Bank of England No Longer the "Standout G10 Central Bank Dove" and Risks of a 'Policy Mistake' Grow

- Written by: Gary Howes

Image © Adobe Stock

TS Lombard says two more Bank of England interest rate hikes are possible in the first half of 2021, and that the risks of a policy mistake are also growing.

"The BoE is no longer the standout G10 central bank dove," says Konstantinos Venetis, Director of Global Macro at TS Lombard, the independent economic research provider. "Rate hikes at the two remaining MPC meetings in 2023 H1 (May and June) cannot be ruled out."

The new assessment by TS Lombard follows the release of UK wage and inflation data this week, both of which read above analyst expectations.

In particular, services and core CPI readings were at levels consistent with an expectation the Bank will raise interest rates further (6.4% and 6.2% respectively).

"With core CPI inflationary pressures showing little sign of turning the corner in March, we pencil in a 25bp increase in Bank Rate to 4.50% next month alongside language that leaves the door open for further tightening," says Venetis.

This would be consistent with the March BoE update that surprised some Bank-watchers as it was interpreted as being relatively 'hawkish'.

The Bank has long been accused of being too timid in its approach to interest rates in this cycle. This 'behind the curve' approach has meanwhile been linked to Pound Sterling underperformance in 2022.

The Bank however said in March that it would raise interest rates again if the data warranted - an uncomplicated message to the market - and subsequent wage and inflation numbers are entirely consistent with a further lift to Bank Rate.

"In nominal terms the pace of wage gains remains hot," says Venetis. Average private-sector regular pay growth in the December 2022-February 2023 period was 6.9% year-on-year.

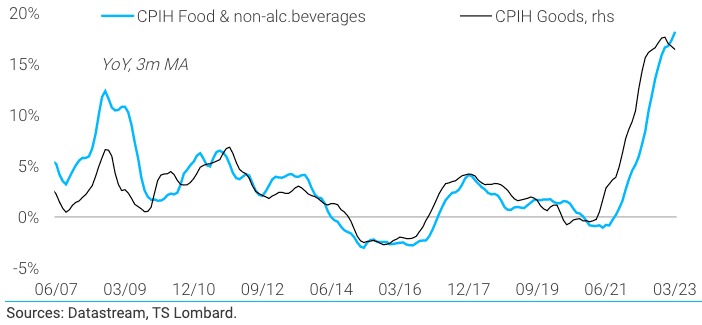

Above: A turning point in inflation beckons says TS Lombard.

But a pause in the rate hiking cycle will ultimately come as inflation is predicted to fall across the board.

"The combination of the 'slow burn' impact of shrinking real incomes, tighter consumer credit conditions and the retracement of the household saving ratio lower to its long-term average is shaping up to be the catalyst for services inflation to turn the corner in 2023 H2 – the question is not if, but when," says Venetis.

Looking ahead, TS Lombard looks for outright disinflation in the second half of the year but warns the lagged impact of interest rate hikes risks shifting the economy into reverse.

"The more this tightening cycle lasts, the larger its cumulative effect will be and the greater the likelihood that it ends up pushing real economic activity over the cliff going into 2024," warns Venetis.