Pound Rallies after UK CPI Inflation Jumps, Heaps Pressure on Bank of England to Raise Rates Further

- Written by: Gary Howes

Image © Adobe Images

The British Pound was higher in the wake of UK CPI inflation that beat expectations in February and raised the prospects of further Bank of England interest rate rises.

The talk among analysts was the Bank of England could afford to end its interest rate hiking cycle by opting to keep interest rates unchanged on Thursday, but CPI inflation growth of 10.4% year-on-year would make a mockery of the institution.

The figure beats January's 10.1% year-on-year increase and defies the market's expectation for a figure of 9.9%. Inflation rose 1.1% month-on-month in February said the ONS, almost doubling the expected 0.6%.

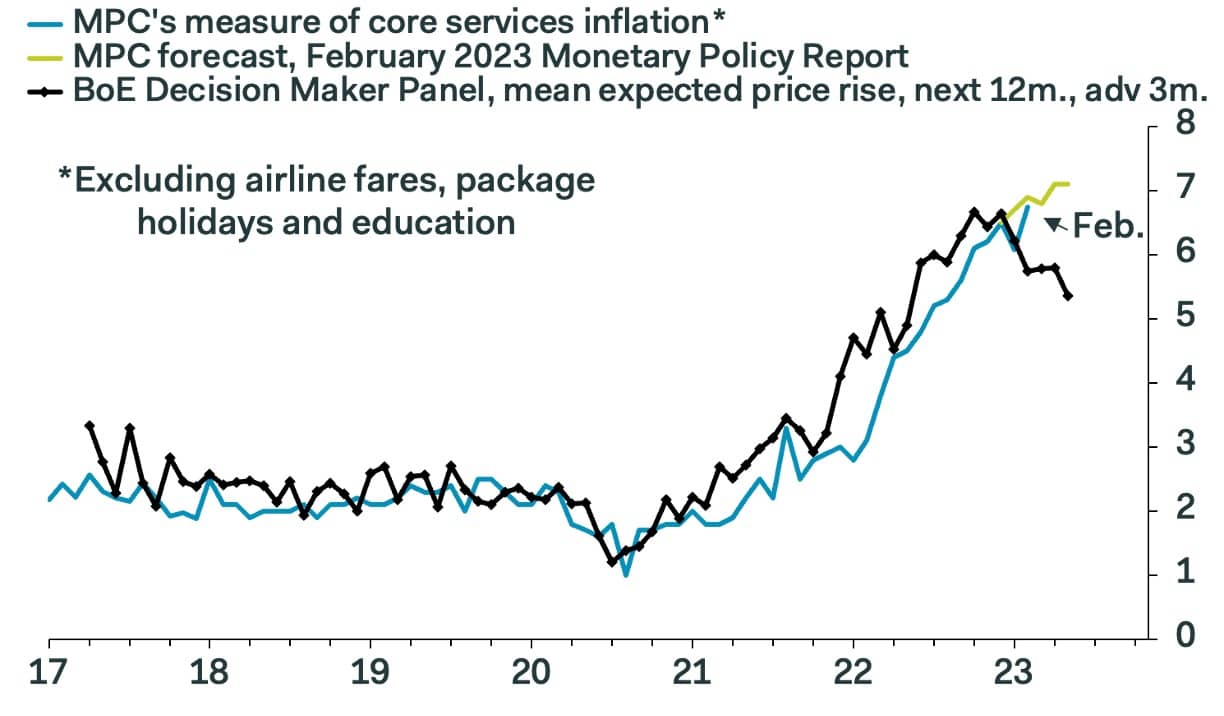

Core inflation, which the Bank of England is particularly interested in, surged 6.2% year-on-year in February, surpassing the 5.7% the market was looking for and January's 5.8%.

Image courtesy of Pantheon Macroeconomics.

The Bank of England is tasked with keeping inflation at 2.0% and has repeatedly forecast inflation to fall back to this level, and below, over the medium term.

But today's figure suggests the Bank has been far too optimistic in its assumptions and will have to raise rates.

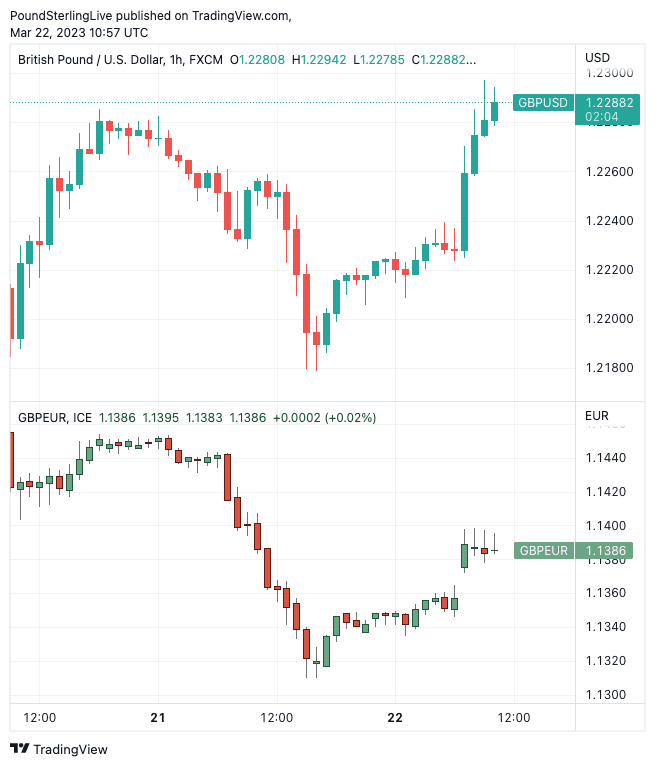

The Pound to Euro exchange rate rose a quarter of a percent to 1.1383 in the half-hour following the data, the Pound to Dollar exchange rate rose 0.20% to 1.2250.

Compare Currency Exchange Rates

Find out how much you could save on your international transfer

Estimated saving compared to high street banks:

£2,500.00

Free • No obligation • Takes 2 minutes

"The reacceleration in CPI inflation in February may be enough to tilt the Bank of England towards raising interest rates from 4.00% to 4.25% tomorrow despite the recent turmoil in the global banking system," says Paul Dales, Chief UK Economist at Capital Economics.

Expectations for higher rates at the Bank of England will raise the yield paid on UK government bonds, which in turn supports the Pound.

The Pound struggled through February as markets slashed expectations for future Bank of England rate hikes, while expectations for hikes from the ECB and Federal Reserve remained elevated.

This inflation data could therefore shore up rate hike expectations in the UK, which would support the Pound.

"The British pound has erased yesterday’s losses after an unexpected rise in both headline and core inflation. GBP/USD is trading just shy of a 7-week high, whilst GBP/EUR lingers just under €1.14," says George Vessey, FX & Macro Strategist at Convera. "Although the latest inflation surprise will disappoint the BoE, it has supported sterling demand thanks to rising UK yields/rate expectations."

Above: GBP/USD (top) and GBP/EUR at one-hour intervals, showing the post-CPI uptick. Consider setting a free FX rate alert here to better time your payment requirements.

The Pound would likely come under pressure were the Bank to keep rates unchanged, something that is still possible despite the nature of incoming data.

"February’s unexpected rise in CPI inflation leaves the outcome of this week’s MPC meeting finely balanced, though we still think that concerns about financial stability and the recent slowdown in wage growth will ensure that a small majority of members vote to keep Bank Rate at 4.0%," says Samuel Tombs, Chief U.K. Economist at Pantheon Macroeconomics.

The Pound's rally in the wake of Wednesday's release shows investors to be raising expectations for a hike on Thursday; therefore a decision to leave rates unchanged would prove a surprise that would trigger losses by Sterling.

The Pound has tended to fall in the wake of the majority of Bank of England interest rates decisions since the start of the current cycle, and a 'dovish' surprise that leads the Pound lower would therefore not be a surprise.

Looking Ahead, Inflation Can Still Fall Sharply

The Bank of England's most recent forecasts show the Monetary Policy Committee expects a sharp contraction in inflation during 2023, such that it will more or less be back at the 2.0% target by the time 2024 dawns.

Today's inflation data leaves this assumption looking incredibly optimistic.

But Samuel Tombs at Pantheon Macroeconomics says there is a path to this outcome.

"Looking ahead, the headline rate of CPI inflation likely will fall to about 9.6% in March, on the anniversary of the surge in motor fuel prices in the wake of Russia’s invasion of Ukraine," he says.

He expects price rises in the hospitality and tourism sector to likely be smaller in March than a year ago, when some businesses hiked prices ahead of the increase in VAT to 20%, from 12.5%.

With regards to the all-important energy component, Pantheon Macroeconomics expects the contribution of electricity and natural gas prices to the headline rate will fall by about 1.4pp to 1.8pp in April, when prices will hold steady but the anniversary of April 2022’s huge 54% increase on Ofgem's price cap will be reached.

"What's more, the current level of wholesale prices suggests that electricity and natural gas prices will be making a slightly negative contribution to the headline rate by the end of the year," he says.

This week saw wholesale gas prices for next-month delivery fall below £100/Thm for the first time since August 2021, raising the prospect of meaningful cuts to household and business energy bills later in the year.

"Meanwhile, the recent slowdown in producer output price rises, the collapse in shipping costs, and the excess inventory in retailers’ warehouses all suggest that the core goods CPI will rise less quickly than a year ago," says Tombs.

"The MPC still should be able to confidently predict that CPI inflation will fall sharply over the rest of this year—perhaps even back to the 2% target—steering them away from a significant further increase in Bank Rate," he adds.

Compare Currency Exchange Rates

Find out how much you could save on your international transfer

Estimated saving compared to high street banks:

£2,500.00

Free • No obligation • Takes 2 minutes