Mann: Bank of England Risks Policy Mistake if it Pauses Rate Hikes Now

- Written by: Gary Howes

Above: File image of Catherine Mann. Photo: OECD/Michael Dean.

The Bank of England must raise interest rates again in March says Catherine Mann, an external member of the Monetary Policy Committee (MPC), after presenting evidence that suggests UK inflation won't fall as fast as her colleagues are expecting,

In a speech delivered in Budapest, Hungary, just days after the Bank raised interest rates by a further 50 basis points, Mann said she sees material upside risks to the Bank's inflation forecasts.

She said the Bank risks making a monetary policy mistake by ending its rate hiking too soon and allowing real rates in the UK to fall, which in turn represents a form of monetary easing that only stimulates inflation.

This mistake would risk inflation becoming entrenched at high levels.

"We need to stay the course, and in my view the next step in Bank Rate is still more likely to be another hike than a cut or hold," said Mann.

The February rate hike was interpreted by some corners of the market as being the last, given the Bank dropped guidance for further hikes as being a strong certainty.

Instead, the Bank said it would be willing to pause and assess the impact of previous rate hikes on the incoming data.

This resulted in UK bond yields falling, which lowered UK real yields (as Mann fears will continue) which in turn weighed in the Pound.

But Mann's latest research reveals inflation in the UK has stabilised at elevated levels and is not falling rapidly as not all its components are moderating.

"The stabilization of headline inflation, therefore, is not yet the harbinger of a turning point towards a sustainable return to the 2% target," she says.

Ahead of Mann's speech markets were pricing a 61% chance of a hike to 4.25% in March.

Mann's latest research sends a clear warning to her colleagues on the MPC: inflation could prove stickier than expected.

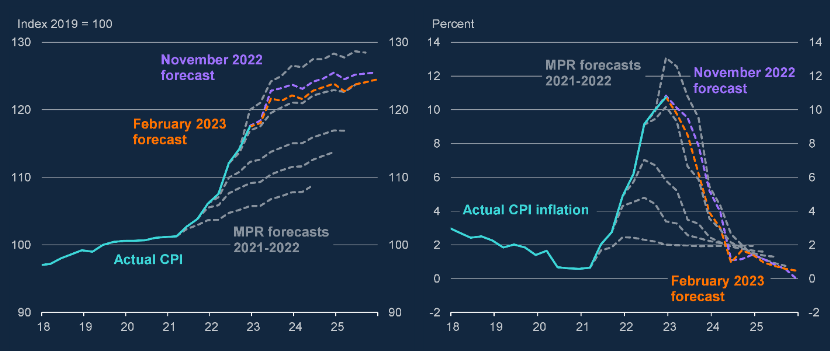

"There is no clear turning point in these UK data, which puts a premium on the other, more granular assessments of turning points," says Mann, presenting the following chart:

Above: International consumer price inflation. 3m-on-3m changes at annualised rates in headline (LHS) and core CPI (RHS).

Source: ONS, BLS, Eurostat, and Bank calculations. Notes: Charts show growth in three-month averages of seasonally-adjusted consumer prices over the preceding three-month average. Core CPI for the UK is CPI less energy, food, and non-alcoholic beverages, for US it is CPI less energy and food, and for EA it is CPI less energy, food, and non-alcoholic beverages as reported by the respective statistical authority. Latest observation: December 2022.

The above inflation projections plots changes between rolling three-month average prices in the headline (LHS) and core CPI (RHS) at annualized rates.

It shows, therefore, what the annual, year-on-year inflation rate would be if price changes between these three month-periods were to compound for a whole year.

Mann says this is perhaps a more accurate way of forecasting inflation than the presently preferred method.

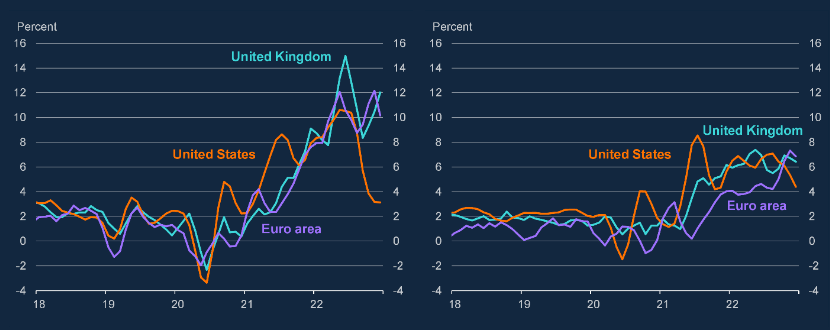

Recall, the Bank said at its February Monetary Policy update that inflation would plummet during 2023 and 2024, and this is one reason why they can afford to stop hiking:

Above: Bank of England forecasts for consumer prices. Levels and year-on-year changes.

Source: ONS and Bank of England. Latest observation: 2022 Q4 (realised) and Q1 2026 (forecast).

But Mann says the methodology that leads to the above expectations not only relies on price pressures today but also price pressures nearly a year ago.

"Actually, annual inflation is predominantly a lagging indicator of underlying price pressures. That makes it difficult to discern when a turning point in inflation is happening," says Mann.

Mann has been a dependable voice on the MPC for a front-loaded approach to raising interest rates.

This is where the Bank hikes by big increments early on, thereby getting on top of inflation expectations and negating the need to engage in a protracted cycle of interest rate hikes.

Under this scenario Bank Rate peaks at a lower level than would be the case under a more timid approach that risks the Bank falling 'behind the curve' and reacting to stubborn inflation.

"If inflation indeed is more persistent, then Bank Rate will need to rise again after the pause, to be followed later with reversal. In my view, a tighten-stop-tighten-loosen policy boogie looks too much like fine-tuning to be good monetary policy," said Mann.

Mann has often been a lone voice for the need to act hard and act early, leaving the Bank in a situation where rate hikes could continue well into 2023.

"We see elevated risks of the BoE being forced to take more drastic action later in the year if inflation disappoints," says Stephen Gallo, Head of European FX Strategy at BMO Capital Markets.

As a member of the MPC Mann has released evidence of her economic research that warns of inflation remaining stubbornly high, unlike some of her peers that have released little by way of actual research but are stubbornly resistant to raising interest rates.

"My reading of the more granular data and likely asymmetries in the inflation process has led me to vote for a more robust monetary policy path that stays the course because inflation dynamics have not yet been quelled," she warns in her speech in Hungary.