Two 50bp Bank of England Hikes Coming Before end-2022 say Major Investment Banks

- Written by: Gary Howes

- Goldman Sachs hike Bank Rate forecasts

- Deutsche Bank sees 50bp in Aug, Sept.

- But NatWest Markets say they are misreading the guidance

- See just one more hike in 2022

Image © Adobe Stock

The Bank of England will accelerate the pace it intends to raise interest rates say analysts at Goldman Sachs and Deutsche Bank, but NatWest Markets are not convinced and expect just one more 25 basis point hike in 2022.

The divergence in opinion reflects a growing uncertainty amongst analysts since the Bank of England raised interest rates again last week but, crucially, departed from previous guidance.

The Bank indicated it would now be more inclined to take a harder stance on inflation at the expense of growth, stating it "would be particularly alert to indications of more persistent inflationary pressures, and would if necessary act forcefully in response".

The market response was to price in a faster rate hiking cycle while adding additional rate hikes to expectations. This was reflected in rising UK bond yields and a firmer British Pound.

Economists at Goldman Sachs say the Bank has changed tone and they accordingly raise their Bank Rate forecasts.

"We view the reference to scale/pace and the use of the term "forcefully" in the June MPC Minutes as suggesting that 50bps hikes are now under consideration for all committee members," says Steffan Ball, Chief UK Economist at Goldman Sachs.

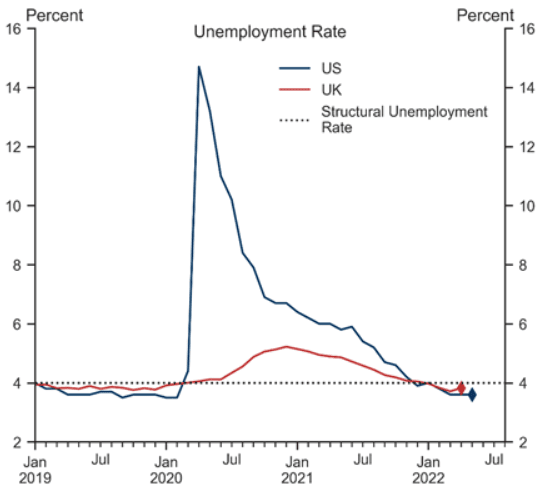

Above: Goldman Sachs present the above two graphs and state the UK is experiencing "similar labour market conditions to the U.S." Data source: Goldman Sachs, Haver Analytics.

UK economist Sanjay Raja at Deutsche Bank notes UK inflation and labour market pressures have risen, rather than abated, over the near- to medium-term and this will be met by a more forceful response by the Bank.

"We now think that the ingredients for larger rate hikes have crystalised, with the broader committee more openly debating the need to go faster in the hiking cycle," says Raja.

He notes the Bank's Agents and DMP survey highlight increasing concerns over rising cost pressures, rising pay, and still extreme recruitment difficulties. "The breadth and scale of price pressures have become harder to ignore."

Deutsche Bank now expects the Bank to hike Bank Rate by 50 bp in August and September, ahead of any active quantitative tightening.

Goldman Sachs revise their Bank Rate call and look for a faster hiking cycle; they too now expect a 50 bp hike in August and September.

"This would quickly take Bank Rate into contractionary territory, given our estimate that the neutral rate is 1.75%. We then expect 25bps hikes in November and December, taking Bank Rate to 2.75%. This boosts our terminal rate forecast from 2.5% to 2.75%," says Ball.

Goldman Sachs economists are not projecting a recession in the UK, which should give the Bank confidence in hiking faster. Goldman Sachs continue to expect excess savings, room to grow in services, and fiscal policy to support aggregate consumption through the cost-of-living crisis.

"At the same time, the labour market remains strong, and the tightness of the UK and US labour markets is remarkably similar," says Ball.

Economists at NatWest Markets are however not inclined to upgrade their Bank Rate forecasts, saying the market had misread the Bank's latest communications.

They say if anything the Bank is now more nuanced in its guidance by underscoring they would only act more forcefully IF inflation data surprised to the upside.

"That would appear to dampen the prospects of 50bp Bank Rate rise in the near-term, certainly August and probably in September, while opening up the possibility of faster/larger rises further down the line," says Ross Walker, Head of Global Economics & Chief UK Economist at NatWest Markets.

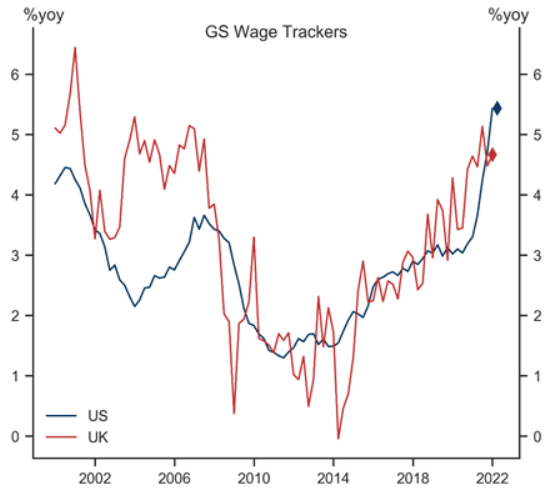

Above: BoE Bank Rate, actual & expectations %, Source: BoE, Bloomberg, NatWest Markets.

If anything, Walker is inclined to view the "act forcefully" reference as an attempt to provide reassurance around a less hawkish central case (materially less hawkish than market pricing).

Furthermore, Walker believes the Bank of England is keen to emphasise it is not "in the slipstream" of the Federal Reserve which is racing ahead after dropping an outsized 75 bp hike last week.

Walker's assessment was however made before a speech by MPC member Catherine Mann on Monday where she said the Bank should in fact consider the Federal Reserve's pace.

She said the Bank does not act in a vacuum and on balance Fed rate hikes are inflationary for the UK.

Her modelling shows that a more "activist" approach to hiking rates - which would effectively mean the Bank matches the Fed - would result overall in lower inflation outcomes and better growth prospects for the economy.

NatWest Markets nevertheless see Mann being outvoted again and pencil in just one more rate hike of 25 bp in August, followed by a further 25 bp hike in February and May.

They say the risks are skewed towards those 2023 rate rises being brought forward to September 2022 and November 2022.