Consumers Increasingly Optimistic About Personal Finances

- Written by: Sam Coventry

Consumers’ optimism about their own finances going forward has hit a two-year high.

The GfK consumer confidence survey has revealed ongoing optimism about our personal finances, although the trend of improving overall optimism stalled in March.

The UK's longest-running consumer confidence survey revealed the Personal Financial Situation Over The Next 12 Months measurement has risen to +2, which is a significant improvement on the -21 score from March last year.

"This is welcome news given the challenges faced by Britons of fiscal drag, higher costs for fuel, rising council taxes and utilities eroding any increases in wages or other income," says Joe Staton, Client Strategy Director at GfK.

Staton explains this metric is key to understanding the financial mood of the nation because confident householders are more likely to spend despite the cost-of-living crisis.

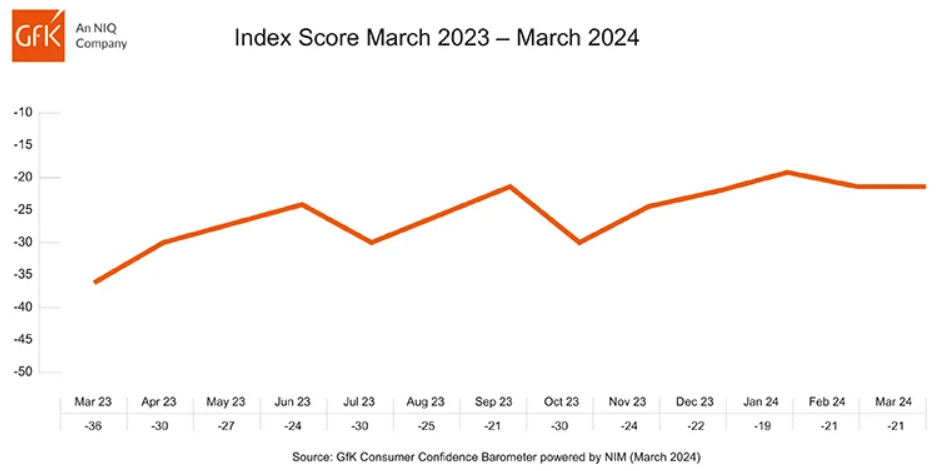

The survey's headline Overall Index Score remains stalled at -21 having steadily improved through 2023. In January, this measure hit a two-year high at -19.

Above: UK consumer confidence is a key determinant of retail sales activity, a major driver of the UK economy. Image: Deposit Photos, purchase images.

The survey shows consumers' view of the wider economy over the past year is down in March and the Savings Index has dived four points, suggesting little lift from the Spring budget.

"Are we temporarily on pause, or are consumers about to press 'reverse'? In the run-up to the next UK General Election, these are important questions for the future health of the economy," says Staton.

Economists at Investec say the forward-looking personal financial situation moved into positive territory for the first time since December 2021, confirming respondents are increasingly optimistic about their personal finances.

Ellie Henderson, an economist at Investec, says this "could have been influenced by the further 2p cut to employees' National Insurance contributions announced in the March Budget."

Above: The GfK data came on the same day the ONS reported resilient retail sales in the UK, despite one of the wettest Februarys on record. Image: Deposit Photos, photos for sale.

However, she notes that respondents still appear to be downbeat about the past and future economic situation, with the sub-indices at -45 and -23, respectively.

Meanwhile, the major purchase index also fell by two points to -27, constraining the overall index.

"We do expect consumer confidence to break out of its current tight range in the coming months, though, and retail activity to rebound," says Henderson.

"The prospect of interest rate cuts and the boost to real household incomes from lower inflation and the 2p cut to national insurance in April suggest the recovery in real consumer spending will continue throughout this year," says Alex Kerr, Assistant Economist at Capital Economics.