The Pound Tends to Weaken in the Wake of Bank of England Decisions

- Written by: Gary Howes

- GBP traditionally falls in wake of BoE decisions

- Why should today be any different?

- Markets expect 25bp hike

- Following hot inflation data release

- But some analysts see a route to a higher GBP

Image © Adobe Stock

The Bank of England is expected to raise interest rates by a further 25 basis points on Thursday, taking Bank Rate to 4.25%; but the Pound risks falling as it signals the completion of the hiking cycle.

The Pound rose on Wednesday after data showed UK inflation unexpectedly rose in February to 10.4%, prompting investors to fully price in a rate hike.

This marks a notable uplift in expectations from last week when a 'no change' was fully expected.

Rising rate hike expectations boosted UK bond yields, which in turn pulled the Pound higher alongside.

The immediate downside trigger for the Pound, therefore, would see the Bank opting to keep interest rates unchanged.

"The Bank of England appear to be looking for an excuse to pause hikes, citing the lags that monetary policy works over," says CJ Cowan, portfolio manager at Quilter Investors.

"Several MPC members are particularly concerned about the rate sensitivity of the British consumer given most mortgage rates are only fixed over a relatively short horizon, so it would not be a big surprise to see the BoE use recent events as justification to pause rate hikes," he adds.

Compare Currency Exchange Rates

Find out how much you could save on your international transfer

Estimated saving compared to high street banks:

£2,500.00

Free • No obligation • Takes 2 minutes

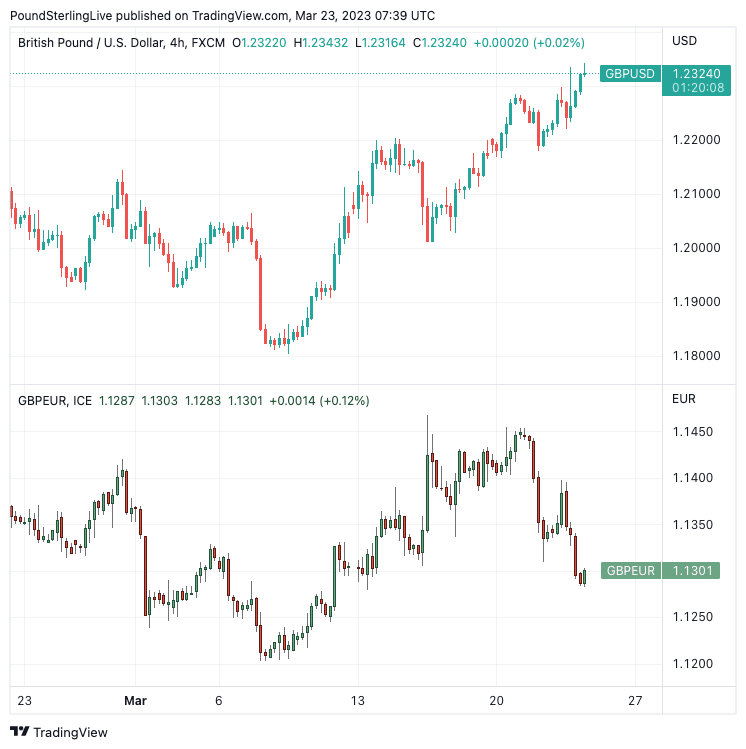

The Pound to Euro exchange rate rose to a high of 1.14 on Wednesday as the inflation surprise was digested, but soon pared these gains to settle at 1.1340 at the time of writing.

The Pound to Dollar exchange rate had risen to 1.2297, before retracing back to 1.2226.

The retreat in the Pound from its highs betrays a currency market that is well aware that the Pound typically falls following Bank of England interest rate decisions.

In short, holding 'long' Sterling position into a Bank of England meeting is a 'mugs game'.

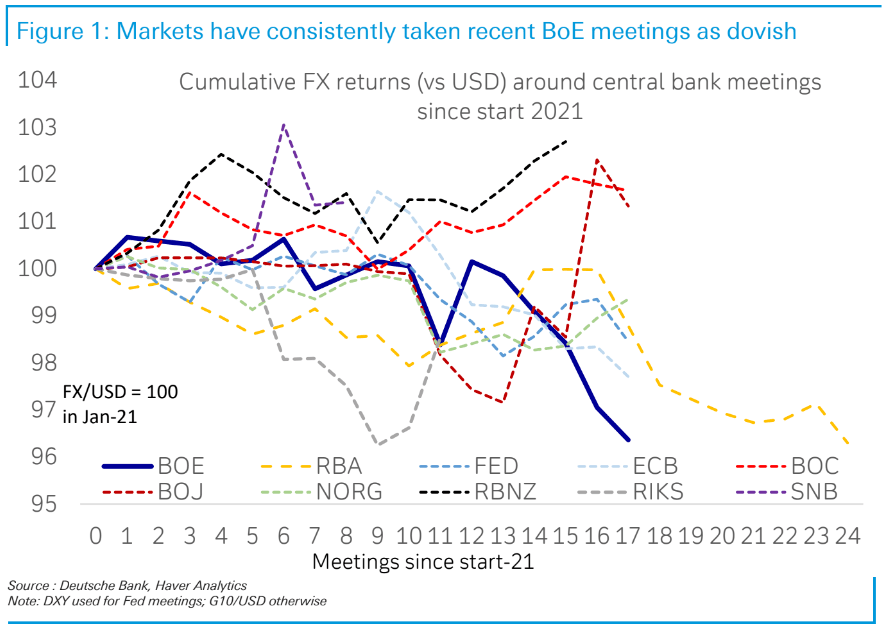

"Our chart of the week shows respective currency performance (vs USD) in the six hours following the release of each G10 central bank decision, since the start of 2021. On average, no-one has seen their currency weaken more than the BoE," says Shreyas Gopal, Strategist at Deutsche Bank.

The Bank has proven to be a reluctant hiker by either 1) not meeting the market's expectations in terms of the size of the hike it delivers on the day, or 2) warning that rates won't rise as high as markets are expecting.

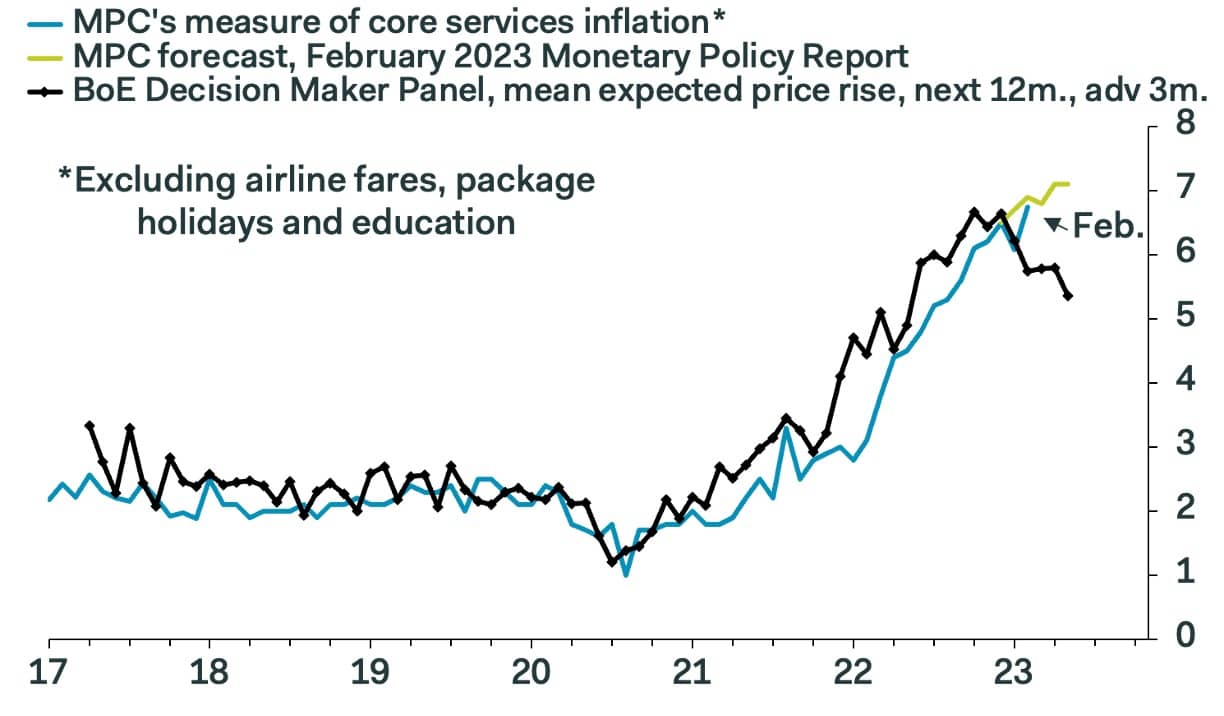

This is because the Bank is adamant in its expectations that inflation will plunge over the coming months and its February forecasts show that by the end of 2024 UK inflation will be close to 1.0%.

"The Bank of England has consistently delivered a dovish message to markets over the last year, and this hardly seems like the environment to break that streak. For that reason, we think it is too early to be long GBP even if it is no longer the best short," says Kamakshya Trivedi, an economist at Goldman Sachs.

Above: GBP/USD (top) and GBP/EUR at four-hour intervals, showing recent price action ahead of the BoE decision. Consider setting a free FX rate alert here to better time your payment requirements.

The Bank could raise interest rates by 25bp on Thursday, thereby meeting market expectations, but also send a firm signal it has finished the cycle.

This would be in keeping with its dovish credentials and Pound exchange rates would likely come under pressure.

"We expect a hike, and we envisage no further hikes from here. While inflation & wages remain hot, the combination of financial sector volatility and rapidly falling inflation later this year should keep the MPC on hold after this week," says James Rossiter, Head of Global Macro Strategy at TD Securities.

TD Securities says this base case assumption (45% chance) would see EUR/GBP rally to 0.89. (This GBP/EUR exchange rate fall to 1.1236).

(If you are looking to protect or boost your international payment budget you could consider securing today's rate for use in the future, or set an order for your ideal rate when it is achieved, more information can be found here.)

What Could Trigger a Rally in the Pound?

There is however an outside chance (only a 5% probability) that the Bank hikes and signals further hikes are needed. Here, EUR/GBP declines to 0.87 (GBP/EUR goes to 1.15).

Strategists at Wells Fargo also see a potential route to a higher Pound:

"In the absence of a closer, or finely balanced, vote in favour of a rate hike, or a softening in the Bank of England's language, we will be inclined to adjust our outlook towards further tightening, an adjustment that could also be positive for the pound," says Nick Bennenbroek, International Economist at Wells Fargo.

Although the Pound's default reaction to Bank of England decisions has been to fall, analysts at MUFG say weakness would potentially be short-lived.

"A decision to leave rates on hold this week poses some downside risk for the pound but its recent resilience suggests that it could continue to hold up better than expected in the near-term," says Lee Hardman, Senior Currency Analyst at MUFG Bank Ltd.

GBP to USD Transfer Savings Calculator

How much are you sending from pounds to dollars?

Your potential USD savings on this GBP transfer:

$1,702

By using specialist providers vs high street banks

Indeed, as of Tuesday, the Pound was the best-performing currency of 2023 with the improved performance of the UK economy, a more stable political environment and a steady banking sector all conspiring to underpin the currency.

Ironically, it was the dovish Bank of England that also ensured the Pound had 'less to lose' from the recent 'mini' banking crisis: the market had already slashed expectations for further Bank of England rate hikes prior to the recent bank failures.

This meant there was more fat to cut from ECB and Federal Reserve expectations relative to the Bank of England, ensuring Pound Sterling outperformance against the Dollar and Euro over recent days.

"For choice, we are holding the view of 25bps and done. On the proviso that the bank holds the line and adjusts policy, this comes as the BoE remains of the view that the banking sector remains well capitalized, suggesting recent GBP resilience is set to remain in place," says Jeremy Stretch, Head of G10 FX Strategy at CIBC Capital Markets.

Holding Rates Unchanged Wold be a Mistake says the NIESR

Economists reacted with surprise to data confirming the UK's inflation rate rose in February to 10.4% year-on-year, from 10.% in January.

"These figures suggest that the increase in headline inflation is not a one-off movement, but rather reflects rising inflationary pressures," says Paula Bejarano Carbo, Associate Economist at the NIESR.

The think-tank says what is of particular concern is how broad-based inflation is, as opposed to being driven by temporary one-offs.

The NIESR's measure of underlying inflation, which excludes 5% of the highest and lowest price changes, rose to a new series high of 9.7% in February, after remaining flat at 9.0% for three months.

At the same time, the ONS's measure of core inflation – CPI excluding food, energy, alcohol and tobacco – rose to 6.2% in February from 5.8% in January.

"The data suggests that inflationary pressures in the economy have yet to be tamed," says Carbo.

Image courtesy of Pantheon Macroeconomics.

The ONS said food inflation grew at an annual rate of 18.2% in February, a significant rise from 16.7% in January – the highest rate for this category observed in over 45 years.

Given today's data, and the expected effect of incoming wage rises on inflation in the coming months, Carbo says it "would be a mistake" if the Bank of England kept interest rates unchanged on Thursday.

Bank of England Governor Andrew Bailey signalled on March 02 there was no firm commitment to raising interest rates on March 23, saying "I would caution against suggesting either that we are done with increasing Bank Rate, or that we will inevitably need to do more."

Markets have steadily slashed expectations for another rate hike following the comments, particularly in light of recent banking market turmoil.

However, Bailey confirmed the Bank remains sensitive to the data and Wednesday's inflation release leaves it little room within which to manufacture a reason to keep interest rates unchanged.

Compare Currency Exchange Rates

Find out how much you could save on your international transfer

Estimated saving compared to high street banks:

£2,500.00

Free • No obligation • Takes 2 minutes