Pound Sterling Holds Firm after Bank of England Hikes Rates and Growth Forecasts, But a Pause is Coming into View

- Written by: Gary Howes

- GBP broadly firmer in immediate aftermath of BoE decision

- 25bp hike as expected, won't rule out further hikes

- 7-2 vote split considered a 'hawkish' signal

- Raises GDP growth forecasts, hit to households to be less severe

- But inflation will fall sharply, raising prospect of a pause

Image © Adobe Stock

The Bank of England’s Monetary Policy Committee (MPC) raised Bank Rate 25 basis points to 4.25%, its highest level since 2008, and said it would raise interest rates again if required.

The British Pound's initial reaction to the decision and accompanying guidance was to go higher, suggesting markets are reading this as a 'hawkish' event.

Pound Sterling Live notes that the Pound tends to fall in the wake of Bank of England decisions and it would therefore be considered a 'hawkish' event if the currency defends its ground, or even edges higher.

Hawish elements of the update include a majority of 7–2 voting to raise interest rates, with the two dissenters opting to hold and not cut.

"Sterling popped to seven-week highs as the Bank of England delivered an 11th straight rate hike, a quarter-point increase to 4.25%, the juiciest level in 14 years. The BoE vowed further rate hikes if inflation remains stubbornly elevated," says Joe Manimbo, Senior Foreign Exchange Analyst at Convera.

The Bank said cost and price pressures have remained elevated, reflecting Wednesday's surprisingly strong CPI inflation reading.

Indeed, the Bank appears to have had little choice but to raise interest rates and maintain a 'data dependent' stance in light of the inflation print.

"If there were to be evidence of more persistent pressures, then further tightening in monetary policy would be required," said the Bank in a statement.

Compare Currency Exchange Rates

Find out how much you could save on your international transfer

Estimated saving compared to high street banks:

£2,500.00

Free • No obligation • Takes 2 minutes

"The pound exhibited a slightly more entertaining response to today’s decision, but ultimately even its kneejerk reaction higher was subsequently faded by traders given how today’s BoE announcement provided little new information," says Nick Rees, FX Market Analyst at Monex Europe.

There was a downside risk to Pound exchange rates of a 'dovish' pivot, whereby the Bank hikes but signals it would opt to pause over the coming months to allow previous hikes to make their presence felt.

In the event, the Bank is open to further rate hikes, if the data warrants (see analysis below regarding how services CPI inflation, due on April 19, could form the crux of the Bank's next decision).

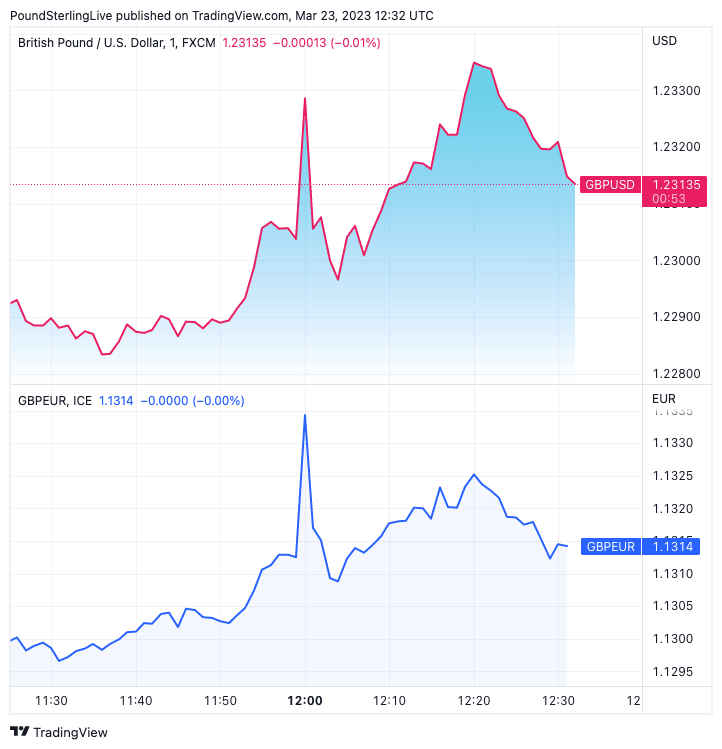

This has supported UK bond yields and the Pound to Euro exchange rate was seen a third of a per cent higher on the day at 1.1318 in the minutes following the release, before ultimately paring the advance to 1.13.

The Pound to Dollar exchange rate was seen 0.40% higher at 1.2320 before retreating back to 1.2302.

Above: GBP/USD (top) and GBP/EUR at one-minute intervals, showing a relatively firm response by the Pound to the Bank of England. Consider setting a free FX rate alert here to better time your payment requirements.

Another 'hawkish' signal came from a material upgrade to economic growth projections: "GDP is still likely to have been broadly flat around the turn of the year, but is now expected to increase slightly in the second quarter, compared with the 0.4% decline anticipated in the February Report," it said.

The prospect of a multi-quarter recession - as envisaged in August 2022 - is not materialising.

Furthermore, real household disposable income could remain broadly flat in the near term, rather than falling significantly.

Over recent MPCs, it has been the Bank's relentlessly pessimistic growth forecasts that have contributed to the underperformance of the Pound.

Abandoning this position could, therefore, offer support to UK bond yields and the Pound.

But, the prospect of the Bank pausing its rate hiking cycle is material given it still expects a sharp decline in inflation over the coming months.

It said that despite the recent spike, CPI inflation is still expected to fall significantly in 2023 Q2, to a lower rate than anticipated in the February Report.

This lower-than-expected rate is largely due to the near-term news in the Budget including on the Energy Price Guarantee, where household energy bills would remain capped at current levels.

Falls in wholesale energy prices mean outright falls in energy bills are likely later in the year.

The Bank says services CPI inflation is expected to remain broadly unchanged in the near term, but wage growth is likely to fall back somewhat more quickly than projected in the February Report.

Compare Currency Exchange Rates

Find out how much you could save on your international transfer

Estimated saving compared to high street banks:

£2,500.00

Free • No obligation • Takes 2 minutes

Is that it?

The next MPC falls in May, by which time it will have another set of wage and inflation data to chew on.

Konstantinos Venetis, Global Economist at TS Lombard says the Bank is now poised to pause given inflation will trend decisively lower.

"February’s CPI report was a reminder that inflation will not fall in a straight line – it never does. But the Committee still thinks consumer price pressures remain 'likely to fall sharply over the rest of the year'. We agree," he says.

Nick Rees, FX Market Analyst at Monex Europe, says his reading of the guidance suggests the Bank is likely signalling it has probably reached a terminal rate.

When the next inflation dataset is released on April 19 markets will pay particular attention to services CPI inflation, which was 6.6% in February.

The Bank noted this was 0.1% weaker than they had forecast in their February Monetary Policy Report.

"This has been one of the key indicators that core members have identified in recent communications as central to their thinking on the inflationary dynamics, with weaker-than-expected numbers implying faster-than-expected progress," says Rees.

"There was already a strong case for a pause this week to assess the full impact of the tightening of monetary and financial conditions that have already taken place," says Julian Jessop, IEA Economics Fellow.

“It would certainly be worrying if the MPC has been spooked by just one month’s data on consumer price inflation, given all the other evidence that pipeline price pressures are fading. Monetary policy is supposed to be far more forward-looking than this," he adds.

But Marc Cogliatti, Head of Global Capital Markets at Validus Risk Management, says further hikes are possible.

"Although another 25 bps hike is fully priced into the market by June, there is little expected beyond there. In our view, this underestimates the risk of rates having to go higher in the months ahead to avoid inflation expectations becoming further embedded and CPI spiralling further out of control," he says.

Given the recent focus on banking sector stability in the U.S. and Switzerland, some analysts were expecting the Bank to call a pause today.

But according to the statement, the Bank of England's Financial Policy Committee (FPC) told the MPC the UK's banking system is "resilient."

"If the MPC are not concerned about the banking system, it is a further reason why they might feel comfortable raising rates again in the months ahead," says Cogliatti.

"The MPC were keen to signal that the door remained open to further hikes," says Nikesh Sawjani, Senior UK Economist at Lloyds Bank.

"Developments in the labour market will be an important consideration in this assessment with signs that conditions are proving tighter than the MPC expects likely add to concerns that underlying inflationary pressure may prove more enduring," says Sawjani.

Compare Currency Exchange Rates

Find out how much you could save on your international transfer

Estimated saving compared to high street banks:

£2,500.00

Free • No obligation • Takes 2 minutes