UK House Prices Forecast to Fall in H2 by Pantheon Macroeconomics

- Written by: Gary Howes

Image © Adobe Images

UK house prices will fall in the second half of 2022 as a surge in mortgage rates continues over the summer says Pantheon Macroeconomics.

Analysts at the independent research providers and consultancy say rising interest rates at the Bank of England mean monthly mortgage payments for the average borrower will be £300 higher in July than at the end of 2021.

In a new research note out June 27 Pantheon Macroeconomics says although house prices will continue be supported by the solid labour market and by savings build up during the pandemic, the hit from higher rates will dominate.

"The recent surge in risk-free interest rates and mortgage rates has been so severe that we now doubt that a period of falling house prices can be avoided," says Gabriella Dickens, Senior UK Economist at Pantheon Macroeconomics.

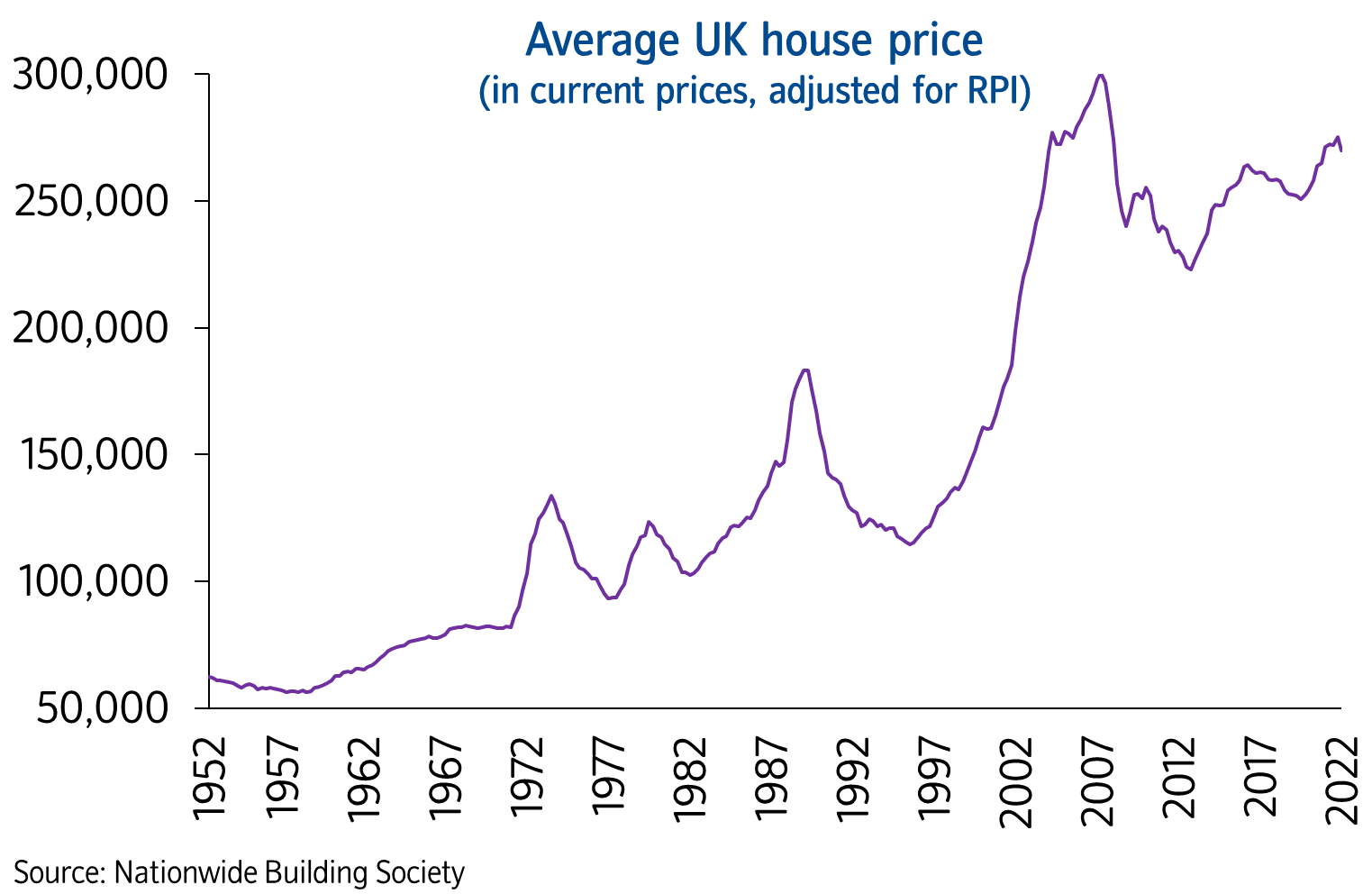

The call comes amidst an ongoing rise in house prices with Nationwide's House Price Index showing UK house prices posted a tenth successive monthly increase in May to keep annual price growth in double-digits.

Nationwide said prices were up 0.9% month-on-month and 11.2% year-on-year after taking account of seasonal effects.

"The housing market has retained a surprising amount of momentum," said Robert Gardner, Nationwide's Chief Economist, but Nationwide nevertheless continues to expect the housing market to slow as the year progresses.

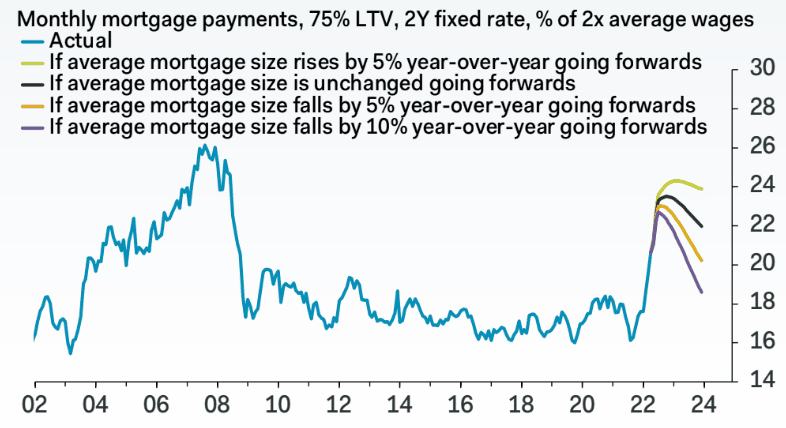

Pantheon Macroeconomics says the average quoted rate for a two-year 75% Loan to Value fixed rate mortgage rose to 2.63% in May, up from 1.53% in November which is the fastest six-monthly increase since 2003.

"This rate will rise considerably further over the summer," says Dickens.

Above: "Mortgage payments' share of wages will rise further." - Pantheon Macroeconomics.

She notes the two-year overnight index swap rate has risen to 2.7%, from 2.2% at the start of May, "and mortgage rates hadn't fully reflected the prior surge in OIS rates last month".

Pantheon Macroeconomics calculates the equivalent mortgage rate likely will jump to around 3.2% in July, before reaching 3.8% by December.

But even rates for 90% and 95% LTV ratio mortgages have risen, despite the continued tightening of the labour market.

"Changes in mortgage rates have been a good guide to changes in year-over-year growth in house prices in the past," says Dickens.

She calculates year-over-year growth in house prices could decelerate by as much as 30 percentage points over the next year.

This would imply that UK house prices would fall outright by about 20%.

But there are further factors to consider that would cushion against such a fall, most notable the strong jobs market that conveys security to home owners and prospective buyers as well as changing work habits.

"We now expect house prices to fall by around 2% in the second half of the year, rather than just hold steady," says Dickens.