Don't Bet Against the Bank of England when it Comes to Forecasting Inflation says TD Securities

- Written by: Gary Howes

Image © Adobe Stock

Don't bet against the Bank of England's inflation forecasts, is the warning from a leading international investment bank following the release of softer-than-expected UK inflation figures for January.

TD Securities says "yet again, the MPC's near-term inflation forecast for January (released 2 weeks ago) hit the nail on the head."

UK headline CPI inflation declined to 10.1% year-on-year in January (markets were primed for 10.3%), from 10.5% in December, said the ONS.

"Never bet against the MPC's near-term inflation forecast. That's about as good a rule as ever when it comes to UK inflation forecasts," says Lucas Krishan, Analyst, at TD Securities.

The headline inflation figure was driven lower by a sharp -0.6% month-on-month reading in January, which was more than the -0.4% the market was looking for and December's 0.4% growth.

The Pound fell in response and investors lowered bets for the peak in Bank Rate.

Core inflation fell a sizeable 0.9% month-on-month in January, which was far more than the -0.5% the market was expecting and represents a sharp decline from the 0.5% growth seen in December.

Core inflation was down to 5.8% in the year to January from 6.3% in December, exceeding the consensus expectation for a 6.2% reading.

As the below chart shows, services inflation also appears to have peaked, an outcome that could have significant implications for UK monetary policy.

Above: CPI inflation with core inflation (green line). Source: ONS.

"The MPC has made it clear that services inflation and wage growth are front and center in shaping their upcoming policy decisions," says Krishan.

Taken together with Tuesday's wage figures, TD Securities say the Bank of England is highly likely about to end its rate hiking cycle in March, something investors are not yet fully prepared for.

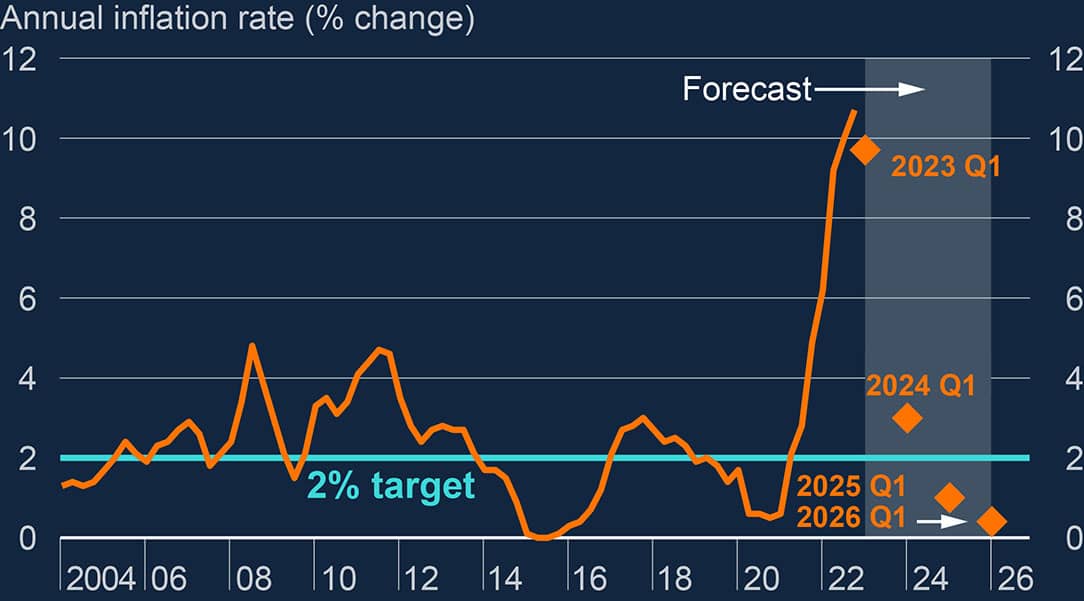

The Bank of England released new forecasts on February 02 that showed inflation would fall significantly in 2023 and be back at the 2.0% target in 2024.

Above: The Bank's latest inflation forecast profile.

As a result, the Bank indicated via its guidance it was nearing the end of its rate hiking cycle.

Ahead of the inflation release money markets showed investors were looking for an additional 68 basis points of rate hikes to be delivered through to September.

In practical terms, this would be consistent with two more rate hikes near-term and a holding of Bank Rate at 4.5% until it is cut again.

Markets promptly lowered their expectations for cumulative remaining Bank of England rate hikes to 54 basis points as a result of the inflation numbers, representing a sharp reduction on the 68 points priced a day prior.

The market, therefore, has further repricing to do if the Bank is to indeed halt hikes in March, or even leave rates unchanged.

Taken together, the inflation and wage data, "should offer the MPC enough evidence to hike Bank Rate once more in March to 4.25%. We expect that to be its terminal rate," says Krishan.

A further rerating lower in Bank Rate expectations would lower UK bond yields, and the Pound, if recent financial market correlations are to remain intact.