UK Economy in "Extraordinary" Growth Upgrade

- Written by: Gary Howes

Image © Adobe Images

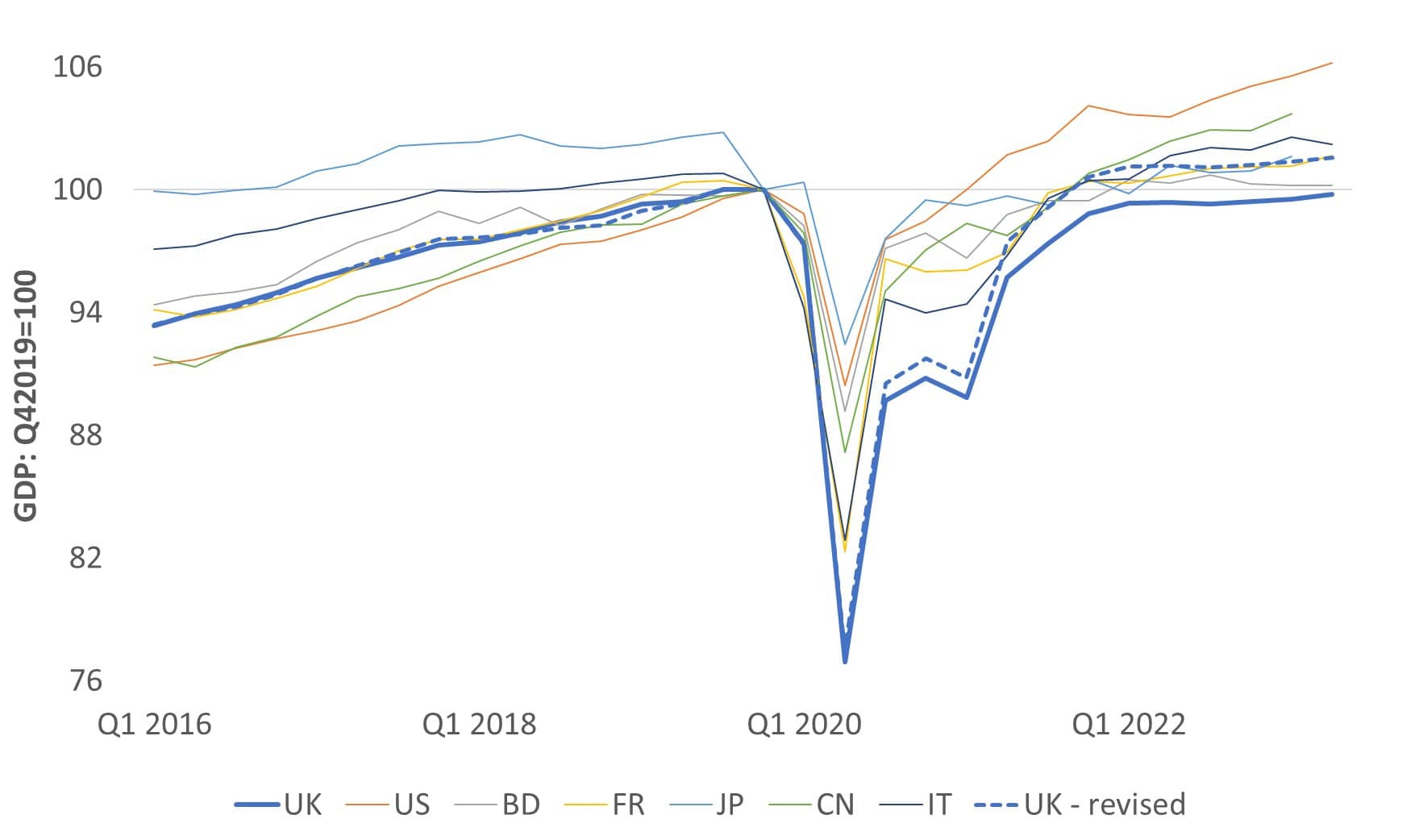

A major revision to the UK's GDP statistics reveals the country is no longer a laggard when compared to its major rivals with the economy now firmly above pre-pandemic levels.

The findings will have significant implications for the Bank of England and the Office for National Statistics say economists, while investors could also reconsider UK assets such as its undervalued stocks and the Pound.

"The entire UK economic narrative - post-pandemic - has just been revised away. Every "UK not back at pre-CV-19 level" headline now obsolete. "UK bottom of the G7" no longer true. Extraordinary," says Simon French, Economist at Panmure Gordon.

The ONS says its latest revisions from 1997 to 2019 are generally small, however, there are larger revisions to 2020 and 2021:

Image courtesy of Simon French @ Panmure Gordon.

Annual current price GDP growth for the UK in 2021 is revised up 0.9 percentage points to an 8.5% increase; this follows an unrevised fall of 5.8% in 2020.

Annual volume GDP growth in 2021 is revised up 1.1 percentage points to an 8.7% increase; this follows an upwardly revised 10.4% fall in 2020 (previously an 11% fall).

Upward revisions to annual volume GDP growth in 2020 and 2021 mean that GDP is now estimated to be 0.6% above pre-coronavirus pandemic levels in Quarter 4 (Oct to Dec) 2021; previously this was estimated as 1.2% below.

"The excellent GDP news for the UK poses a problem for the analysis of the Bank of England and OBR. All this about the UK having particular problems and being an outlier has just disappeared. For example productivity also now looks a lot better," says independent economist Shaun Richards, a former institutional economist who currently advises to pension and investment funds.

The findings come after the ONS updated its measure of UK GDP by incorporating a wider range of improvements to sources and methods to measure output. It says the new methods put it at the forefront of global efforts to improve accuracy in measuring national accounts.

The latest Organisation for Economic Co-operation and Development (OECD) information shows that the UK is one of the first countries in the world to estimate the 2020 and 2021 coronavirus (COVID-19) pandemic period through the SUT framework. This means that the UK has one of the most up-to-date sets of estimates for this period of considerable economic change, says the ONS.

The ONS says these revisions are mainly because they have richer data from their annual surveys and administrative data and are now able to measure costs incurred by businesses (intermediate consumption) directly and we can adjust for prices (deflation) at a far more detailed level.

"I may be biased but this deserves to lead every UK economic/business story today - to provide symmetry to the coverage that the sluggish post-pandemic recovery that has shaped investor/business/household sentiment," says French.

What has changed?

The 2023 Annual National Accounts, also known as Blue Book 2023, incorporate a wide range of improvements to sources and methods.

The ONS says these include:

- introducing new methodology to improve estimates of the impact of global supply chains

- implementing outstanding classification decisions affecting the public sector

- a range of improvements to the deflators used across the National Accounts

- completing a further group of data source and method changes to improve the international comparability of UK gross domestic product (GDP) estimates

- estimating 2021 for the first time using the supply and use tables (SUTs) framework, and improving our estimates of 2020 with the latest data; this looks at the supply of goods and services and how they are used in the economy, and their associated prices, in great detail.