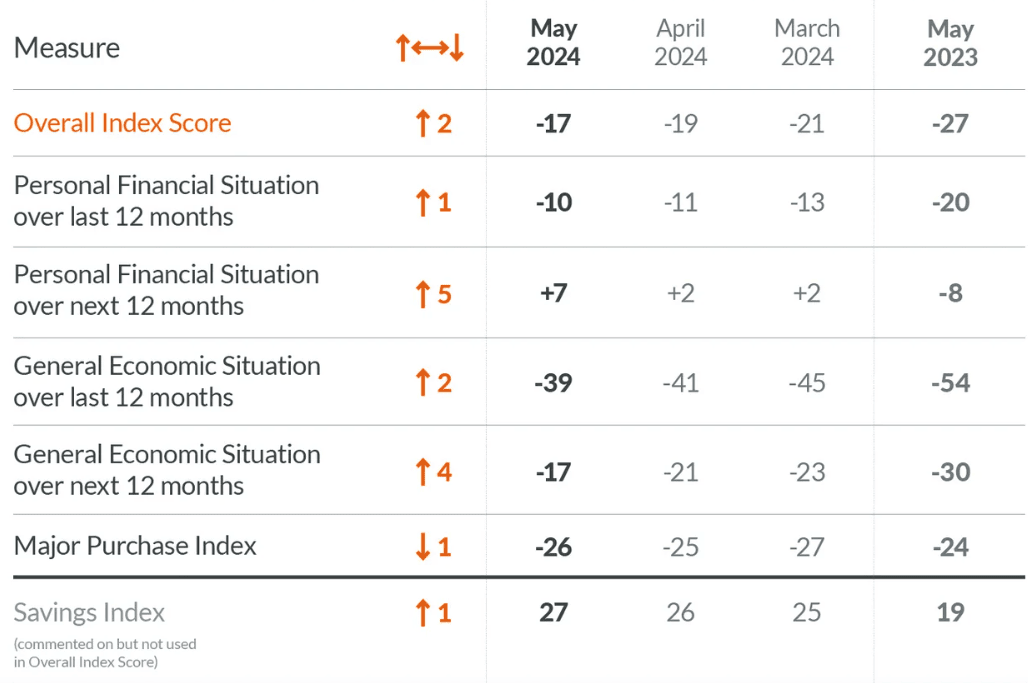

The GfK Consumer Confidence Index increased two points to -17 in May. Four measures were up and one was down in comparison to last month’s announcement.

The biggest driver of the improvement was the 5-point rise in the outlook for personal finances, with expectations for the UK's general economic situation also improving markedly.

The only negative in May is the slight dip in our major purchase measure (down one point to -26).

"With the latest drop in headline inflation and the prospect of interest rate cuts in due course, the trend is certainly positive after a long period of stasis which has seen the Overall Index Score stuck in the doldrums. All in all, consumers are clearly sensing that conditions are improving. This good result anticipates further growth in confidence in the months to come," says Joe Staton, Client Strategy Director GfK.

"Falling inflation and still strong wage growth are combining to drive a recovery in consumer confidence that should keep the economy humming along," says Rob Wood, Chief UK Economist at

Pantheon Macroeconomics.

The UK reported headline inflation had fallen to 2.3% year-on-year in April, which brings it to within touching distance of the Bank of England's target.

However, the fall in inflation and improving consumer confidence is yet to translate into a material uptick in retail sales, which suggests ongoing caution.

"Consumers remain reluctant to splash out on a major purchase until the Bank of England starts cutting interest rates. We still expect the MPC’s first cut in August, with one more following in November," says Woods.

It was announced Friday that UK retail sales fell a sharp 2.3% year-on-year in April, although the ONS ascribed much of the disappointment to the month's poor weather.

Pantheon Macroeconomics expects consumers’ confidence in their personal finances and their spending to keep rising as real wage growth improves.

Woods points out that real average weekly earnings growth excluding bonuses rose to 2.5% year-over-year in the three months to March—the latest month for which wage data are available—and will likely rise further by June as inflation falls faster than wage growth.