Inflation Predictions: Oil Price Rise Won't Throw The Downtrend Off Course

- Written by: Gary Howes

Image © Adobe Images

UK inflation for August was reported at lower-than-expected levels in a welcome development for the Bank of England.

But can inflation continue to fall, in line with the Bank's own forecasts, and therefore ultimately justify growing expectations that the Bank is about to end the hiking cycle?

"Looking ahead, the headline rate of CPI inflation likely will edge up in September, but will then resume its decent in October and finish the year slightly below 5%," says Samuel Tombs, Chief UK Economist at Pantheon Macroeconomics.

The ONS reported CPI inflation fell to 6.7% in August, from 6.8% in July, which is below consensus expectations for a reading of 7.1% in a development that lowered interest rate expectations and prompted a fall in the Pound.

Fading food inflation pulled the headline rates lower, overcoming the predicted uptick based on rising fuel prices courtesy of the rally in oil prices seen over recent weeks.

"The latest rise in the oil price to $94 per barrel means that petrol price inflation will probably add an extra 0.2 percentage points to CPI inflation in both September and October too, although the fall in the Ofgem utility price cap will subtract a bigger 0.6pps in October," says Paul Dales, Chief UK Economist at Capital Economics.

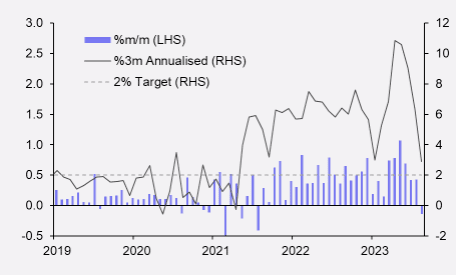

Above: Core consumer prices, seasonally adjusted. Source: Refinitiv, Capital Economics, image courtesy of Capital Economics.

Pantheon Macroeconomics notes the recent pick-up in oil prices means that motor fuel CPI inflation is now on track to rise to about zero in December, from -16.3% in August, boosting the headline rate by 0.6pps.

"But this uplift will be more than offset by a 1.5pp decline in the contribution from electricity and natural gas prices in October, triggered both by the sharp increase in prices a year ago and the 7% reduction in Ofgem's price cap," explains Tombs.

Producer price data - seen as a leading indicator for headline inflation - meanwhile suggests the rate of increase in consumer goods prices will continue to slow over the coming months.

The ONS reported core inflation rose just 0.1% m/m, below the 0.6% expected and 0.3% of July. The y/y increase measured 6.2%, which is below the 6.8% expected and 6.9% of July. Services inflation had fallen to 6.8% in August from 7.4% in July.

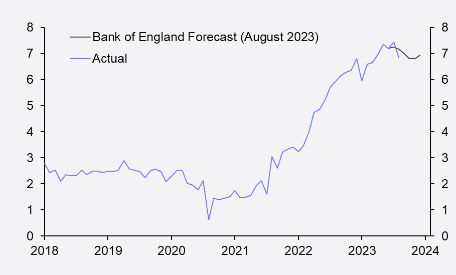

Above: CPI services inflation. Source: Refinitiv, Bank of England, Capital Economics, image courtesy of Capital Economics.

Inflation is now tracking below the Bank of England's projections made in the August Monetary Policy Report. Headline inflation has undershot the August forecast by 0.4pps, as has services inflation.

"Looking at these metrics alone, they may suggest that rates are already restrictive enough to bring inflation back down to target," says Ellie Henderson, an economist at Investec.

Both core and services inflation are of particular interest to the Bank of England given they can be influenced by policy.

"The combination of falling energy costs for businesses and improving labour availability looks set to facilitate a further fall in services CPI inflation. And while some components of the services CPI inflation, such as social housing rents, will grind higher because they are linked to past rates of the headline rate of CPI inflation, others will slow soon as they are linked to goods prices," explains Tombs.

Pantheon Macroeconomics anticipates interest rates to rise to 5.50% tomorrow and expects the first rate cut for May 2024.